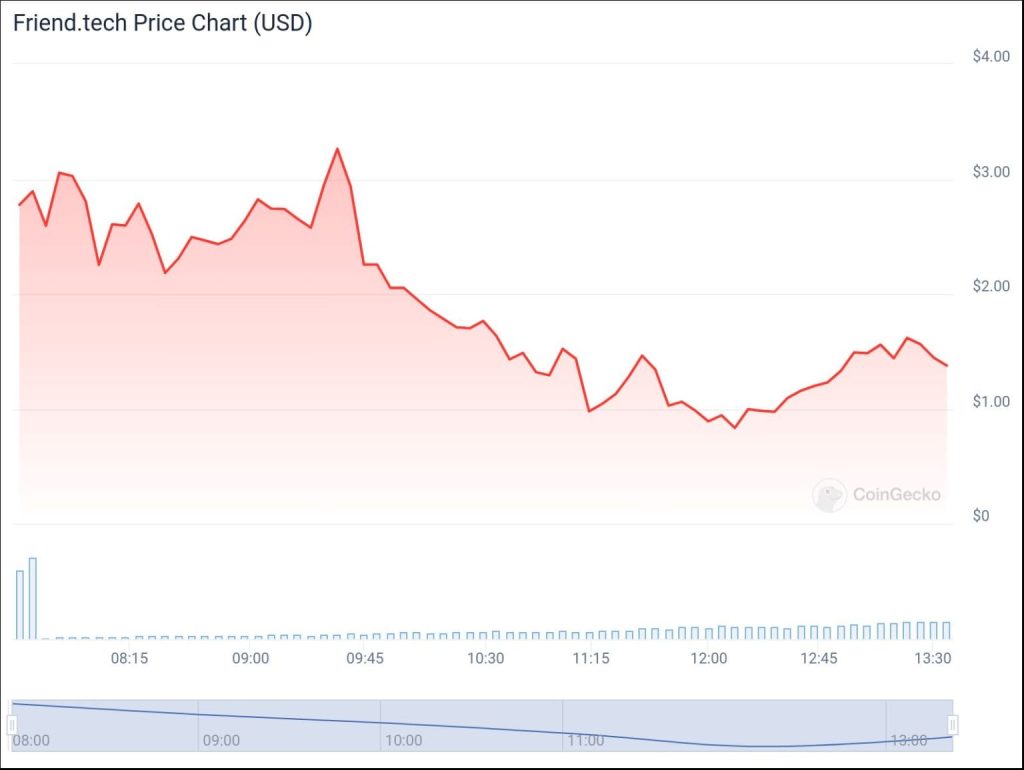

On May 3, the native token of Friend.tech, $FRIEND, plummeted by 50% following its launch, triggered by the sell-off of holdings by the largest whale. Simultaneously, users encountered difficulties accessing their airdropped tokens.

According to BaseScan data, shortly after the airdrop, the largest holder, “Murphys1d,” swiftly disposed of over 55,000 units of the newly issued $FRIEND. Consequently, the token’s price swiftly plummeted by 53.3%, dropping from $3.26 to $1.30 at the time of reporting.

The Friend.tech community faces challenges accessing the airdrop.

Amidst the sell-off frenzy, a distressing situation unfolded for certain users who found themselves unable to access their entitled airdrop, leaving them in a state of frustration as they witnessed the precipitous decline in the price of $FRIEND tokens. This unfortunate turn of events elicited poignant remarks from notable figures within the crypto community, such as crypto investor Luke Martin, who aptly expressed that this predicament only compounded the existing woes, essentially adding “insult to injury.”

Watching the value of my airdrop go from 7 figs to 5 figs in the span of 2hrs while I keep refreshing the page trying to claim….still can't claim.

Meanwhile I gotta watch this guy cashout while my wallet won't even load.

Adds insult to injury 💀💀💀

— Luke Martin (@VentureCoinist) May 3, 2024

In an environment characterized by limited liquidity, a small number of substantial orders can exert a disproportionate influence on the market price.

With just $0.01 worth of liquidity, $FRIEND holders found themselves in a precarious position, susceptible to market volatility.

The exceedingly meager liquidity sparked widespread discontent within the community.

“First, you exploit your users with fees, then you coerce them into providing liquidity only to have them unload on one another,” lamented disgruntled user mcSleuth.

The persistent issue of airdrop farmers continues to plague token launches.

The recent Friend.tech dump serves as just one illustration of the pervasive problem posed by professional airdrop farmers, who exploit emerging protocols solely for the sake of airdrop rewards. These “squatters” often utilize multiple wallets to maximize their rewards, thereby exacerbating the impact of their actions.

The consequences of such practices are significant and far-reaching for the communities associated with the targeted protocols. Dumping activities initiated by these airdrop farmers generate substantial selling pressure, triggering panic among legitimate protocol users who may feel compelled to offload their holdings as well. This cascading effect only amplifies the magnitude of the issue.

A parallel instance occurred in April 2024 with the Omni Network, which fell victim to Sybil farmers. Following its airdrop, the native OMNI token experienced a staggering 55% decline in less than 18 hours, resulting in a loss of over half of its market capitalization.

While these events undeniably exert a considerable negative impact on price action, it’s important to recognize that such effects are typically short-term in nature. Although $FRIEND may face challenges in the aftermath of this incident, the resilience of its investor community may ultimately serve to navigate it through these turbulent waters in the long term.