Summary

- Grayscale reallocates from Cardano to XRP, sparking community interest and speculation.

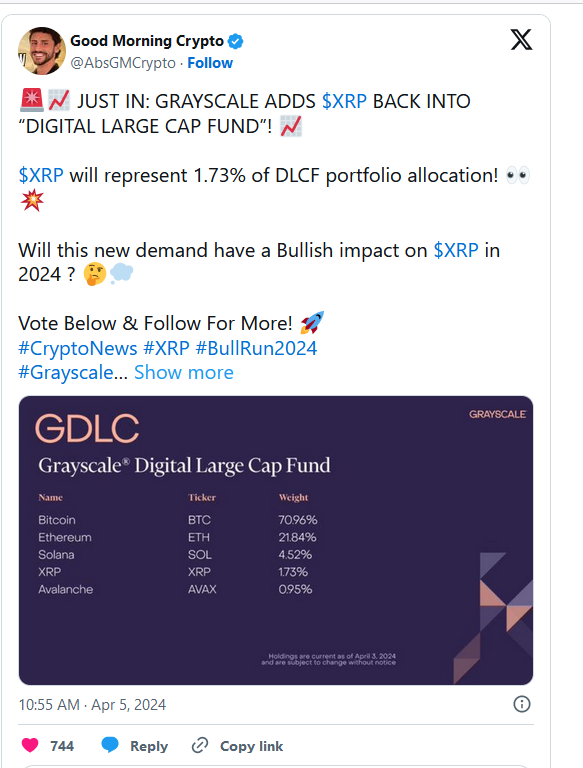

- Bitcoin dominates Grayscale’s DLC Fund with 70.96%, followed by Ethereum and Solana.

- XRP now comprises 1.73% of Grayscale’s DLC Fund, totaling approximately 16.7 million tokens

Grayscale Investments, widely recognized as a pioneering force in the management of cryptocurrency assets, has recently executed substantial modifications to its renowned Digital Large Cap (DLC) Fund, thereby garnering considerable attention for its meticulously crafted strategic adjustments in asset allocation.

In a move that has left the crypto sphere abuzz with speculation and analysis, Grayscale took the unexpected step of divesting from Cardano (ADA), a move that has sent ripples through the digital asset market. The proceeds from this divestment were strategically redirected towards the acquisition of XRP, alongside other existing assets within the fund’s portfolio. This strategic pivot has not only raised eyebrows but has also ignited fervent discussion and scrutiny within the cryptocurrency community.

The decision to reallocate resources away from Cardano, a project with a dedicated following and significant market capitalization, to bolster positions in XRP, a digital asset with its own unique set of strengths and controversies, has prompted analysts and enthusiasts alike to delve deeper into Grayscale’s underlying investment rationale and the broader implications for the cryptocurrency landscape.

Indeed, the spotlight now shines brightly on the market dynamics of XRP, with questions arising as to how Grayscale’s increased exposure might influence its price trajectory and overall market sentiment. Moreover, the strategic pivot underscores Grayscale’s agility and adaptability in navigating the ever-evolving cryptocurrency landscape, positioning itself not merely as a passive investor but as a proactive participant shaping the contours of the digital asset ecosystem.

As stakeholders dissect the implications of Grayscale’s strategic maneuvers, one thing remains abundantly clear: the intersection of institutional investment and cryptocurrency continues to be a fertile ground for innovation, intrigue, and perhaps most importantly, relentless scrutiny and analysis. In this evolving narrative, Grayscale’s latest move serves as a poignant reminder of the dynamic nature of the cryptocurrency market, where strategic decisions made by key players have the potential to reverberate far and wide, shaping the future trajectory of the entire ecosystem.

Grayscale Adds XRP In DLC Fund

In a recent press release that reverberated throughout the financial markets, Grayscale, a leading digital currency asset manager, formally announced the eagerly anticipated quarterly rebalancing of its esteemed investment products. This strategic maneuver, a hallmark of Grayscale’s commitment to prudent portfolio management, impacted several of its flagship funds, including the Digital Large Cap Fund, Smart Contract Platform Ex-Ethereum Fund, and the DeFi Fund, marking a pivotal moment in the digital asset investment landscape.

Among the myriad adjustments orchestrated by Grayscale in this sweeping rebalancing initiative, perhaps the most attention-grabbing was the transformation witnessed within its Digital Large Cap Fund (DLC Fund). With surgical precision, Grayscale executed a series of tactical moves, including the liquidation of its holdings in Cardano, a notable blockchain platform, followed by the judicious reinvestment of the proceeds into a carefully curated selection of alternative assets. This strategic decision underscores Grayscale’s unwavering commitment to adaptability and dynamism in navigating the ever-evolving digital asset ecosystem.

However, it is the recalibration of the DLC Fund’s composition that has garnered widespread acclaim and scrutiny alike. The recalibrated allocation now sees Ripple’s XRP assume a commanding presence within the fund, constituting a weighty 1.73% of its total holdings. With the DLC Fund’s valuation currently towering at an impressive $570,206,758.29, this calculated allocation crystallizes into a formidable stash of approximately 16.7 million XRP tokens under Grayscale’s custodianship.

This strategic realignment not only underscores Grayscale’s astute market acumen but also serves as a testament to the organization’s unwavering commitment to maximizing value and mitigating risk for its esteemed investors. Moreover, it heralds a new chapter in the ongoing saga of institutional adoption and mainstream recognition of digital assets, positioning Grayscale at the vanguard of this transformative financial paradigm shift.

As the digital asset landscape continues to evolve at breakneck speed, Grayscale’s proactive approach to portfolio management sets a gold standard for industry best practices. With its finger firmly on the pulse of market trends and dynamics, Grayscale remains poised to navigate the turbulent waters of the digital asset ecosystem, forging new pathways to prosperity and cementing its status as a trailblazer in the realm of institutional-grade cryptocurrency investment.

Bitcoin Dominance in DLC Fund

In the intricate tapestry of the DLC Fund’s holdings, Bitcoin stands tall as the unrivaled titan, commanding a staggering 70.96% of the fund’s allocation. Its dominance is unquestionable, a testament to its enduring allure and undisputed status as the pioneer of the cryptocurrency realm. Following in its wake, Ethereum (ETH) assumes a respectable position, albeit with a significantly lesser share, comprising 21.85% of the fund’s makeup. Solana (SOL) carves out its niche with a modest yet noteworthy 4.52% slice of the pie, showcasing its emergence as a contender in the competitive crypto landscape. Bringing up the rear is Avalanche (AVAX), occupying a diminutive 0.95% portion, underscoring the diversity within the fund’s portfolio.

However, amidst this symphony of established giants, a notable absence of fresh additions echoes through the halls of the DLC Fund in the first quarter of 2024. The static composition hints at a period of consolidation, where existing assets are given room to mature and flourish, guided by Grayscale’s strategic vision.

Yet, amidst the static tableau, a ripple of change emerges—a decision resonating with boldness and foresight. Grayscale, the custodian of the DLC Fund, announces its intention to fortify its position in XRP, the contentious yet undeniably influential digital asset. This move is not merely a reallocation of resources; it is a proclamation of faith, a testament to Grayscale’s unwavering confidence in XRP’s long-term viability and regulatory clarity.

As XRP steps into the limelight, it joins the esteemed ranks of Bitcoin and Ethereum within Grayscale’s hallowed portfolio. This integration marks a pivotal moment, not just for XRP, but for the broader crypto ecosystem. It symbolizes a maturation—a recognition of XRP’s potential to stand shoulder to shoulder with the titans of the industry, shaping the future of finance.

In essence, the decision to bolster XRP holdings within the DLC Fund is more than a strategic maneuver; it is a declaration of belief—a bet on innovation, resilience, and the transformative power of blockchain technology. It is a reaffirmation of Grayscale’s commitment to pioneering the evolution of the digital asset landscape, steering the course towards a future where boundaries blur, and possibilities abound.

Grayscale’s Investment Strategy

Grayscale’s Digital Large Cap Fund (DLC) stands as a pioneering vehicle in the crypto investment landscape, designed with a paramount aim: to furnish investors with exposure to a meticulously curated array of major cryptocurrencies. This fund, renowned for its diversified portfolio, has garnered significant attention once again, following the decision to reincorporate XRP into its fold.

The reintroduction of XRP into Grayscale’s DLC Fund has acted as a catalyst, reigniting fervent discussions within the financial sphere about the feasibility and potential implications of Grayscale launching an XRP-specific exchange-traded fund (ETF). This move has ignited a plethora of opinions, ranging from optimistic projections to cautious evaluations, as market participants eagerly await further developments.

In the wake of Grayscale’s recent strides into the realm of Bitcoin spot ETFs and their persistent endeavors towards the establishment of an Ethereum ETF, industry observers are increasingly considering XRP as a logical candidate for a similar investment avenue. The underlying rationale behind this conjecture stems from XRP’s well-established regulatory clarity, a factor that positions it favorably for structured investment products.

Market analysts and stakeholders are closely monitoring the evolving narrative surrounding Grayscale’s potential XRP ETF, recognizing it as a pivotal development that could reshape the dynamics of the crypto investment landscape. This prospect has sparked a surge of interest and speculation, with stakeholders across the financial spectrum eagerly anticipating further insights into Grayscale’s strategic intentions and regulatory pathways.

As discussions continue to unfold, propelled by the ever-shifting tides of regulatory clarity and market sentiment, the potential emergence of a Grayscale XRP ETF remains a captivating subject of discourse within the global investment community. Amidst this backdrop of anticipation and speculation, investors and enthusiasts alike are poised to witness how this narrative unfolds, as Grayscale navigates the intricate terrain of regulatory compliance and investor demand in its pursuit of pioneering investment solutions in the crypto space.

Read more Ripple Plans Liquidity Pool for XRP on AMM; Expert Predicts SHIB Price Surge