Polkadot, a revolutionary blockchain platform meticulously engineered to foster seamless interoperability among diverse blockchains, is presently witnessing a remarkable surge in the influx of new users. Yet, an intriguing conundrum has emerged—a stark disjunction between this burgeoning user base and the corresponding network activity, thereby eliciting profound inquiries regarding its enduring viability in the blockchain ecosystem.

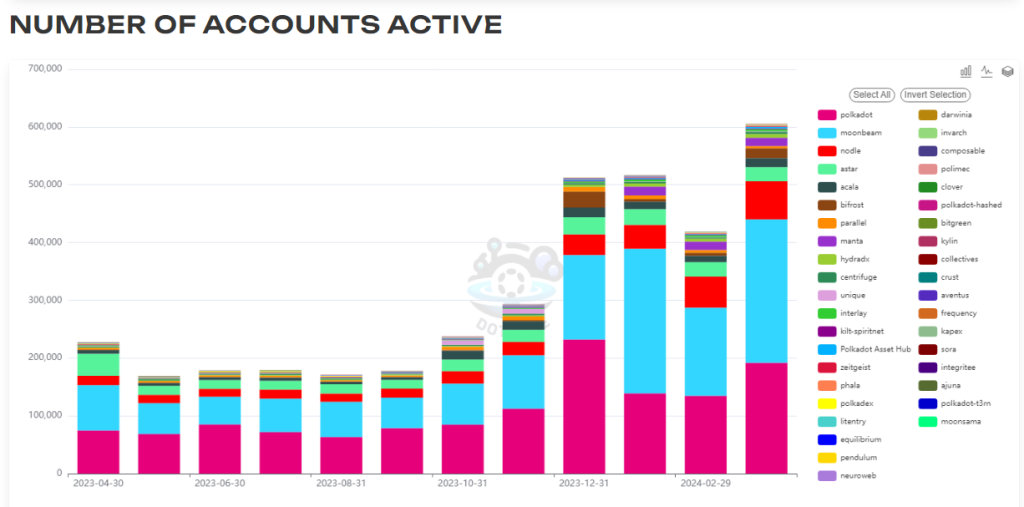

Diving into the latest statistical insights, March unveiled an unprecedented zenith for DOT, as it notched up an all-time pinnacle in both active wallets and unique accounts. Surpassing the impressive milestones of 600,000 active wallets and 5.59 million unique accounts, Polkadot’s exponential ascent hints at an escalating fascination with the platform. This escalating interest can potentially be attributed to the burgeoning ecosystem of developers congregating around Polkadot’s parachains—ingeniously crafted blockchains intricately connected to the primary Polkadot chain.

Amidst this thriving ecosystem, one parachain, in particular, has seized the limelight—Moonbeam. Emerging as a beacon of innovation, Moonbeam has significantly bolstered Polkadot’s user growth trajectory by contributing an overwhelming majority of active addresses, clocking in at nearly 250,000. Such staggering figures underscore not only the burgeoning allure of Polkadot but also the pivotal role of its diverse parachain ecosystem in propelling its ascendancy.

However, beneath the surface of this burgeoning user base lies a tantalizing enigma—the apparent discordance between user acquisition and network activity. This disjuncture, while intriguing, raises pertinent questions regarding the sustainability and long-term prospects of Polkadot within the dynamic landscape of blockchain technology.

As the Polkadot community navigates through this intricate labyrinth of growth and sustainability, one thing remains abundantly clear—its journey is far from over. With each passing milestone and every surge in user adoption, Polkadot etches its indelible mark on the canvas of blockchain innovation, heralding a new era of interoperability, collaboration, and boundless potential.

Polkadot Transactions Dip Despite Active User Growth

Despite the notable influx of fresh participants embracing the Polkadot network, there exists a conspicuous lag in transactional vigor. While a marginal surge in transactions has been observed since February, the prevailing volume substantially trails the zenith attained in December.

Such a glaring incongruity invariably elicits apprehensions regarding the extent of user involvement with the network. The prevailing conjecture suggests that users might be opting to retain or stake their DOT tokens rather than proactively leveraging them for transactions within the platform. This propensity, if sustained, could potentially impede the network’s intended functionality and hinder its broader adoption trajectory.

Indeed, this quandary underscores the critical need for a deeper examination into the underlying dynamics governing user behavior within the Polkadot ecosystem. By discerning the drivers behind this reluctance to transact, stakeholders can strategize and implement targeted initiatives aimed at fostering a more vibrant and participatory network environment. Such initiatives might encompass incentivization schemes, educational campaigns, or user-friendly enhancements to the platform’s interface, all geared towards catalyzing greater user engagement and fortifying the network’s resilience in the face of evolving market dynamics.

Polkadot Price Seeks Stability After Recent Decline

The trajectory of Polkadot’s native cryptocurrency, DOT, is presently exhibiting a notable phenomenon, as it appears to have established a support level in the vicinity of $9. This pivotal observation hints at a potentially significant phase of consolidation within the market dynamics, particularly following a discernible downturn from its previous zenith, which had soared above the $11 threshold. The intricate dance between supply and demand dynamics, coupled with the evolving sentiment among investors, is shaping this current narrative.

Within the context of cryptocurrency markets, a period of consolidation can serve as a pivotal juncture, where market participants reassess their positions and strategies in response to recent price movements. It represents a phase of relative stability amidst preceding fluctuations, signifying a potential recalibration of market sentiment and expectations. Consequently, the establishment of a support level around $9 for DOT could be interpreted as a manifestation of market participants finding equilibrium within the prevailing conditions.

Moreover, it’s imperative to contextualize this price behavior within the broader framework of Polkadot’s underlying network fundamentals. While a resurgence in price is often perceived as a positive indication of market sentiment, it’s equally essential to scrutinize this development vis-à-vis the actual utilization and adoption of the Polkadot network. The intrinsic value of any cryptocurrency ultimately hinges on its utility and functionality within the ecosystem it operates.

Therefore, while observing the price movements of DOT can provide valuable insights into market sentiment and short-term trends, it’s imperative to delve deeper into the underlying factors driving its valuation. Assessing metrics such as network activity, transaction volume, developer activity, and ecosystem growth can furnish a more comprehensive understanding of the intrinsic value proposition of Polkadot and its native token, DOT.

In essence, while the stabilization of DOT around $9 may indicate a phase of consolidation following a price decline, a holistic analysis that encompasses both market dynamics and network fundamentals is indispensable for gaining a nuanced perspective on the cryptocurrency’s trajectory and potential future prospects.

Is Polkadot Building Without Using?

The current landscape within the realm of Polkadot presents a fascinating paradox that demands our attention and careful scrutiny. Despite experiencing a notable surge in the number of individuals drawn towards its ecosystem, there appears to be a perplexing gap between this influx of users and their translation into active and engaged participants within the network. This intriguing observation begs the question: what could be the underlying reasons behind this seeming dissonance?

There exist a myriad of potential explanations for this phenomenon, each warranting thorough exploration. One plausible conjecture is that prospective users are adopting a cautious stance, perhaps waiting for the emergence of specific applications or services that align more closely with their needs and expectations before fully committing to active involvement within the Polkadot network. It’s conceivable that until the platform reaches a critical mass of diverse and compelling functionalities, some users may remain on the periphery, hesitant to fully immerse themselves in its ecosystem.

Furthermore, it’s imperative to consider the possibility of technical constraints posing barriers to user engagement. Despite Polkadot’s formidable technological infrastructure, it’s not inconceivable that certain limitations or complexities inherent in the system might deter users from navigating its intricacies with ease. Whether it be issues related to user experience, interoperability challenges, or performance bottlenecks, these technical hurdles could undeniably play a role in hindering the seamless transition of users from passive observers to active participants within the network.

Given the multifaceted nature of this conundrum, it’s evident that a deeper level of analysis is warranted to unravel the intricacies of the situation. In particular, a comprehensive examination of the types and patterns of transactions occurring within the Polkadot ecosystem could provide invaluable insights into the underlying dynamics at play. For instance, a discernible uptick in governance-related transactions might signal a heightened level of engagement and commitment among a subset of users, even if the overall transaction volume remains relatively subdued. Conversely, a disproportionate focus on certain types of transactions, coupled with a lack of diversity in usage patterns, could indicate potential areas of improvement or untapped opportunities for enhancing user engagement and participation.

In essence, the phenomenon of burgeoning user interest juxtaposed with tepid levels of active engagement within the Polkadot network represents a rich tapestry of complexities and nuances that necessitates careful examination and analysis. By delving deeper into the underlying factors at play and leveraging insights gleaned from transactional data and user behavior patterns, stakeholders within the Polkadot community can gain a more nuanced understanding of the challenges and opportunities inherent in fostering a vibrant and thriving ecosystem of active participants and contributors.

Polkadot’s Future Hinges On Active Network Use

The burgeoning growth witnessed in active wallets and accounts on the Polkadot network undeniably signals a positive trajectory for its ecosystem. However, merely amassing user interest is but the first step in the journey towards achieving sustained success and relevance. The true measure of a network’s vitality lies in its ability to transform this burgeoning interest into meaningful and impactful network utilization.

In this context, the success story of Moonbeam emerges as a beacon of hope and inspiration for the Polkadot community. Moonbeam’s flourishing demonstrates the immense potential harbored within Polkadot’s framework to cultivate a vibrant and thriving developer ecosystem. Through innovative solutions and collaborative efforts, Moonbeam has not only showcased the capabilities of the Polkadot platform but has also highlighted the opportunities it presents for developers to create groundbreaking applications and services.

Yet, amidst the celebration of Moonbeam’s achievements, it is essential to recognize that the journey towards realizing Polkadot’s full potential is far from over. While Moonbeam’s success undoubtedly underscores the viability of Polkadot as a platform for innovation, achieving widespread adoption across a spectrum of diverse use cases remains imperative.

The significance of broader adoption cannot be overstated. It is not merely about increasing the number of users or transactions on the network but about unlocking the full spectrum of possibilities that Polkadot offers. From decentralized finance (DeFi) and non-fungible tokens (NFTs) to supply chain management and decentralized governance, Polkadot’s versatility enables it to cater to a wide array of industries and applications.

Moreover, achieving broader adoption fosters network resilience and sustainability. Diversifying the user base and use cases mitigates the risk of overreliance on any single application or sector. It also ensures that the network remains relevant and adaptive to evolving market trends and technological advancements.

Therefore, while the success of Moonbeam undoubtedly marks a significant milestone in Polkadot’s journey, it is but a precursor to the greater heights the network can ascend to. By fostering a culture of innovation, collaboration, and inclusivity, Polkadot has the potential to redefine the future of decentralized technology. However, to realize this vision, it is imperative that the Polkadot community continues to strive towards achieving broader adoption and unlocking the full spectrum of possibilities that the network offers.