Degen Chain, a layer-3 blockchain integrated with the Base network, has swiftly captivated the interest of investors and traders alike, boasting a remarkable surge in transaction volumes, nearing the $100 million mark within a mere 24-hour timeframe. Despite its recent launch just four days ago, the network has already recorded over 272,000 unique transactions.

On-chain analysts have observed the emergence of more than 7,500 contracts and 2,300 tokens on Degen Chain since its inception. However, it’s crucial to note that a significant portion of these tokens are linked to rug pulls or fraudulent schemes, underscoring the speculative and precarious nature inherent in today’s cryptocurrency landscape.

Degen Chain, a blockchain operating at Layer 3 and designed specifically for the DEGEN token, leverages Layer 2 protocols to expedite transactions and cater to specific applications.

On March 27th it had 8 active accounts

On March 28th it had 1,270 active accounts

On March 29th it had 25,236 active accounts

On March 30th it had 91,261 active accountsAstonishing growth pic.twitter.com/uBgUa96lml

— Shual (@0xShual) March 31, 2024

Degen Chain stands as a unique layer 3 blockchain intricately tailored to the DEGEN token, offering a specialized platform for its functionalities. Operating atop layer-2 protocols, which are known for their swiftness and cost-effectiveness in transaction settlement compared to underlying layer-1 blockchains like Ethereum or Solana, layer-3 blockchains provide a customizable environment suited for specific applications.

In essence, layer-3 networks like Degen Chain are crafted to efficiently execute a defined set of tasks, ranging from payment processing to gaming transactions and other targeted functionalities. At the heart of Degen Chain’s operations lies the DEGEN token, acting as the native gas token for facilitating fee payments within the network.

Degen Chain’s developers emphasize its versatility, enabling a wide array of experiments and applications. From tipping mechanisms to community rewards, seamless payments, gaming experiences, and beyond, Degen Chain serves as a playground for innovation and exploration within the realm of decentralized applications and blockchain-based functionalities.

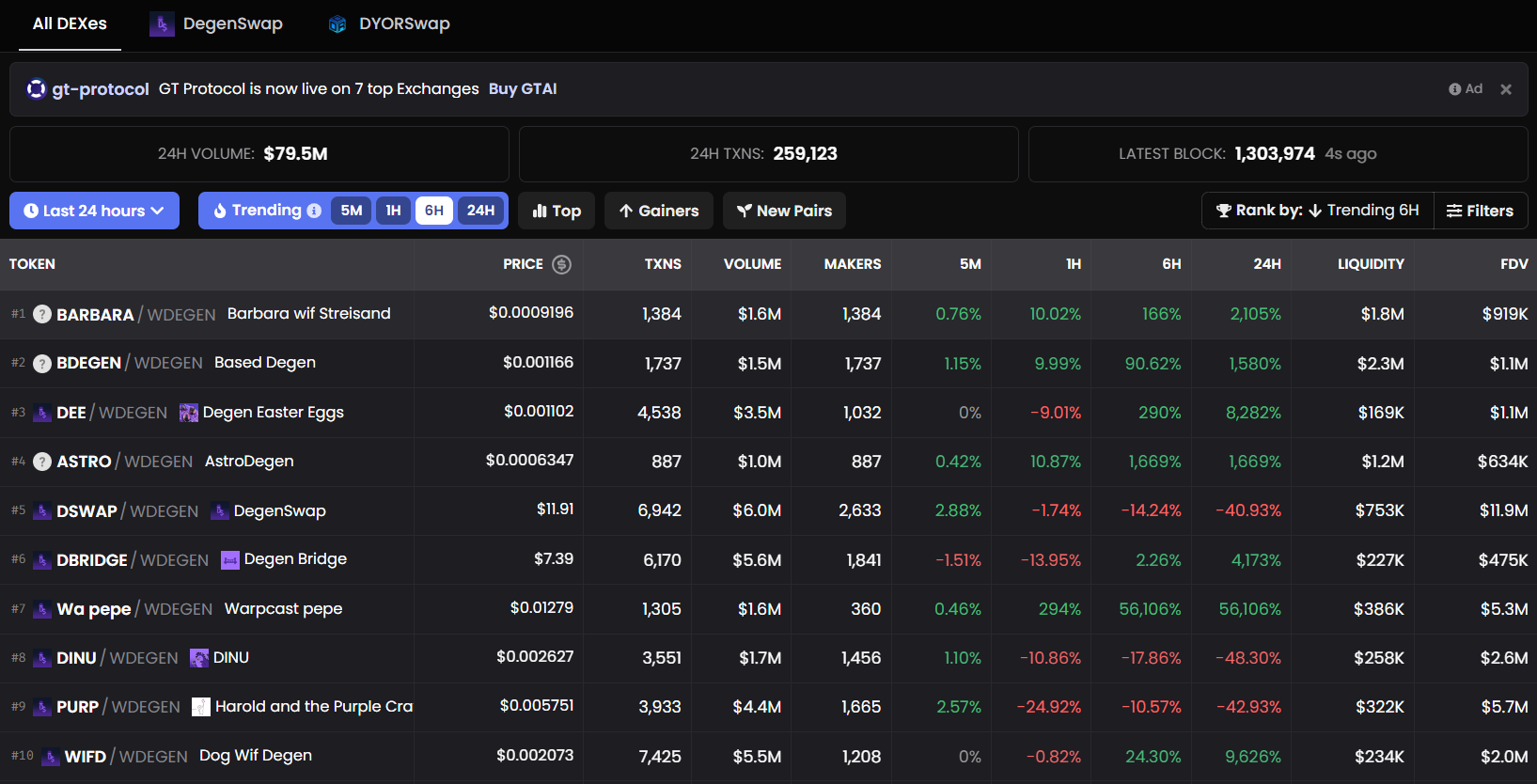

Trending Degen Chain tokens. Source: DEXScreener

Trending Degen Chain tokens. Source: DEXScreener

On the Degen Chain, Degen Swap (DSWAP) emerges as a standout token, representing an in-network exchange valued at over $14 million. Another notable token within the ecosystem is Degen Easter Eggs (DEE), boasting a valuation of $3.5 million. However, it’s important to note that DEE primarily functions as a meme coin, carrying speculative value.

While several tokens on the platform hold market capitalizations below $1 million, they predominantly serve as speculative investments, with many falling victim to rug pulls. Presently, stablecoins are not supported on Degen Chain, and transactions or trading activities are exclusively conducted using the native DEGEN tokens. Notably, the value of DEGEN has experienced a significant surge, soaring to 6 cents on March 31st, compared to the previous Thursday’s valuation of 1 cent, representing an impressive increase of over 500%. As of the time of writing, DEGEN is trading at 4 cents.

Despite Degen Chain’s rapid expansion and substantial user adoption, critics have raised concerns regarding the necessity of layer-3 networks for scaling Ethereum, fearing potential value depletion from the mainnet. This perspective reflects the ongoing discourse within the blockchain community regarding the most effective approaches to blockchain scalability and application deployment.

Comments made by the CEO of Polygon have ignited a discussion within the blockchain community regarding the role of layer-3 networks and their impact on scaling Ethereum.

I’ll say the quiet part out loud: L3s exist only to take value away from Ethereum and onto the L2s on which the L3s are built.

*You do not need L3s to scale*

And this is why Polygon Labs does not work on L3s.

— Marc Boiron (@0xMarcB) March 31, 2024

The discourse surrounding layer-3 networks (L3s) and their relevance in scaling Ethereum has been reignited following remarks made by Polygon CEO Marc Boiron. Boiron’s contention suggests that L3s might not be indispensable for scaling existing networks like Ethereum, positing instead that they could potentially redirect value away from the mainnet.

Boiron’s comments have stirred both concurrence and dissent within the community. While some echo his sentiments, others have challenged his perspective. One counterargument highlights the significance of Layer 2s (L2s) on Ethereum, asserting that they represent value intrinsically linked to the mainnet. Boiron acknowledged this viewpoint to some extent. However, he underscored a nuanced distinction, emphasizing that while L2 value indeed contributes to Ethereum’s ecosystem, it does not necessarily equate to Ethereum’s core value. He cautioned against a scenario where an excessive proliferation of L3s settling to one L2 could potentially dilute Ethereum’s overall value and compromise its security posture.

The debate reflects a broader discourse within the blockchain community regarding the strategic trajectory for Ethereum’s scalability and the optimal deployment of layer-based solutions. As Ethereum continues to evolve and adapt to meet the demands of a rapidly expanding ecosystem, such discussions play a crucial role in shaping the future direction of blockchain technology.

I agree that L2s are Ethereum. I disagree that L2 value is Ethereum value. Just take this to the extreme. If all L3s settled to one L2, then Ethereum would capture basically no value and, thus, Ethereum security would be at risk.

— Marc Boiron (@0xMarcB) March 31, 2024

Boiron clarified that Polygon’s primary focus revolves around scaling Ethereum and ensuring equitable value distribution between Layer 2s (L2s) and Ethereum. From his standpoint, Layer 3s (L3s) do not align with this overarching mission.

Nevertheless, divergent viewpoints exist within the crypto community regarding the merits of L3s, which extend beyond Ethereum’s value proposition. Advocates highlight several advantages, including cost-effective native bridging from L2s, streamlined on-chain proofing mechanisms, the introduction of custom gas tokens, and specialized state transition functions.

While Boiron’s stance raises questions about the indispensability of L3s, alternative perspectives, such as that of Ethereum co-founder Vitalik Buterin, propose a more nuanced interpretation. Buterin suggests that L3s could offer distinctive functionalities that complement L2s rather than directly competing with them. This perspective underscores the potential for L3s to enrich the broader Ethereum ecosystem by providing supplementary tools and services.

for further reading:The Ethereum network reaches a milestone with one million validators, safeguarding a total of $114 billion worth of staked Ether.