Summary

- Galaxy Digital CEO Novogratz remains bullish on Bitcoin amid potential Fed rate cuts.

- Lower interest rates could benefit Bitcoin and other assets, says Novogratz, predicting $100,000 BTC.

- Former BitMEX CEO Hayes warns of potential post-halving price plunge due to profit-taking.

In the realm of digital currencies, Bitcoin reigns supreme, captivating global attention with its tumultuous price gyrations. Its volatile nature has become a double-edged sword, offering tantalizing profit prospects alongside daunting risks. Recently, the Twitterverse was set ablaze by Galaxy Digital’s illustrious CEO, Mike Novogratz, whose tweet sparked fervent discussion and speculation.

In his virtual missive, Novogratz conveyed an air of optimism, suggesting that the U.S. Federal Reserve might embark on the path of interest rate cuts. This potential move, if materialized, could profoundly influence the trajectory of not only traditional financial markets but also the enigmatic realm of cryptocurrencies, with Bitcoin poised at the forefront.

The implications of such a decision by the Federal Reserve are far-reaching, potentially reshaping investor sentiments and market dynamics on a global scale. Novogratz’s tweet served as a catalyst, stirring the already simmering pot of intrigue and speculation surrounding Bitcoin and its intricate relationship with macroeconomic factors.

As Bitcoin enthusiasts and market participants dissect every syllable of Novogratz’s tweet, the broader implications loom large. Will a dovish stance by the Federal Reserve inject renewed vigor into Bitcoin’s meteoric ascent, or will it exacerbate the already palpable volatility, inviting heightened regulatory scrutiny and investor apprehension?

The interplay between Bitcoin and traditional financial institutions has never been more pronounced, with each twist and turn in the regulatory landscape sending ripples across the cryptocurrency market. Novogratz’s tweet represents a mere snapshot of the broader narrative, a tantalizing glimpse into the intricate dance between monetary policy and the digital revolution.

In the ever-evolving saga of Bitcoin, where fortunes are made and lost in the blink of an eye, Novogratz’s tweet serves as a poignant reminder of the symbiotic relationship between traditional finance and the burgeoning world of cryptocurrencies. As investors brace themselves for the next chapter in this unfolding saga, one thing remains certain: in the world of Bitcoin, the only constant is change.

Fed To Cut Rate…

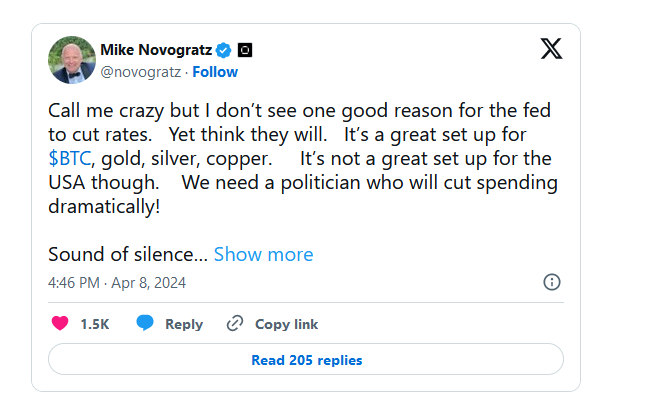

In a recent tweet, Michael Novogratz, renowned investor and cryptocurrency advocate, has articulated a profound skepticism towards the Federal Reserve’s proposed strategy of reducing interest rates. With a tone of incredulity, Novogratz challenges the rationale behind such a move, boldly asserting, “You might think I’m crazy, but I fail to discern any valid rationale for the Fed to lower rates. Nevertheless, it appears they are poised to do so.”

This statement reflects not only Novogratz’s skepticism but also his keen insight into macroeconomic trends and monetary policy. It underscores his conviction that the Federal Reserve’s decision may lack a sound basis, thereby casting doubt on its potential effectiveness.

Despite his apprehension regarding the Federal Reserve’s impending actions, Novogratz maintains a steadfast belief in the resilience of Bitcoin, the flagship cryptocurrency. He confidently asserts that Bitcoin will continue to thrive, even amidst fluctuations in interest rates orchestrated by central banks.

However, amidst this conviction lies a palpable concern about the fiscal health of the United States government. Novogratz raises a cautionary flag, expressing apprehension over the persistent trend of deficit spending outpacing revenue generation. This fiscal imbalance, in his view, poses a significant risk to the stability of the economy.

Yet, amidst the clouds of skepticism and concern, Novogratz discerns a silver lining. He suggests that the Federal Reserve’s decision to lower interest rates could potentially serve as a boon for alternative assets such as Bitcoin, gold, silver, and copper. This optimistic outlook is grounded in his bullish long-term perspective on Bitcoin, which includes a bold prediction of its value surpassing $100,000 by 2024.

Novogratz’s optimism isn’t merely speculative; it’s rooted in a deeper understanding of Bitcoin’s evolving role as a safe-haven asset. In an era marked by economic uncertainty and geopolitical instability, Bitcoin’s appeal as a hedge against systemic risks continues to grow. Novogratz highlights this growing interest among investors seeking refuge from the stormy seas of financial turbulence.

In sum, Novogratz’s tweet encapsulates a nuanced perspective on the intersection of monetary policy, fiscal responsibility, and the evolving landscape of alternative assets. It serves as a reminder of the complexities inherent in navigating the turbulent waters of global finance, while also offering a glimmer of hope for those who see opportunity amidst uncertainty.

Profit-Taking To Add Selling Pressure

On the opposite end of the spectrum, we find former BitMEX CEO, Arthur Hayes, issuing a poignant warning that resonates through the cryptosphere. He paints a sobering picture, one that foresees a potential tumultuous plunge in the value of Bitcoin following the much-anticipated halving event. Hayes, with his seasoned insight, suggests that as the halving approaches, investors who have been steadfast in their Bitcoin holdings might seize the opportunity to realize profits, initiating a cascade of sell-offs that could reverberate across the market, exerting significant downward pressure on prices.

But that’s not the only storm cloud looming on the horizon. The impending Bitcoin halving, a momentous event that slashes miner rewards by a staggering 50%, looms ominously, casting a shadow of uncertainty over the mining community. As the rewards dwindle, miners find themselves thrust into a fiercely competitive landscape, where profit margins are squeezed to precarious levels. In such a volatile environment, miners are faced with a daunting dilemma: either adapt to the harsh realities of reduced rewards or risk being swallowed by the unforgiving currents of the market.

The ramifications of this confluence of events extend far beyond mere speculation, sending ripples of apprehension throughout the entire crypto ecosystem. With miners potentially forced to liquidate more of their holdings to sustain operations, the specter of increased selling pressure looms large, casting a pall over the market sentiment and dampening the fervor of even the most ardent Bitcoin enthusiasts.

In the face of such uncertainty, the crypto community finds itself at a crossroads, grappling with the implications of these seismic shifts. Will Bitcoin emerge unscathed, rising triumphant from the ashes of uncertainty, or will it succumb to the relentless forces of market dynamics, consigned to the annals of history as yet another failed experiment in digital finance? Only time will tell as the crypto saga unfolds, charting a course fraught with peril and promise alike.

Bitcoin Price Action

Despite the persistent ambiguity surrounding the cryptocurrency landscape, Bitcoin persists in maintaining a formidable position, boasting a valuation that exceeds $70,120. This enduring resilience underscores its status as a dominant force in the digital asset realm. However, amidst this overarching stability, a subtle downtrend has emerged within the past 24 hours, signaling a nuanced shift in market dynamics. Nonetheless, Bitcoin’s enduring prominence remains a testament to its enduring appeal and significance within the ever-evolving financial landscape.