In the dynamic world of blockchain technology, Solana has undeniably emerged as the unrivaled leader of the year, capturing the spotlight and asserting its dominance as the foremost blockchain platform of 2024. This year has been a whirlwind of monumental achievements and critical challenges for Solana, inviting both adulation and scrutiny from the global crypto community.

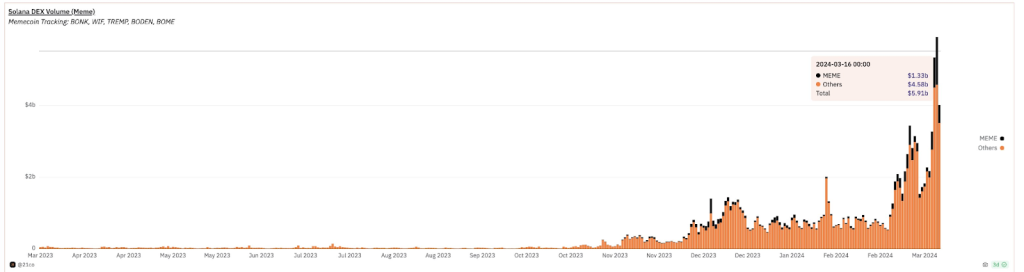

Solana’s ascent to prominence has been nothing short of extraordinary, marked by a series of groundbreaking milestones that have propelled it to the pinnacle of the industry. With its unparalleled scalability, lightning-fast transaction speeds, and innovative features, Solana has set itself apart as a trailblazer in the blockchain space. Its trading volume skyrocketed to unprecedented levels, surging past the $1.33 billion mark on March 16th, a testament to its unparalleled popularity and widespread adoption among investors and traders alike.

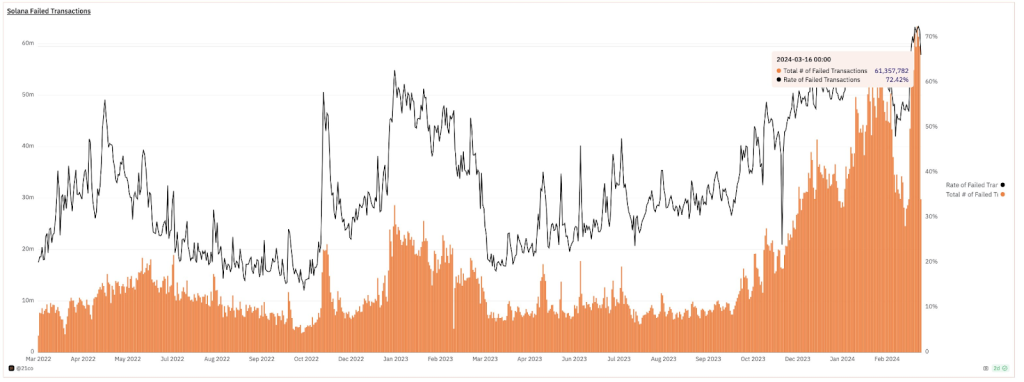

However, amidst the euphoria of its remarkable achievements, Solana has also faced its fair share of formidable challenges. Chief among these is the alarming issue of transaction failures, which have plagued the network and cast a shadow over its otherwise stellar performance. Reports indicate that more than 72% of transactions on Solana have encountered failures, raising serious concerns about the platform’s reliability and scalability. This stark disparity between soaring demand and operational shortcomings underscores the urgent need for Solana to address and overcome its technical hurdles in order to sustain its momentum and secure its position as a long-term leader in the blockchain landscape.

Moreover, Solana’s foray into the volatile world of meme coins has been met with mixed fortunes, as the platform grapples with incidents of rug pulls and scams that have tarnished its reputation and eroded investor trust. Despite its efforts to foster innovation and experimentation within its ecosystem, Solana must navigate the delicate balance between fostering growth and safeguarding against fraudulent activities, lest it jeopardize its hard-earned credibility and integrity.

From its meteoric rise to its ongoing struggles with transaction failures, and from its ambitious foray into meme coins to the challenges of ensuring security and reliability, Solana’s journey in 2024 has been nothing short of eventful and impactful. As the blockchain landscape continues to evolve and mature, Solana remains at the forefront, poised to shape the future of decentralized technologies and redefine the possibilities of what blockchain can achieve. Join us as we delve deeper into Solana’s remarkable year, exploring the triumphs, trials, and transformative potential that define its journey in the ever-evolving world of blockchain.

DEX and MEME Coin Volume Surge

Throughout the year, Solana has ascended to the upper echelons of top-tier blockchain networks, propelled by a surge in meme coin activity that catapulted trading volumes to unprecedented heights. Amidst the frenzied excitement surrounding meme coins such as BONK, WIF, TREMP, BODEN, and BOME, Solana has emerged as a beacon of opportunity, attracting genuine investors eager to capitalize on the lucrative potential inherent in this newfound craze.

The proliferation of meme coins on the Solana network has not only captured the imagination of traders and enthusiasts but has also underscored the platform’s growing significance within the broader cryptocurrency ecosystem. With its robust infrastructure and lightning-fast transaction speeds, Solana has proven to be an ideal breeding ground for meme coin projects seeking to capitalize on the fervor and speculation surrounding this burgeoning asset class.

For genuine investors, Solana represents a compelling avenue for exploring high-yield opportunities amidst the meme coin frenzy. The platform’s unparalleled scalability and efficiency offer a conducive environment for capitalizing on the volatility and momentum inherent in meme coin trading, providing a gateway to potentially lucrative returns for those willing to navigate the risks and uncertainties of this speculative market.

However, amidst the allure of meme coin speculation, genuine investors must exercise caution and diligence, conducting thorough research and due diligence to identify promising projects with strong fundamentals and sustainable growth prospects. While the meme coin phenomenon presents tantalizing opportunities, it is also fraught with risks, including volatility, liquidity concerns, and susceptibility to market manipulation.

As Solana continues to solidify its position as a leading blockchain network, the convergence of meme coin activity and genuine investor interest underscores the platform’s resilience and adaptability in catering to diverse market demands. With its unwavering commitment to innovation and its steadfast pursuit of scalability and security, Solana remains at the forefront of driving the evolution of decentralized finance and reshaping the future of digital assets. For genuine investors seeking to capitalize on the meme coin frenzy, Solana stands as a beacon of opportunity amidst the tumultuous seas of the cryptocurrency market.

Transactions Failing?

Amidst the soaring trade volume that imbued Solana with a sense of optimism and vitality, the network was besieged by a troubling phenomenon—a dramatic surge in failed transactions exceeding a staggering 72%. This unexpected setback cast a shadow over the platform’s otherwise promising trajectory, prompting a comprehensive investigation into the root causes of this alarming trend.

Enter Tom Wan, an esteemed on-chain data analyst renowned for his meticulous scrutiny of blockchain phenomena. In his exhaustive analysis, Wan delved deep into the labyrinthine intricacies of Solana’s transactional ecosystem, uncovering a disconcerting reality: the overwhelming majority of these failed transactions—93%, to be exact—were attributable to the nefarious machinations of bots inundating the network with spam. In stark contrast, a mere 17% emanated from genuine, organic users, underscoring the pervasive influence wielded by automated entities in disrupting the network’s operational efficiency and impeding the seamless execution of transactions.

Wan’s findings reverberated across the Solana community like a thunderclap, sparking fervent debates and urgent calls to action. The implications were dire, laying bare the systemic vulnerabilities inherent in blockchain ecosystems when subjected to the relentless onslaught of malicious bot activity. As Solana grappled with the ramifications of this onslaught, stakeholders rallied together, united in their determination to fortify the network’s defenses and safeguard its integrity and reliability against future incursions.

In response, a multifaceted strategy was devised, encompassing an array of proactive measures aimed at thwarting the insidious tactics employed by bots seeking to exploit vulnerabilities within the network. Enhanced monitoring mechanisms were implemented, bolstered by sophisticated anti-bot protocols designed to detect and neutralize malicious activity in real-time. Transparency and accountability were prioritized, fostering greater collaboration and information-sharing among users and developers alike.

Yet, Wan’s analysis served as more than a mere diagnostic tool—it was a clarion call for vigilance, a rallying cry for heightened awareness and resilience in the face of adversity. The Solana community embraced this challenge with characteristic resolve, recognizing that only through collective action and unwavering commitment could they surmount the obstacles posed by malicious actors and emerge stronger and more resilient than ever before.

As Solana embarked on this arduous journey towards fortification and renewal, Wan’s insights served as a guiding beacon, illuminating the path forward and instilling a renewed sense of purpose and determination within the community. For in the crucible of adversity lies the crucible of opportunity—the opportunity to forge a future where security, integrity, and resilience reign supreme, ensuring that Solana’s journey towards greatness remains undeterred and unstoppable.

More Challenges to Tackle

Furthermore, Solana users found themselves grappling with another pressing issue—escalating transaction charges that surged nearly 2-3 times higher than previous levels. While the average user could still conduct transactions without opting for priority fees, the median transaction fee skyrocketed from 0.000005 SOL to 0.000016 SOL, translating to a substantial increase in transaction costs averaging around $0.065. This abrupt spike in transaction expenses exerted a palpable strain on users, hampering the overall user experience within the Solana ecosystem.

The confluence of network congestion, a surge in failed transactions, and escalating costs collectively contributed to a perceptible slowdown in user activity across the Solana network. This slowdown reverberated throughout the ecosystem, dampening user engagement and impeding the seamless execution of transactions. Frustrations mounted as users encountered prolonged wait times, higher fees, and increased uncertainty, eroding confidence in the platform’s reliability and efficiency.

The ramifications of these challenges extended beyond mere inconvenience, casting a shadow over Solana’s reputation as a high-performance blockchain platform. As users grappled with the adverse effects of network congestion and rising transaction costs, concerns mounted regarding the platform’s scalability and its ability to accommodate growing demand without sacrificing speed or affordability.

In response to these pressing concerns, stakeholders within the Solana community mobilized to address the underlying issues and restore confidence in the platform’s operational integrity. Initiatives were launched to optimize network efficiency, enhance scalability, and mitigate the impact of congestion-induced disruptions. Moreover, concerted efforts were made to explore innovative solutions aimed at reducing transaction costs and improving the overall user experience within the Solana ecosystem.

Despite these challenges, the Solana community remained steadfast in its commitment to overcoming obstacles and realizing the platform’s full potential as a leading blockchain solution. Through collaborative action, innovation, and resilience, Solana sought to navigate the turbulent waters of network congestion and rising transaction costs, emerging stronger and more resilient on the other side. As the ecosystem continued to evolve, users and developers alike remained united in their shared vision of building a decentralized future that is inclusive, efficient, and accessible to all.

User Trust – Crushed and Crumpled!

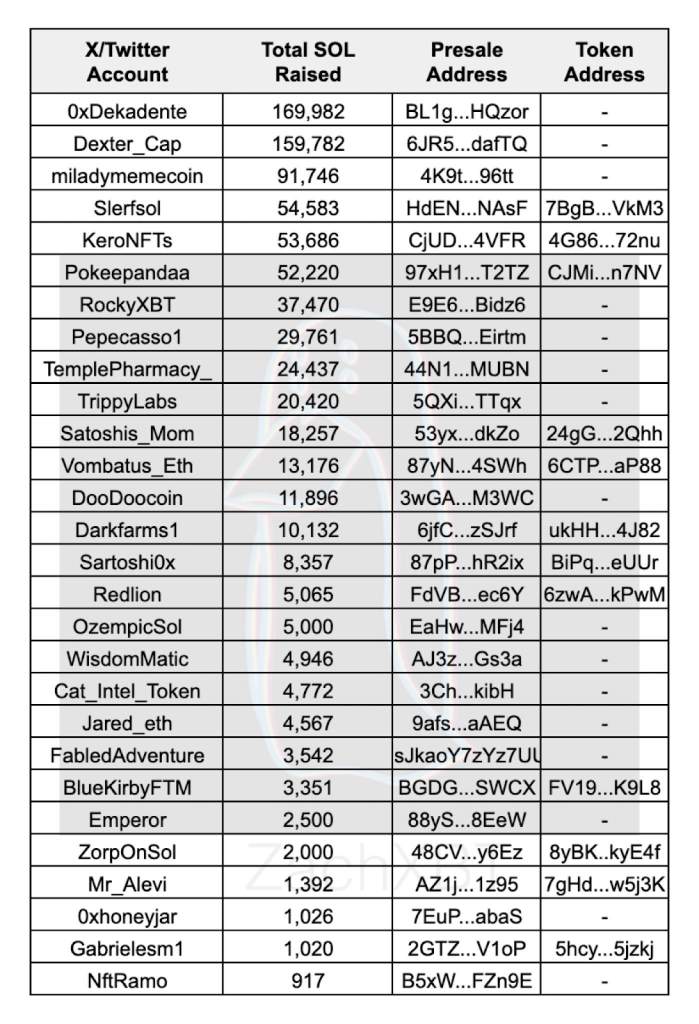

As per the latest findings unveiled by the renowned on-chain investigator ZachXBT, the Solana ecosystem has demonstrated an extraordinary capacity to mobilize resources, having amassed a staggering 796,000 SOLs—equivalent to approximately $149.2 million—since March 12 through a series of 33 meme coin presales. This remarkable surge in fundraising activity can be directly attributed to the fervent anticipation surrounding the launch of the Book of Meme ($BOME) token, which has captivated the attention and enthusiasm of investors and enthusiasts alike.

The exponential growth in fundraising within the Solana ecosystem underscores the platform’s burgeoning prominence as a preferred launchpad for meme coin projects seeking to capitalize on the prevailing market trends and investor sentiment. With its robust infrastructure, lightning-fast transaction speeds, and vibrant community, Solana has emerged as a fertile breeding ground for innovative token launches, attracting substantial capital inflows and propelling the ecosystem to new heights of success and recognition.

The hype surrounding the Book of Meme ($BOME) token launch serves as a poignant illustration of the transformative potential inherent in meme coins within the broader cryptocurrency landscape. As investors clamor to participate in these presales, driven by a combination of speculative fervor and the allure of potential returns, Solana stands at the forefront of this burgeoning trend, facilitating a seamless and efficient fundraising process for projects seeking to carve out their niche in the digital asset space.

However, amidst the euphoria of this fundraising frenzy, it is imperative for investors to exercise caution and due diligence, recognizing the inherent risks and uncertainties associated with meme coin investments. While the allure of quick gains may be enticing, it is essential to conduct thorough research, assess project fundamentals, and evaluate the credibility and integrity of the teams behind these initiatives.

The remarkable fundraising success witnessed within the Solana ecosystem serves as a testament to the platform’s growing prominence and relevance in the cryptocurrency landscape. With the launch of meme coin projects such as the Book of Meme ($BOME) token, Solana continues to demonstrate its capacity to drive innovation, foster community engagement, and facilitate capital formation, reaffirming its position as a leading blockchain platform at the forefront of the digital revolution.

A Good Opportunity, But Proceed With Caution

In the ever-expanding universe of cryptocurrencies, where trends seem to emerge and evolve at warp speed, Solana stands out as a beacon of stability and promise amidst the chaotic landscape of meme coins. Its resilience and technological prowess have cemented its position as one of the foremost blockchains, attracting a plethora of investors eager to partake in the burgeoning digital economy it facilitates. However, beneath the surface of this seemingly utopian crypto realm lie lurking dangers and pitfalls, waiting to ensnare the unwary and ill-prepared.

For investors venturing into the realm of Solana, the adage “forewarned is forearmed” could not ring truer. While the potential for lucrative gains may be enticing, the journey is fraught with risks that demand careful navigation and strategic foresight. Indeed, the allure of quick riches can often blind investors to the inherent dangers lurking within the shadows of the blockchain.

At the forefront of these perils are the ever-present threats of scam businesses and deceptive schemes, which prey upon the unsuspecting and gullible. The rapid proliferation of meme coins has provided fertile ground for unscrupulous actors to propagate fraudulent ventures, masquerading as legitimate investment opportunities. From Ponzi schemes promising astronomical returns to phishing scams aimed at siphoning funds from unsuspecting victims, the dangers are manifold and omnipresent.

In the face of such pervasive risks, safeguarding one’s investments becomes paramount. Yet, the path to financial security in the realm of Solana is not without its challenges. Investors must tread cautiously, exercising due diligence and scrutinizing every opportunity with a discerning eye. Blindly entrusting funds to unknown addresses or succumbing to the allure of seemingly irresistible offers is akin to playing Russian roulette with one’s financial future.

To mitigate these risks, investors must adopt a multifaceted approach that combines prudence, vigilance, and proactive risk management strategies. First and foremost, exercising caution in all financial transactions is imperative. This includes verifying the legitimacy of counterparties, scrutinizing the terms and conditions of investment opportunities, and conducting thorough research into the projects and platforms in which one chooses to invest.

Furthermore, investors must remain ever vigilant against the threat of impersonation accounts and phishing attempts, particularly on social media platforms where scammers often lurk in the shadows, waiting to prey upon unsuspecting victims. Verifying the authenticity of usernames and profiles, exercising caution when engaging with unsolicited messages or offers, and refraining from divulging sensitive information are essential safeguards against falling victim to these insidious tactics.

In the fast-paced and ever-evolving world of cryptocurrency trading, the mantra of “trust, but verify” reigns supreme. While the opportunities within the Solana ecosystem are abundant, they are also accompanied by a commensurate level of risk. By adopting a cautious and discerning approach, investors can navigate the treacherous waters of meme coin madness with confidence, safeguarding their investments and capitalizing on the vast potential that Solana has to offer.