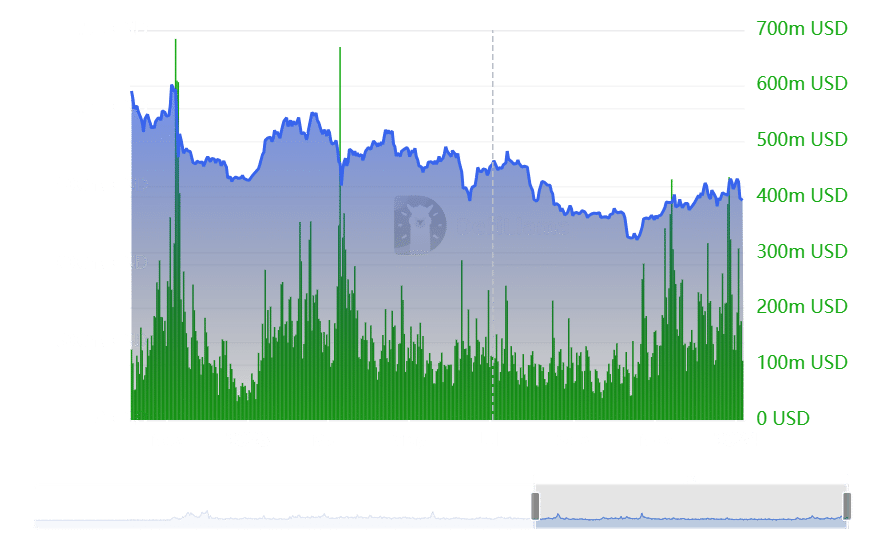

Recent importance has been bestowed upon Polygon (MATIC), especially following the recent introduction of the Layer-2 network Arbitrum (ARB) in recent months. Analyzing Polygon’s volume trajectory on DefiLlama suggests a potential uptrend, with its volume reaching the second-highest of the year, around $435 million, by the end of December.

MATIC and ARB’s TVL

The peak volume for 2023 was observed in March, reaching around $669 million. Polygon’s volume exceeded $1 billion only once in 2021, surpassing $2 billion. As of now, the altcoin’s volume stands at approximately $106 million. Examining Total Value Locked (TVL), Polygon has experienced a recent decline, with the current TVL around $845 million. In contrast, Arbitrum’s TVL has surged over $2 billion and displayed an upward trend in recent weeks.

Arbitrum’s volume in the last 24 hours surpassed $405 million, noteworthy as it exceeded $1.8 billion twice in the new year. According to data from L2 Beats, Arbitrum currently holds a dominant position among Layer 2 (L2) networks, commanding about 50% of the market share with a Total Value Locked (TVL) exceeding $9.8 billion.

Polygon lags Behind in the Competition!

On the flip side, Polygon held a more reserved position, securing the 12th rank with $111 million and possessing less than 1% of the market share. This data highlights a notable shift in the L2 landscape, signaling the ascent of other networks surpassing Polygon. These alternative L2 networks not only exhibit increased transaction volumes but also attract a wider user base, evident in their expanding market shares.

Analyzing Polygon’s daily timeline chart unveils the impact of recent market dynamics on its price. On January 3rd, Polygon encountered a substantial 11.8% price drop and has been grappling to recover since then. Preceding the downturn, the trading price hovered around $1, but as of now, it has descended to approximately $0.8. In contrast, Arbitrum displayed a divergent trend amid the market crash. Despite the broader market decline, Arbitrum saw an uptick of over 8%. However, it has recently experienced a downturn, with losses exceeding 2%, peaking above 10% on January 5th. At the present moment, it is showcasing nearly a 5% gain, with a trading price around $1.8.