PeckShield’s findings reveal that around $100 million in cryptocurrency funds pilfered during hacking episodes in March have been effectively retrieved. Despite the substantial initial losses reaching millions of dollars, owners saw 52.8% of the looted funds restored.

PeckShield specified that the primary portion of the recuperated funds originated from the Munchables case, wherein the hacker relinquished the purloined cryptocurrency subsequent to negotiations.

PeckShield’s Report Highlights Decrease in Crypto Hacks for March, Surpassing January’s Numbers

#PeckShieldAlert March 2024 witnessed 30+ hacks in the crypto space, resulting in ~$187.29 million in losses, with ~$98.8 million recovered.

This marks a decrease of ~48% from February 2024.#Top5 hacks:#Munchables (#Juice affected): $97 million (recovered)#CurioNetwork: $40… pic.twitter.com/u3zejt9Ygn— PeckShieldAlert (@PeckShieldAlert) April 1, 2024

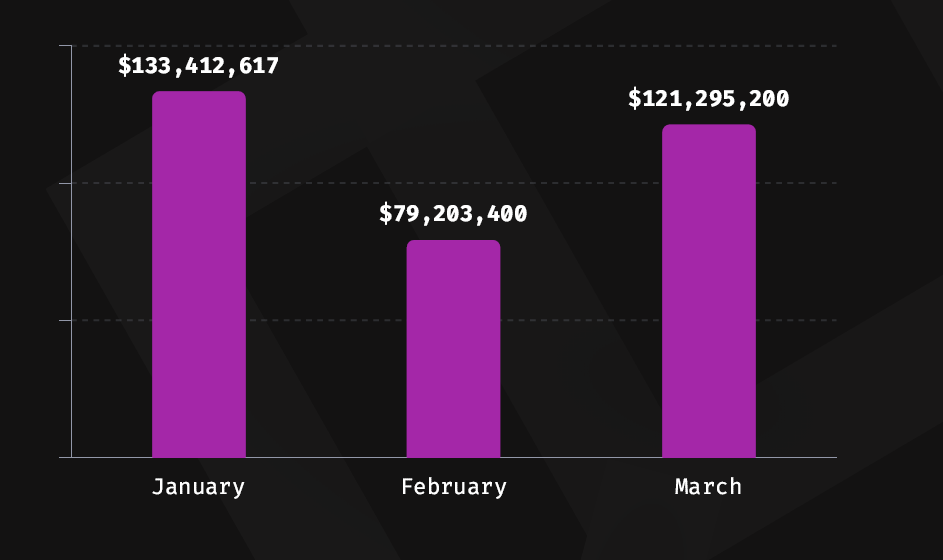

In its report released on April 1, web3 cybersecurity firm PeckShield revealed that the crypto market experienced over 30 hacking incidents in March, resulting in losses amounting to $187.29 million. However, there was a silver lining as $98.8 million of the stolen funds were successfully recovered. This marked a notable decrease of 48% from the previous month, February, which witnessed hackers siphoning off over $360 million.

Despite the positive trend of reduced losses compared to February, March’s figures still surpassed those recorded in January, when the market endured losses amounting to $182.5 million. This persistent challenge underscores the ongoing threat posed by cybercriminals in the crypto space.

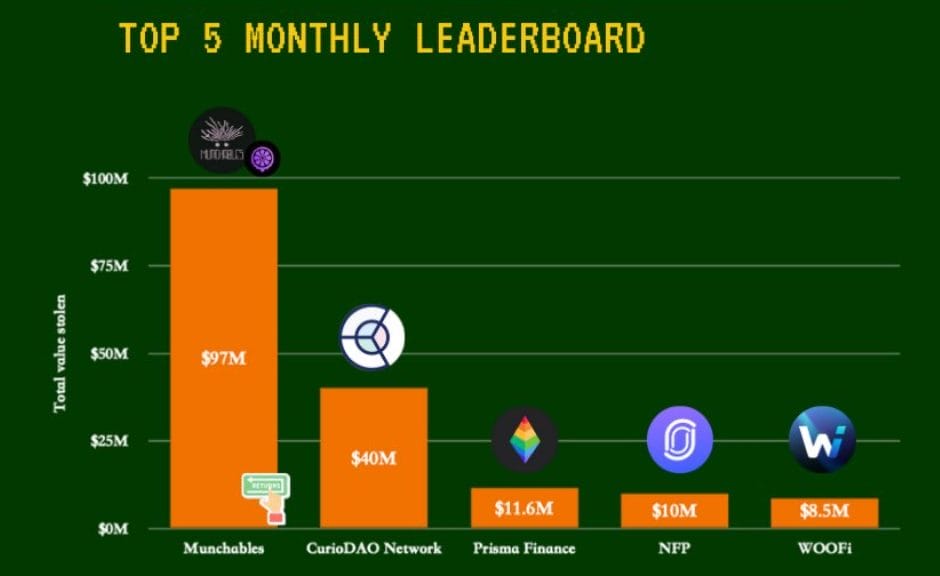

PeckShield’s report also shed light on the top five incidents that occurred during the month. The Munchables hack emerged as the most significant in terms of losses, followed by the Curio hack, the Prisma Finance breach, the NFPrompt hack, and the WOOFi exploit. These incidents serve as stark reminders of the vulnerability of the crypto ecosystem and the importance of robust cybersecurity measures.

Source: PeckShield

Source: PeckShield

As per the report, the majority of the recovered funds were associated with the Munchables incident, which involved a non-fungible token (NFT) game hosted on the Blast network. The project disclosed on March 26 that it had fallen victim to an exploit, initially estimating losses at $62 million. However, the hacker later returned the funds without making any ransom demands.

Subsequently, on March 27, Munchables identified the hacker as one of its developers. Eventually, core contributors to Blast announced that they had secured $97 million in cryptocurrency stolen during the incident.

Similarly, in the case of the Prisma Finance incident, where approximately $11 million worth of digital assets were stolen, there remains a possibility of recovery. Following the hack on March 28, the decentralized finance protocol froze its platform for investigation. The hacker later claimed that the incident was a “white hat rescue,” and negotiations between the protocol and the hacker are ongoing.

On March 24, Curio, a MakerDAO-based smart contract on Ethereum, was breached. While the initial estimated losses were $16 million, PeckShield suggests that the actual amount may be closer to $40 million in stolen cryptocurrency funds, making it the second-largest loss incident of the month.

The fifth-largest incident for the month occurred on the Binance-backed platform NFPrompt, which experienced unauthorized access, resulting in approximately $10 million in losses. Additionally, the WooFi decentralized exchange suffered losses of around $8.5 million.

In the first quarter of 2024, there was a decrease in crypto hacks and fraudulent activities, resulting in total losses amounting to $336.3 million.

During the initial quarter of 2024, the collective sum lost to hacking and fraudulent activities amounted to around $336.3 million, which marks a decline from the $437.5 million reported in 2023. The report delineates 46 hacking episodes and 15 instances of fraudulent activities within this period.

Source: Immunefi

Source: Immunefi

Two projects encountered significant losses, totaling $144.5 million, comprising 43% of the overall loss. The primary attack, amounting to $81.7 million, targeted the cross-chain bridge protocol Orbit Bridge on New Year’s Eve.

January recorded the highest monthly losses in the first quarter, totaling $133 million. The second-largest attack during the quarter involved a $62 million exploit on Munchables. Overall, $73.9 million (22%) of the stolen funds from seven exploits in Q1 were successfully recovered. The number of attacks decreased by 17.6%, from 74 in Q1 2023 to 61 in 2024.

Hacking incidents accounted for the majority of the losses, comprising 95.6% ($321.6 million) across 46 incidents, while fraudulent activities, scams, and rug pulls constituted 4.4% ($14.7 million) across 15 incidents.

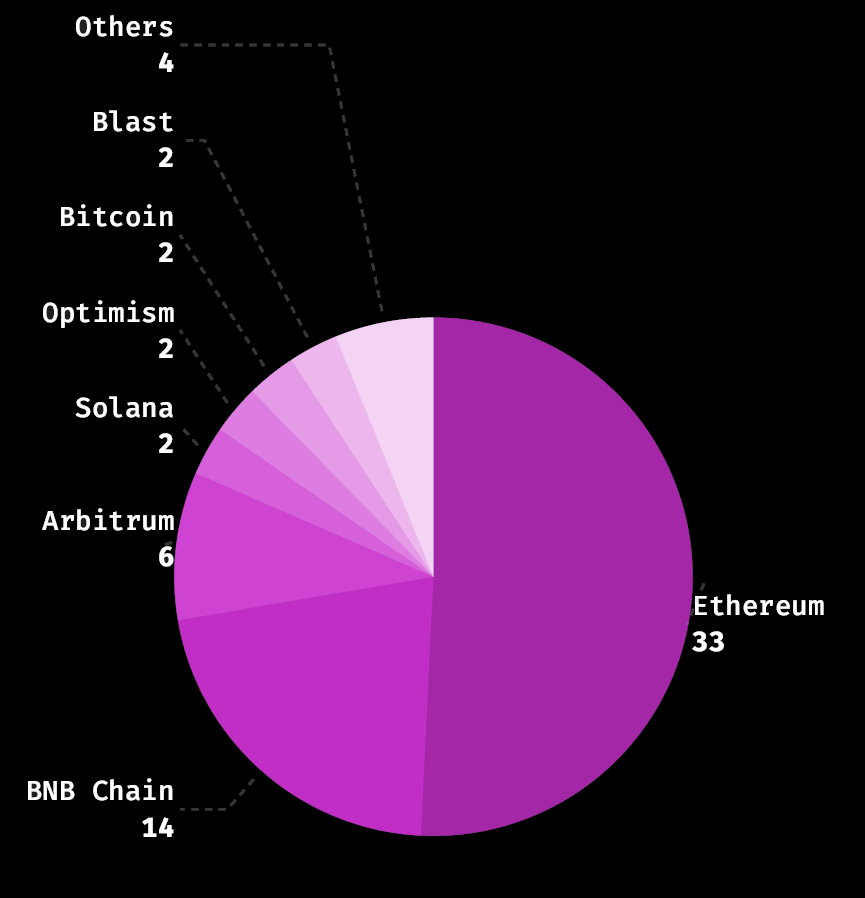

Ethereum emerged as the most targeted blockchain, followed by the BNB Chain, with both networks representing 73% of the total losses. Ethereum witnessed the highest number of attacks, with 33 incidents constituting 51% of the total losses.

Source: Immunefi

Source: Immunefi

Conversely, the BNB Chain experienced 12 attacks, which accounted for 22% of the exploited funds. Furthermore, incidents took place on platforms such as Arbitrum, Solana, Optimism, Bitcoin, Blast, Polygon, Conflux Network, and Base.