Outline

- Is a pre-halving Bitcoin correction imminent?

- BTC price underperforming previous halvings

- Bitcoin price to $150K after halving: Bernstein

In the dynamic world of cryptocurrency, where predictions and warnings often collide, the stage is set for a fascinating dichotomy between optimism and caution. While Bernstein boldly proclaims a lofty Bitcoin price target of $150,000, a chorus of other analysts are raising red flags, underscoring the possibility of an imminent correction.

Despite Bitcoin’s recent triumphant surge to a dazzling all-time high of approximately $73,700 on March 13, whispers in the financial corridors suggest a looming pre-halving correction may be in the cards. This cautionary sentiment is rooted in the examination of historical chart patterns, which, despite the euphoria of recent price milestones, indicate a potential downturn on the horizon.

As the crypto market braces for what could be a pivotal moment, with Bitcoin currently hovering around the formidable $73,493 mark, the tension between optimism and caution intensifies. Investors and enthusiasts alike find themselves grappling with conflicting narratives, pondering the trajectory of the world’s most famous cryptocurrency against the backdrop of market volatility and uncertainty.

Is a pre-halving Bitcoin correction imminent?

The cryptocurrency market is currently abuzz with speculation and analysis as signs of potential overheating emerge, fueling anticipation of a significant Bitcoin price adjustment prior to the impending halving scheduled for April. This sentiment, echoed by pseudonymous analyst Rekt Capital, underscores a cautious outlook rooted in historical precedents.

Rekt Capital draws attention to the notable corrections preceding previous halving events, citing a 20% downturn before the 2020 halving and a more substantial 38% retracement ahead of the 2016 halving. These observations serve as sobering reminders of the volatility inherent in the cryptocurrency landscape, prompting careful consideration of potential outcomes in the lead-up to the upcoming halving.

In assessing the potential duration and magnitude of a pre-halving correction, Rekt Capital offers insights into the dynamics at play. While anticipating a retracement period lasting up to 77 days, the analyst suggests that the severity of the drawdown may be tempered compared to historical cycles.

Crucially, Rekt Capital points to recent market movements as indicators of potential trends, citing an 18% pullback observed in January and a subsequent 14% correction in early March. These recent corrections, though notable, suggest a pattern of shallower retracements in the current market environment.

This nuanced analysis underscores the complexity of navigating the cryptocurrency market, where a myriad of factors ranging from technical indicators to macroeconomic trends can influence price movements. As investors and analysts alike brace for potential volatility in the lead-up to the halving, the insights provided by Rekt Capital offer valuable perspectives for navigating the evolving landscape of digital assets.

BTC price underperforming previous halvings

Let’s delve deeper into the intriguing dynamics at play, contemplating what happens if the expected course of history deviates from its familiar path in the current Bitcoin cycle. Indeed, the unfolding narrative presents a series of captivating departures from precedent, with Bitcoin achieving an extraordinary feat by surging to a new record high even before the halving event unfolds.

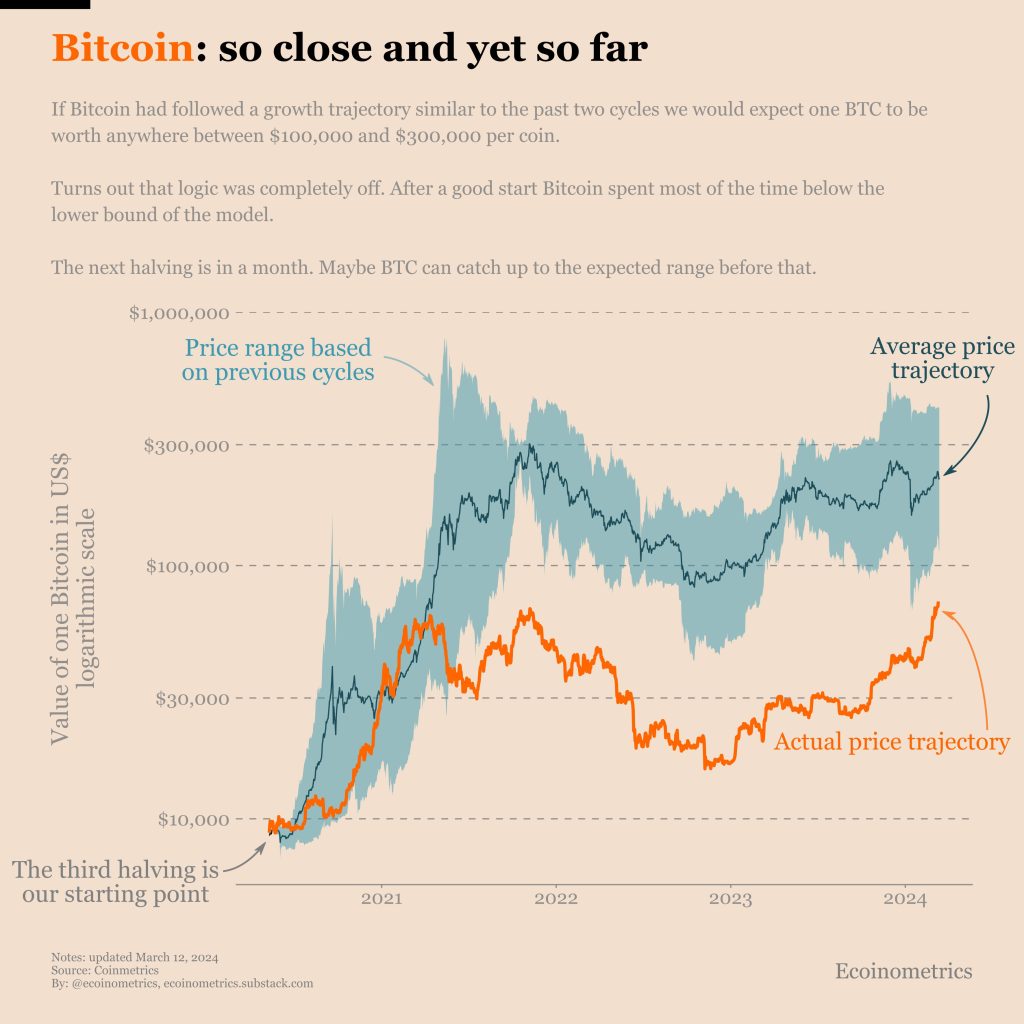

This divergence from convention prompts a profound reevaluation of expectations, particularly when considering the insights gleaned from historical data shared by Ecoinometrics. In a meticulously crafted analysis posted on March 12, Ecoinometrics offers a compelling perspective on Bitcoin’s growth trajectory, suggesting that the cryptocurrency has yet to fully embrace the exponential surge witnessed in past halving cycles. The implications are staggering, with projections hinting at the tantalizing possibility of Bitcoin reaching stratospheric valuations ranging from $100,000 to $300,000 per coin if historical trends were to be replicated.

Such revelations inspire a renewed sense of optimism, suggesting that the current price action may possess untapped potential for further ascent. This optimism is bolstered by the notion that the previous all-time high now serves as a formidable springboard for Bitcoin’s upward trajectory, offering a solid foundation for future gains.

Adding to the chorus of optimism, Rekt Capital provides invaluable insights into Bitcoin’s recent performance. Notably, the successful retesting of the old all-time high at $69,200 is heralded as a significant milestone, one that solidifies this price level as a robust support zone. Such resilience in the face of market fluctuations underscores the underlying strength and fortitude of Bitcoin’s market dynamics, instilling confidence among investors and analysts alike regarding the cryptocurrency’s future prospects.

In essence, while the current Bitcoin cycle may present deviations from historical norms, these deviations serve not as harbingers of uncertainty, but rather as beacons of opportunity. As the cryptocurrency market continues to evolve, these insights into Bitcoin’s resilience and potential for growth offer a compelling narrative that captivates the imagination and inspires confidence in the future of digital assets.

Bitcoin price to $150K after halving: Bernstein

In contemplating the trajectory of Bitcoin’s value, Bernstein, an esteemed wealth management firm, is foreseeing a seismic shift in the digital currency landscape. Their prognostication? A staggering surge for Bitcoin, catapulting its value to an astronomical $150,000 by the midway point of 2025, post the anticipated halving event. This bold prediction, relayed to their esteemed clientele in a meticulously crafted note on a crisp Monday morning, serves as a beacon of insight amidst the tumultuous seas of cryptocurrency speculation.

Within the hallowed halls of Bernstein, analysts Gautam Chhugani and Mahika Sapra stand as torchbearers of foresight, anticipating a momentous “breakout” for BTC post-halving. But what underpins this assertion of bullish sentiment? It’s the mounting fervor surrounding spot Bitcoin ETFs that lends credence to their conviction. The duo, undeterred by the capricious whims of market sentiment, cite the burgeoning demand for these ETFs as the linchpin of their lofty price target—a target first unveiled to the world in yesteryears.

With a meticulous eye for detail, they elucidate, “Our initial projections pegged inflows at a modest $10 billion for the year 2024, with an additional deluge of $60 billion forecasted for the following year.” Yet, the reality has far outstripped their most audacious expectations. In a mere 40 trading days since the epochal ETF launch on the auspicious date of January 10th, Bitcoin ETF inflows have surged beyond the $9.5 billion mark, sending shockwaves across the financial landscape.

At this blistering pace, it’s a matter of mere months, or precisely 166 trading days, before Bitcoin ETFs usurp the lofty 2025 inflow estimates for the remainder of 2024—a testament to the insatiable appetite for crypto exposure among institutional investors.

But that’s not all. Bernstein, ever the purveyor of sage investment advice, implores its discerning clients to cast their gaze towards Bitcoin miners, beckoning them to seize the fleeting opportunity presented by the recent underperformance. For in the murky waters of market dynamics, lies hidden the promise of untold riches, a promise that may soon evaporate with the impending halving event.

Yet, amidst Bernstein’s bold proclamation, there exists a specter of even grander expectations. The specter of Cathie Wood’s Ark Invest, an arbiter of innovation, whose audacious vision eclipses even the most fervent dreams of Bitcoin maximalists. Wood’s Ark Invest has boldly recalibrated its long-term Bitcoin price target, catapulting it beyond the stratosphere to an eye-watering $1 million and beyond—a testament to the boundless potential of this digital gold.

In the grand tapestry of financial prognostication, Bernstein’s prediction stands as a beacon of tempered optimism, a testament to the cautious optimism that pervades the halls of wealth management. And yet, in the shadow of Wood’s soaring aspirations, one cannot help but wonder—what other marvels lie in wait for the enigmatic realm of cryptocurrencies? Only time will tell.