In the latest resurgence witnessed across the cryptocurrency market, memecoins have emerged as notable contenders, with standouts including Pepe (PEPE) and Floki (FLOKI) experiencing remarkable price surges over the past 24 hours. At present, PEPE has demonstrated a commendable climb of 23.62%, while FLOKI has astounded market observers with an extraordinary leap of 44.24% within the same time frame.

What sets these memecoins apart is their shared reliance on the Ethereum blockchain, which serves as the foundational infrastructure for their operations. This interconnectedness underscores the pivotal role of Ethereum’s ecosystem in facilitating the functionalities and transactions of these memecoins, highlighting the deep integration and dependence of such tokens on the Ethereum network.

Conversely, as the market revival unfolded, Solana-based memecoins also experienced a resurgence, albeit to a lesser extent compared to their Ethereum counterparts. However, despite the collective uptrend observed among Solana-based memecoins, none managed to achieve the monumental gains witnessed by PEPE and FLOKI. This disparity underscores the unique dynamics inherent in different blockchain ecosystems, with Ethereum’s robust infrastructure and user base potentially contributing to the outsized performance of memecoins operating within its domain.

Beyond the surface-level price movements, the resurgence of memecoins carries broader implications for the cryptocurrency landscape. It underscores the enduring appeal of meme-based tokens within the market, driven by a combination of speculative interest, community engagement, and the allure of participating in novel and unconventional projects.

Furthermore, the resurgence of Ethereum-based memecoins like PEPE and FLOKI serves as a testament to the enduring strength and versatility of the Ethereum blockchain, which continues to serve as a preferred platform for the development and deployment of a diverse array of digital assets.

The recent resurgence of memecoins, particularly Ethereum-based tokens like PEPE and FLOKI, signals a renewed wave of enthusiasm and interest within the cryptocurrency market. As these tokens continue to capture the imagination of investors and enthusiasts alike, their performance serves as a barometer of market sentiment and a reflection of the evolving dynamics within the broader blockchain ecosystem.

Guess who is superior now

Certainly, let’s dive deeper into the intricacies of the memecoin market dynamics, particularly focusing on the recent price movements of Bonk (BONK), dogwifhat (WIF), and BOOK OF MEMES (BOME), as well as the underlying factors driving these fluctuations, alongside the role of active addresses in shaping market sentiment.

In the ever-evolving landscape of cryptocurrency markets, memecoins have carved out a unique niche, often characterized by rapid price movements driven by social media buzz and community engagement. Recently, this trend manifested in the price action of BONK, WIF, and BOME, each experiencing notable shifts in valuation.

Let’s begin with Bonk (BONK), which witnessed a commendable surge of 10.80% in its price. This uptick was reflective of the enthusiasm surrounding the coin within its community and the broader memecoin ecosystem. Meanwhile, dogwifhat (WIF) outperformed expectations with an impressive price increase of 17.83%, signaling robust investor interest and possibly strategic market positioning.

However, amidst this bullish momentum, BOOK OF MEMES (BOME) faced headwinds, recording a decline of 5.08%. Despite recent hype surrounding the coin, it struggled to sustain upward momentum, highlighting the nuanced nature of memecoin valuation dynamics and the importance of broader market sentiment.

Before delving deeper into the driving forces behind these price movements, it’s crucial to contextualize the broader market environment. Recent analysis from reputable sources such as AMBCrypto has shed light on the comparative performance of memecoins within different blockchain ecosystems, with a notable emphasis on Solana-based tokens outperforming their Ethereum counterparts.

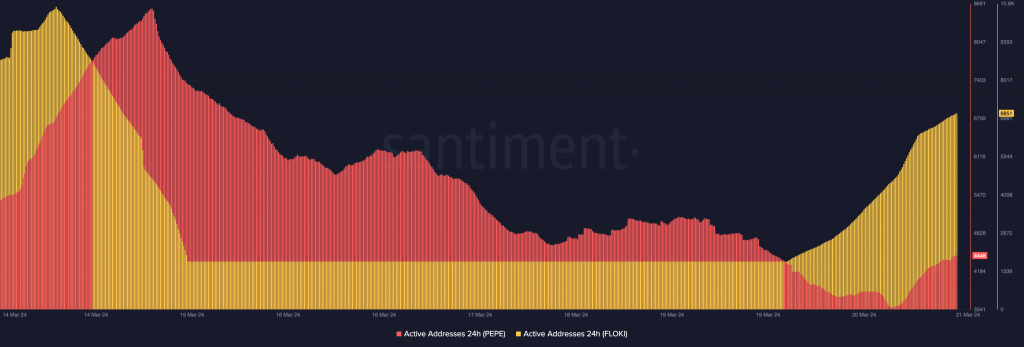

Now, let’s dissect the factors at play. According to comprehensive on-chain analysis, the activity of active addresses emerged as a pivotal driver of market sentiment. On March 20th, a notable decline in 24-hour active addresses was observed on Pepe’s network, indicating a potential dampening of community engagement and investor interest. Similarly, Floki experienced a prolonged period of reduced active addresses, commencing from the 19th.

This decline in active addresses suggested a corresponding decrease in participant interest and demand, thereby limiting the potential for price appreciation. Indeed, it underscores the interconnectedness between on-chain metrics and market dynamics, particularly in the context of memecoin valuations.

However, recent data from Santiment paints a more optimistic picture. At the time of writing, FLOKI’s active addresses had surged to 6851, indicative of renewed community engagement and potentially foreshadowing further price appreciation. Similarly, PEPE recorded a notable increase, reaching 4448 active addresses, signaling a resurgence in interest and activity within its ecosystem.

This data serves as a compelling indicator of the potential trajectory of these tokens’ values in the coming days. Nonetheless, the sustainability of this bullish momentum hinges on several factors, chief among them being the continued engagement of traders and investors within these networks. Should participants opt to withdraw their engagement once more, it could introduce volatility and potentially reverse the recent price gains.

In essence, the recent price movements of memecoins such as BONK, WIF, and BOME underscore the dynamic nature of cryptocurrency markets, where sentiment, community engagement, and on-chain metrics intertwine to shape valuations. As the market continues to evolve, understanding these nuances becomes increasingly imperative for traders and investors seeking to navigate the ever-changing landscape of memecoin investments.

They are not yet out of danger

Delving into the intricacies of the price dynamics of PEPE and FLOKI, the 4-hour PEPE/USD chart provides a nuanced perspective on the current state of these memecoins within the volatile cryptocurrency market. At the forefront of this analysis is the observation that PEPE appears to be navigating through bullish territory, as indicated by the recent crossover of the 9 EMA over the 20 EMA, a commonly recognized signal of upward momentum. However, it’s crucial to scrutinize this apparent bullish trend in greater detail to discern its sustainability and potential implications for market participants.

As we dissect the PEPE/USD price action on the 4-hour timeframe, it becomes evident that the proximity of the EMAs warrants careful consideration. Despite the bullish crossover, the fact that the EMAs are in close proximity to each other suggests a delicate balance between buyers and sellers. This precarious equilibrium could potentially be disrupted if there’s a surge in profit-taking activity, which may drive PEPE’s price below the EMAs and subsequently invalidate the bullish bias.

Nevertheless, amidst this backdrop of uncertainty, insights gleaned from the Accumulation/Distribution (A/D) indicator offer a glimmer of hope for PEPE proponents. The uptick in buying pressure, as reflected by the A/D indicator, underscores the resilience of PEPE against potential downward pressure, hinting at a possible continuation of the bullish trend.

Turning our attention to FLOKI, it’s intriguing to note the parallels with PEPE in terms of price dynamics. Like its counterpart, FLOKI’s EMAs exhibit a similar trend, further underscoring the interconnectedness between these memecoins within the broader cryptocurrency ecosystem. However, the looming possibility of FLOKI’s price descending to $0.00021 poses a potential challenge to sustaining the current upward momentum, signaling a pivotal juncture for market participants to monitor closely.

In addition to analyzing price movements, it’s imperative to consider PEPE’s market capitalization in FLOKI terms, offering valuable insights into its relative strength and market positioning. While such comparisons may be speculative in nature, they serve as a barometer for assessing the competitive landscape within the memecoin market.

Furthermore, insights derived from the Awesome Oscillator (AO) shed light on the underlying market dynamics at play. The increasing upward momentum indicated by the AO suggests a concerted effort by bullish market participants to defend against potential downward pressure, underscoring the resilience of these memecoins in the face of market volatility.

However, it’s essential to acknowledge the potential downside risks associated with a highly bearish scenario. In such a scenario, FLOKI’s price could plummet to $0.00018, while PEPE might experience a similar downturn, dropping to $0.0000066. Despite these challenges, a bullish prediction for both memecoins could herald a new era of prosperity, propelling their values to unprecedented heights and solidifying their status within the ever-evolving landscape of memecoin investments.