EigenLayer, a restaking protocol, has responded expansively to the criticism it faced following its initial airdrop by deciding to provide an extra 100 EIGEN tokens to 280,000 qualifying wallet addresses. The decision comes amidst growing discontentment voiced by users regarding the terms and conditions of the first airdrop.

Initially, on April 29th, EigenLayer had declared its intention to distribute 15% of its entire token supply to the community. However, the airdrop program it implemented was met with disapproval from certain users who found several aspects of it to be overly restrictive.

In a significant move on May 2nd, The Eigen Foundation made an announcement indicating that users who had engaged with the protocol prior to April 29th would be eligible for an additional airdrop. This supplementary distribution includes those who had already claimed tokens from the initial airdrop, thereby extending the benefits to a broader spectrum of participants within the EigenLayer ecosystem.

Updates on the EIGEN Stakedrop pic.twitter.com/1cwSForJnx

— Eigen Foundation (@eigenfoundation) May 2, 2024

In a comprehensive follow-up blog post, Eigen has provided detailed clarification regarding the distribution of EIGEN tokens. The post outlines distinct allotments for two groups of claimants: those from the initial “season 1” and a subsequent wave of “season 2” participants.

According to Eigen’s specifications, individuals who claimed tokens during the initial phase, dubbed “season 1,” are guaranteed a minimum of 110 EIGEN tokens. Conversely, participants falling under the “season 2” category—those who interacted with the protocol between March 15th and April 29th—will receive a minimum of 100 EIGEN tokens.

The delineation of these two seasons is particularly notable, as it reflects Eigen’s proactive approach to maintaining fairness and integrity within its ecosystem. The decision to implement a cut-off point on April 29th serves a dual purpose: firstly, it delineates eligibility for the second wave of claimants, and secondly, it acts as a strategic maneuver to counteract potential exploitation by industry-grade Sybil farms.

By strategically setting the cut-off date, Eigen aims to thwart any attempts by malicious actors to manipulate the distribution process. This measure is vital in safeguarding the authenticity of participants and ensuring that the token distribution remains equitable and reflective of genuine community engagement.

The proactive stance against Sybil farms underscores Eigen’s commitment to fostering a community-driven ecosystem free from external manipulation or disruption. This approach not only safeguards the interests of existing participants but also bolsters confidence in Eigen’s governance mechanisms, ultimately contributing to the long-term sustainability and growth of the protocol.

What led to the backlash?

On April 30th, discontented users who were excluded from the initial airdrop criticized EigenLayer’s “stakedrop” initiative. This program enabled users to stake the airdropped tokens for securing data availability storage (EigenDA) and future Actively Validated Services (AVAs).

The primary reasons behind the backlash against the first airdrop included the nontransferable token structure of EIGEN, a community allocation of only 15%, which was perceived as smaller than anticipated, and the implementation of what were deemed as “aggressive” geo-blocking and anti-VPN measures.

These measures resulted in users from 30 countries, such as the United States, Canada, China, and Russia, being prohibited from participating in the airdrop.

EigenLayer stated its intention to rectify the situation by considering the inclusion of more users from its test net who might have been inadvertently excluded from the initial airdrop. They expressed this intention by stating:

“Missed testnet user allocations will be updated as part of Phase 2 of Season 1. We will provide more details in the coming weeks”

The Eigen Foundation’s initial airdrop announcement indicated that users would be able to claim their tokens on May 10th. However, these tokens would remain non-transferable until an undisclosed future date.

EigenLayer explained that this measure was implemented to guarantee that crucial functionalities, such as payments and slashing parameters, were thoroughly established before EIGEN could be transferred among users.

Additionally, EigenLayer specified that both private investors and team members would be subjected to a complete one-year lock-up period following the token’s transferability to the community.

“After that, they will unlock at 4% per month and finish fully unlocking three years after transferability. This ensures that the users of the protocol get transfer powers well before any core contributors can.”

The community has raised inquiries regarding the EIGEN tokenomics.

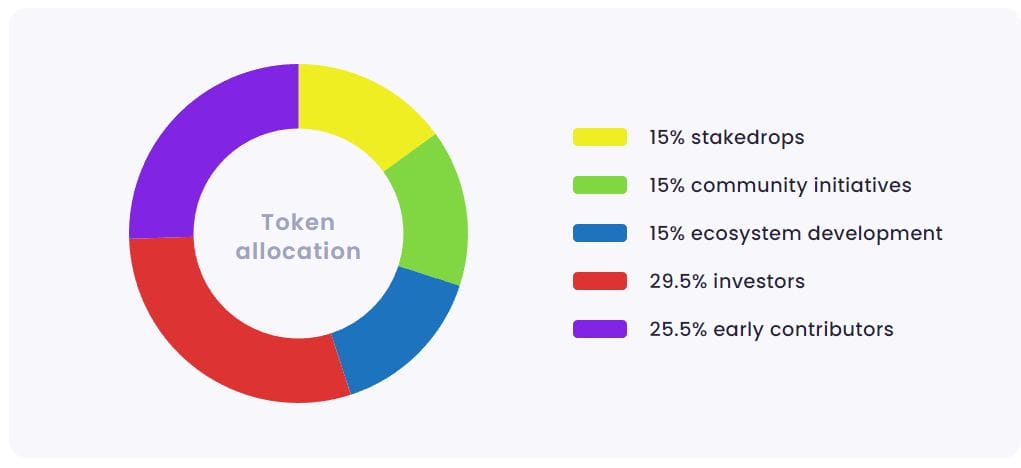

EigenLayer’s unstable tokenomic framework has emerged as another area of concern. Merely 45% of its overall supply is allocated to the community, of which 15% is made available through airdrops.

Users have been discouraged by the minimal returns on Eigen compared to the Ethereum they’ve staked. However, Eigen has explicitly stated that this was deliberate.

“This disincentivization was a key rationale for the original Sybil-neutral distribution, but the feedback we got from real users weighed heavily on this revision!”

The lack of substantial rewards for early supporters within EigenLayer, regardless of the rationale behind it, remains a significant concern among users, evoking a sense of dissatisfaction. This situation has left many users feeling disillusioned, as they anticipated more substantial returns on their contributions, particularly when comparing the returns on Eigen to those on Ethereum, which they have devoted for staking purposes. The intentional decision by EigenLayer to offer minimal rewards has thus left a sour impression on its user base.

Despite this dissatisfaction, it’s worth noting that the absence of substantial rewards for early supporters may actually underscore the strength of EigenLayer’s community. This community, characterized by its passionate and committed members, has played a pivotal role in attracting investments and positioning EigenLayer as a prominent player in the crypto landscape today. The community’s unwavering support and belief in the project have been instrumental in its growth and success thus far.

Interestingly, even before the tokens have entered circulation, there’s already significant activity in the derivatives market surrounding EIGEN. According to data from Aevo, perpetual futures contracts for EIGEN are currently trading at $10, indicating a strong demand for the token. This activity in the derivatives market serves as a testament to the market’s anticipation and confidence in EigenLayer’s potential.

It’s important to acknowledge that the price of EIGEN in the derivatives market is subject to fluctuation and may change significantly leading up to the token’s official distribution event on May 10th. As such, investors and participants should exercise caution and closely monitor developments in the market to make informed decisions regarding their involvement with EIGEN.