Summary

- Accidental burn of $10.4M in Solana pre-sale.

- Investors face losses and call for transparency and regulation.

- Pre-sale funding mishap highlights crypto market risks

Amidst the dynamic and often unpredictable landscape of the cryptocurrency realm, a recent development has sent shockwaves through the community, illuminating the inherent risks and challenges that accompany innovation in this burgeoning industry. The incident in question revolves around an inadvertent action by a developer, resulting in the inadvertent destruction of a substantial volume of Solana (SOL) tokens, earmarked for the launch of a meme coin.

This unforeseen turn of events has captured the attention of both seasoned investors and casual observers alike, underscoring the precarious nature of cryptocurrency ventures and the potential consequences of human error within this complex ecosystem. With a staggering 535,000 SOL tokens effectively rendered unusable, the monetary loss incurred amounts to a jaw-dropping $10.4 million, a figure that serves as a stark reminder of the substantial financial stakes involved in such endeavors.

Furthermore, this incident serves as a poignant cautionary tale regarding the pitfalls of pre-sale fundraising initiatives, wherein the promise of early access to tokens may cloud judgment and lead to unintended consequences. The volatile nature of the crypto market, characterized by rapid fluctuations and unforeseeable events, further exacerbates the challenges faced by developers and investors alike, amplifying the need for meticulous planning and risk management strategies.

As the cryptocurrency landscape continues to evolve and mature, incidents such as this underscore the imperative for increased vigilance and scrutiny at every stage of project development and implementation. Moreover, they highlight the importance of fostering a culture of transparency and accountability within the community, where mistakes are acknowledged, lessons are learned, and best practices are continually refined.

while the accidental burning of Solana tokens may represent a significant setback for those involved, it also serves as a poignant reminder of the resilience and adaptability inherent in the cryptocurrency space. By learning from past missteps and embracing a forward-thinking mindset, stakeholders can navigate the complexities of this ever-changing landscape with greater confidence and resilience, ultimately paving the way for continued innovation and growth in the years to come.

The fallout of accidental token burn

Within the expansive landscape of the cryptocurrency world, the practice of pre-sale fundraising has burgeoned into a ubiquitous phenomenon, serving as a crucial avenue for developers to amass capital for launching ambitious projects. This strategy typically entails offering early access to tokens at discounted rates, enticing investors to contribute to the project’s financial foundation.

However, recent developments have thrust the efficacy and integrity of this fundraising mechanism into the spotlight, unveiling a tapestry of potential pitfalls that lurk beneath its surface. Indeed, instances have emerged where unscrupulous developers have either absconded with the funds raised or manipulated the market to their advantage, sowing seeds of doubt and distrust within the community.

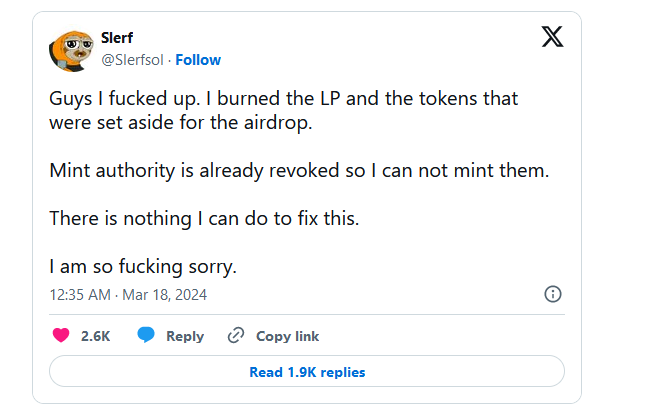

In the particular case under scrutiny, the narrative unfolds with a sense of tragic irony. A developer, buoyed by the promise of a novel venture, succeeded in rallying support and garnering a substantial sum totaling 535,000 SOL, equivalent to a staggering value in the millions of dollars, all earmarked for the launch of a meme coin on the Solana blockchain. Yet, amidst the fervor and anticipation, fate intervened with a twist of cruel irony: an inadvertent misstep, a single catastrophic blunder, resulted in the accidental destruction of the entire pre-sale fund, rendering it irretrievable in an instant.

The aftermath of this calamitous event reverberates with profound implications, casting a long shadow over the cryptocurrency community and igniting a fervent discourse on the perils of unchecked ambition and the fragility of trust in this volatile landscape. Questions abound, swirling in a maelstrom of uncertainty: What were the precise circumstances that precipitated this cataclysmic token burn? Was it an act of negligence or a stroke of misfortune? Regardless of the answers, the consequences are irrefutably dire, leaving investors reeling from the sudden and irrevocable loss of their hard-earned assets.

As the dust settles and the repercussions reverberate across the digital expanse, this harrowing saga serves as a poignant cautionary tale, a solemn reminder of the risks that lurk beneath the surface of innovation and ambition. It underscores the imperative for meticulous due diligence and rigorous risk assessment in every facet of cryptocurrency investment and project development. Moreover, it galvanizes the community to demand greater transparency, accountability, and ethical stewardship from developers and stakeholders alike, forging a path towards a more resilient and trustworthy ecosystem for all who navigate its turbulent waters.

In the wake of this tumultuous chapter, the cryptocurrency community stands at a crossroads, faced with a choice: succumb to despair and disillusionment or rise from the ashes with renewed determination and collective resolve. Though the road ahead may be fraught with uncertainty, one thing remains abundantly clear: only by confronting our challenges head-on, learning from our mistakes, and steadfastly upholding the principles of integrity and accountability can we chart a course towards a brighter, more sustainable future for cryptocurrency and blockchain technology as a whole.

Impact on investors and community

The inadvertent destruction of the pre-sale funds has sent shockwaves through the cryptocurrency community, leaving investors and stakeholders grappling with the ramifications of a significant financial setback. What was once an eagerly anticipated opportunity for many has now turned into a source of profound disappointment and disillusionment. Countless individuals who had eagerly participated in the pre-sale now find themselves facing a grim reality, with their investments effectively reduced to ashes and little prospect of recouping their losses.

This distressing turn of events has not only inflicted a tangible blow to the financial well-being of those involved but has also dealt a severe blow to the trust and confidence that underpin the entire project. Questions abound regarding the competence and accountability of the developer responsible for overseeing the pre-sale, with many expressing dismay at the apparent lack of safeguards or oversight that could have prevented such a catastrophic blunder.

Beyond the immediate financial implications, this unfortunate episode serves as a sobering reminder of the inherent risks inherent in investing in cryptocurrency projects, particularly those in their nascent stages of development. While pre-sale fundraising endeavors may promise tantalizing opportunities for lucrative returns, they also harbor significant pitfalls and vulnerabilities, ranging from mismanagement to outright fraud.

As investors and community members grapple with the fallout of this incident, it prompts a sober reflection on the need for greater diligence, scrutiny, and accountability within the cryptocurrency ecosystem. Moving forward, there is a pressing imperative to institute more robust safeguards and regulatory mechanisms to mitigate the risk of similar occurrences in the future. Only through collective vigilance and a steadfast commitment to transparency and integrity can the cryptocurrency community hope to navigate the turbulent waters of innovation and speculation with greater resilience and confidence.

Calls for transparency and regulation

In light of the recent debacle and other distressing episodes of mismanagement haunting the cryptocurrency domain, there has been a resounding crescendo of demands echoing throughout the community for an epoch of heightened transparency and regulatory scrutiny. With each lamentable tale of funds squandered or projects gone awry, the fervent cries for greater accountability from project developers and the imposition of more stringent regulatory protocols reverberate louder, resonating with a sense of urgency and resolve.

The inadvertent immolation of a staggering $10.4 million worth of Solana tokens earmarked for the launch of a meme coin serves as an unyielding testament to the capricious and unpredictable terrain that characterizes the cryptocurrency market. It serves as a stark and harrowing reminder of the dire consequences that can ensue from even the slightest lapses in oversight or lapses in judgment.

As the dust settles and the reverberations of this catastrophic blunder continue to reverberate through the community, it becomes increasingly evident that mere words of regret or promises of reform will not suffice. There is an imperative need, an urgent mandate, for substantive action to be taken to fortify the safeguards and shore up the defenses of the cryptocurrency ecosystem.

Advocates for change argue fervently that by bolstering the regulatory apparatus and fostering a culture of radical transparency and unwavering accountability, the cryptocurrency sector can rise above the tumult and turbulence that currently beset it. It is through such concerted efforts that the industry can aspire to cultivate an environment where trust and confidence reign supreme, where investors can venture forth with assurance, secure in the knowledge that their interests are safeguarded and their investments protected from the perils that lurk in the shadows.

This calamitous event serves as a clarion call, a rallying cry for all stakeholders to come together in a spirit of unity and purpose, to forge a path forward that is marked by resilience, integrity, and unwavering resolve. It is only by heeding this call and embracing the imperative for change that the cryptocurrency industry can hope to transcend its current predicament and emerge stronger, more resilient, and more robust than ever before.