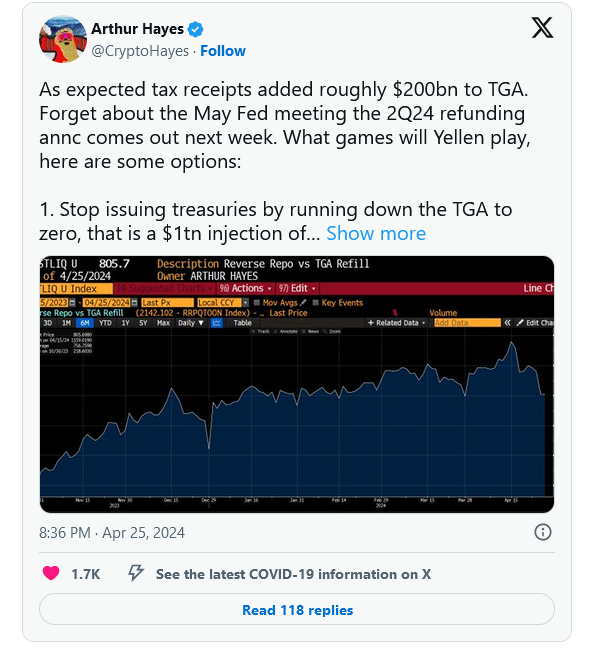

The spotlight falls squarely on Secretary Janet Yellen as anticipation mounts regarding the forthcoming Treasury General Account (TGA) strategies in the wake of a substantial $200 billion influx in tax receipts. With the financial community abuzz with speculation, all eyes turn towards Yellen’s potential course of action during the 2Q24 refunding announcement slated for next week. This announcement is poised to carry significant implications, potentially reshaping the landscape of liquidity, federal funding, and broader market dynamics.

As stakeholders eagerly await Yellen’s decision-making, the financial markets brim with anticipation, poised on the precipice of potential shifts spurred by the Treasury’s strategic maneuvers. Yellen’s choices hold the power to sway investor sentiment, influence liquidity levels, and chart the course for federal funding initiatives in the ensuing period.

Against this backdrop, market participants brace themselves for potential volatility, cognizant of the ripple effects that Yellen’s decisions may trigger across various sectors and asset classes. With the stage set for a pivotal announcement, the financial community stands poised to dissect Yellen’s strategies and decipher their implications for the intricate tapestry of global markets.

Understanding the Options on the Table

Eliminating the TGA Balance – One of the more radical options on the table entails the Treasury ceasing the issuance of new treasuries and completely depleting the Treasury General Account (TGA), thereby infusing approximately $1 trillion of liquidity into the market. This bold maneuver would represent a monumental shift in treasury management strategy, potentially serving as a potent stimulant for financial markets by bolstering the volume of cash circulating within the economy.

Transitioning to Shorter-Term Borrowing – Another potential tactic involves reallocating a substantial portion of government borrowing from longer-term securities to Treasury bills (T-bills). By adopting this approach, an estimated $400 billion could be redirected away from the Reverse Repo Program (RRP), thereby augmenting available market liquidity. Such a strategy is likely to exert near-term adjustments on interest rates and may influence investor behavior towards more immediate, lower-risk investments.

Synergistic Implementation for Optimal Impact – Perhaps the most assertive strategy envisages halting the issuance of long-term treasuries altogether while transferring all borrowing activities to T-bills, concurrently depleting both the TGA balance and the RRP. This coordinated maneuver would unleash approximately $1.4 trillion into the market, representing an unprecedented injection of liquidity. The ramifications of such a seismic intervention could reverberate throughout the financial landscape, potentially precipitating substantial shifts in asset prices across various markets, including equities and cryptocurrencies.

Potential Market Reactions

As the financial world awaits Secretary Yellen’s decision on potential implementation of these strategic maneuvers, the anticipation reaches a fever pitch, echoing across trading floors and boardrooms alike. The ramifications of her choices loom large, poised to send ripples cascading through the intricate tapestry of global markets.

Should Yellen opt to embark on any of these proposed strategies, the stock market stands poised to bask in the immediate glow of heightened liquidity, an elixir known to stoke the flames of asset price appreciation. Envisioning a landscape adorned with lower interest rates and an influx of cash coursing through the market’s veins, investors may orchestrate a resplendent symphony of bullish fervor, propelling equities to dizzying heights, a phenomenon affectionately referred to as the “stonks” rally.

Yet, beyond the traditional bastions of finance, lies the captivating realm of cryptocurrencies, where the winds of change blow with an electrifying force. Here, amidst the digital wilderness, the promise of increased liquidity and an appetite for risk holds sway, serving as the fuel that propels the bullish narrative forward. Crypto enthusiasts, attuned to the nuances of macroeconomic indicators and the art of liquidity injections, stand poised to interpret Yellen’s moves as a clarion call to action, heralding the dawn of a new era in the digital asset realm.

As the countdown to Yellen’s fateful decision ticks ever closer, market participants find themselves ensconced in a state of heightened anticipation, their gaze fixed intently upon the horizon, where fortunes hang in the balance. Indeed, Yellen’s impending actions possess the power to etch her name into the annals of economic history, casting her as a formidable steward of the global financial order, with the potential to shape the destiny of markets for generations to come.

In the labyrinthine corridors of Wall Street and the bustling exchanges of the digital frontier, whispers of Yellen’s impending decision reverberate, weaving a tapestry of anticipation and intrigue. For within her hands lie the keys to unlock the vaults of prosperity or unleash the tempests of uncertainty, forever altering the course of financial history. As the stage is set and the spotlight trained, the world braces itself for the unveiling of Yellen’s grand tableau, where the future of markets hangs in the balance, awaiting her decisive stroke.