The Solana (SOL) network stands as a beacon of innovation in the ever-evolving landscape of blockchain technology. Positioned as a premier layer-one (L1) blockchain, Solana has embarked on a mission to rival Ethereum (ETH) in democratizing smart contracts and revolutionizing decentralized applications (dApps). Over the past few months, Solana has captivated the attention of enthusiasts and investors alike, emerging as a hot topic in the cryptocurrency sphere.

At the forefront of Solana’s allure lies its remarkable ability to onboard millions of individuals into the realm of Web3 through its innovative offerings, particularly its meme coins and decentralized financial (DeFi) platforms. These initiatives have not only fostered widespread adoption but have also catalyzed a seismic shift in the dynamics of the digital asset landscape.

As testament to its growing prominence, Solana currently holds the esteemed title of the fifth-largest digital asset by market capitalization. With over $4.3 billion locked in its ecosystem and a stablecoin market cap exceeding $3 billion, Solana’s financial prowess underscores its significance within the cryptocurrency ecosystem.

Yet, amidst its soaring achievements, Solana has not been immune to criticism. The network has faced its fair share of challenges, including sporadic outages and network congestion, which have cast shadows over its otherwise illustrious reputation. These hurdles, while impediments to seamless operations, have served as crucial learning opportunities, propelling Solana toward greater resilience and adaptability.

However, despite such setbacks, Solana has demonstrated resilience, witnessing a surge in on-chain activity fueled by the proliferation of meme coins. These digital assets, boasting a collective valuation of approximately $7.69 billion, have ignited fervent interest and speculation within the crypto community. Notable examples include the likes of dogwifhat (WIF) and Bonk (BONK), which have captured the imagination of traders and investors with their meteoric rise.

In essence, Solana’s journey is one marked by both triumphs and tribulations. As it continues to navigate the complex terrain of blockchain innovation, Solana remains steadfast in its commitment to reshaping the future of decentralized finance and ushering in a new era of digital transformation. With each obstacle overcome and each milestone achieved, Solana reinforces its position as a pioneering force in the ever-expanding realm of cryptocurrency and blockchain technology.

Short-Term Solana Price Expectations

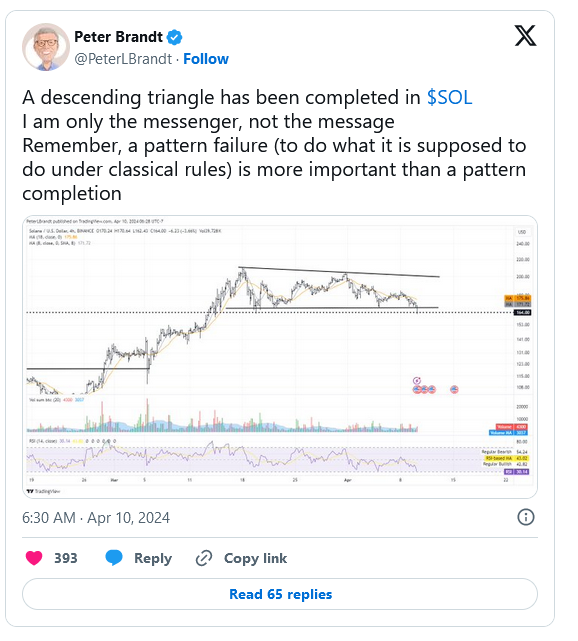

In a recent in-depth analysis of Solana’s price dynamics, esteemed trader Peter Brandt has meticulously scrutinized the current trajectory of the altcoin, unveiling insights that signal a pivotal juncture in its market journey. With the altcoin demonstrating signs of having reached a local peak, Brandt foresees an imminent descent into a multi-week correction phase. This prognosis was underscored by Solana’s value slipping beneath a crucial support threshold hovering around the $171 mark during the early trading hours of Wednesday’s New York session. In light of this development, Brandt has issued a solemn warning to traders, urging them to exercise prudence and vigilance to circumvent the risk of being caught in forced liquidation scenarios.

Despite the backdrop of Solana’s relative underperformance compared to the ongoing bullish trends witnessed in Gold and Silver markets, Brandt’s enthusiasm for the broader cryptocurrency landscape, particularly Bitcoin, remains unwaveringly bullish. Indeed, his outlook suggests a steadfast belief in the enduring potential and resilience of the altcoin industry as a whole.

Nevertheless, amidst the prevailing short-term weakness discernible in Solana’s trajectory, there exists a glimmer of hope for reversal. Brandt posits that should the altcoin manage to close trading sessions above the critical threshold of $183 in the forthcoming days, it could potentially invalidate the current bearish narrative, signaling a resurgence in bullish sentiment and market momentum.

Thus, Brandt’s analysis not only serves as a meticulous examination of Solana’s current market dynamics but also underscores the broader complexities and nuances inherent in navigating the volatile landscape of cryptocurrency trading. In this intricate tapestry of market forces and speculative fervor, Brandt’s insights stand as a beacon of guidance, offering astute traders a compass by which to navigate the turbulent seas of digital asset investment with wisdom and discernment.

Bitcoin (BTC) Price Analysis: Is This the Final Leg Up to $100K?

In the realm of cryptocurrency markets, the landscape has been nothing short of a rollercoaster ride, with Bitcoin’s price gyrating amidst a flurry of activity and speculation. As the dust settles on recent developments, it becomes evident that Bitcoin’s trajectory has been anything but predictable, with each twist and turn eliciting fervent discussions and analysis among traders and enthusiasts alike.

The recent bout of consolidation gripping the crypto markets is a testament to the underlying tension between bullish optimism and bearish caution. Despite a promising weekend rally that evoked memories of pre-halving fervor, the failure of Bitcoin’s price to sustainably breach the $69,000 threshold has cast a shadow of doubt over the possibility of marking a new ATH before the impending halving event. Indeed, the euphoria that once permeated the market has been tempered by the sobering reality of a market struggling to find its footing amidst fluctuating sentiment and volatile price action.

At the heart of this uncertainty lies the pivotal question: will Bitcoin manage to ascend to the fabled $100,000 milestone in the year 2024? This inquiry has become the focal point of heated debates and intense speculation, as traders and analysts alike attempt to decipher the cryptic signals emanating from the charts and indicators.

A closer examination of recent price movements reveals a tale of conflicting forces vying for dominance. The bulls, buoyed by fleeting moments of upward momentum, have repeatedly attempted to breach the formidable resistance levels hovering around $72,500, only to be thwarted by the resolute presence of bears lurking in the shadows. Despite sporadic surges that propelled Bitcoin’s price tantalizingly close to the $74,000 mark, the inability to sustainably consolidate gains above $72,000 has underscored the prevailing bearish sentiment, leaving many to ponder the underlying strength of the market.

Yet, amidst the prevailing uncertainty, there exists a glimmer of hope—a belief that Bitcoin’s journey towards $100,000 is not merely a fanciful dream, but a tangible possibility waiting to be realized. Chart patterns and historical precedents offer tantalizing glimpses into the future, hinting at the potential for a breakout that could catapult Bitcoin to unprecedented heights. The formation of ascending triangles, a hallmark of previous bullish cycles, serves as a beacon of hope for those who dare to dream of a brighter future for the pioneering cryptocurrency.

As the days unfold and the countdown to the halving event draws nearer, the stakes have never been higher. Every fluctuation in Bitcoin’s price is scrutinized with the intensity of a forensic investigator, as traders and analysts alike attempt to discern the underlying trends that will shape the future of the market. The prospect of a breakout looms large on the horizon, tantalizingly close yet frustratingly elusive, as the market teeters on the brink of a paradigm-shifting moment.

In the end, the journey towards $100,000 is not merely a question of price—it is a testament to the resilience of a community united by a shared vision of a decentralized future. Whether Bitcoin ultimately achieves this milestone in 2024 remains to be seen, but one thing is certain: the journey itself is a testament to the indomitable spirit of innovation and discovery that defines the world of cryptocurrency.