According to Scam Sniffer, a company specializing in anti-scam solutions for Web3, February 2024 witnessed a significant loss of $46.86 million in cryptocurrencies to scams.

The report highlights that more than 57,000 individuals were targeted and victimized by a variety of phishing schemes. Interestingly, the findings indicate a notable decrease of 75% in the number of victims who lost sums exceeding $1 million compared to the previous month, January.

🚨 [1/6] ScamSniffer's February Phishing Report

In February, about 57,000 victims lost approximately $47 million to crypto phishing scams.

Compared to January, the number of victims who lost over $1 million decreased by 75%. pic.twitter.com/UgZk0K91lH— Scam Sniffer | Web3 Anti-Scam (@realScamSniffer) March 10, 2024

Of the total stolen amount, Ethereum mainnet accounted for over $36.2 million, representing a substantial 78% of all exploits recorded in February. Moreover, Ethereum blockchain users constituted the largest segment of victims, with 25,029 individuals affected.

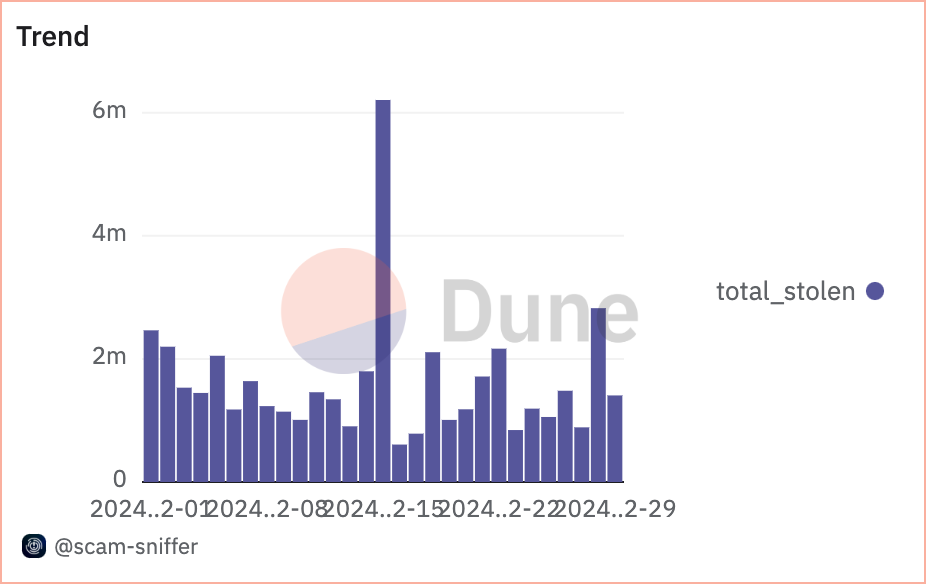

February witnessed a significant decline of 75% in the total number of victims who lost over $1 million compared to January 2024. However, the data also revealed a concerning trend: on February 15 alone, more than $6.2 million in digital assets were lost.

Additionally, Scam Sniffer emphasized that Ethereum-based ERC tokens were particularly impacted, accounting for $40 million of the stolen assets. This amounted to 86% of the total assets stolen.

“The majority of thefts involving ERC20 tokens occurred due to assets being compromised through the signing of phishing signatures, such as Permit, IncreaseAllowance, and Uniswap Permit2,” noted the report.

🧵 [3/6] Most of the thefts of all ERC20 tokens were due to assets being stolen as a result of signing phishing signatures such as Permit, IncreaseAllowance, and Uniswap Permit2. pic.twitter.com/O5UvmSEUTT

— Scam Sniffer | Web3 Anti-Scam (@realScamSniffer) March 10, 2024

According to the most recent cryptocurrency loss report from Immunefi, Ethereum experienced the highest number of individual attacks, totaling 12 incidents and accounting for 85.71% of the total losses across targeted blockchain networks.

Cryptocurrency Scams: Challenges and Implications for the Industry

In February, the cryptocurrency landscape bore witness to a series of significant scams that captured the attention of investors, regulators, and the broader community alike. These scams, ranging from elaborate schemes to sophisticated phishing attacks, underscored the persistent challenges faced by the cryptocurrency industry in maintaining security and trust.

One notable scam that gained widespread attention involved the exploitation of vulnerabilities within decentralized finance (DeFi) protocols. Malicious actors leveraged flaws in smart contracts and protocol implementations to siphon funds from unsuspecting users, resulting in substantial financial losses and reputational damage for the affected platforms.

Furthermore, the proliferation of rug pulls, a form of exit scam where developers abandon a project after attracting significant investment, continued to plague the crypto space. These scams often promise high returns or innovative solutions but ultimately result in the loss of investor funds when the project collapses or the developers abscond with the money.

Phishing attacks also remained a prevalent threat, with scammers employing increasingly sophisticated tactics to deceive users and gain access to their cryptocurrency wallets or private keys. These attacks typically involve impersonating legitimate entities or platforms and tricking users into divulging sensitive information or transferring funds to fraudulent addresses.

Additionally, the rise of social engineering attacks targeting cryptocurrency holders highlighted the importance of cybersecurity awareness and diligence. Scammers employed various tactics, including impersonating customer support representatives, creating fake social media profiles, and orchestrating elaborate Ponzi schemes, to deceive victims and lure them into parting with their digital assets.

The impact of these scams extended beyond just financial losses, as they eroded trust in the cryptocurrency ecosystem and hindered efforts to foster mainstream adoption. Regulatory bodies and industry stakeholders continued to grapple with the challenge of combating fraudulent activities while balancing the need for innovation and decentralization.

Despite ongoing efforts to enhance security measures and educate users about potential risks, the evolving nature of cryptocurrency scams necessitates constant vigilance and proactive measures to mitigate their impact. As the crypto industry continues to mature and attract a broader user base, addressing these challenges will be crucial in building a safer and more resilient ecosystem for all participants.