In a recent discourse on X (formerly Twitter), Joe McCann, who holds the dual roles of CEO and CIO at the esteemed crypto hedge fund Asymmetric, captivated the digital finance community with a bold prognostication. He articulated a visionary forecast, painting a portrait of Solana’s market capitalization soaring to an unprecedented $1 trillion. McCann’s proclamation wasn’t merely an act of conjecture; rather, it was grounded in a meticulously crafted argument, fortified by a series of intricate points.

At the crux of McCann’s thesis lies the notion of Solana embodying the epitome of product-market fit (PMF) as “The Chain for Retail.” This assertion isn’t made in isolation but is set in stark relief against the backdrop of Ethereum’s perceived impediments and inadequacies in catering to retail users. McCann, with an acute analytical lens, meticulously dissected the ecosystem dynamics, laying bare the comparative strengths and weaknesses of both platforms.

In elucidating Solana’s ascent as “The Chain for Retail,” McCann skillfully delineated a narrative wherein Solana’s architectural robustness, lightning-fast transaction speeds, and cost-effectiveness coalesce into an unparalleled value proposition for retail participants. This narrative stands in stark contrast to Ethereum’s congestion issues, exorbitant gas fees, and scalability challenges, which collectively hinder its efficacy in catering to the needs of retail users.

Moreover, McCann’s assertion isn’t founded solely on technical merits; rather, it’s underscored by a keen understanding of market dynamics and user behavior. He artfully articulates how Solana’s frictionless user experience, coupled with its burgeoning ecosystem of decentralized applications (dApps) tailored for retail engagement, positions it as the vanguard of blockchain technology adoption among retail audiences.

By juxtaposing Solana’s ascendancy against Ethereum’s perceived stagnation, McCann adeptly navigates the intricate terrain of digital finance discourse, providing a compelling narrative that transcends mere speculation. His proclamation serves as a clarion call, igniting fervent debate and inciting introspection within the crypto community, as stakeholders grapple with the implications of Solana’s meteoric rise and Ethereum’s potential usurpation from its longstanding pedestal.

In essence, McCann’s bold statement isn’t merely a prediction; it’s a testament to the power of visionary foresight, underpinned by a nuanced understanding of technology, markets, and human behavior. It underscores the transformative potential of blockchain technology in reshaping the landscape of finance, while simultaneously spotlighting Solana as a beacon of innovation, poised to redefine the paradigm of retail engagement in the digital age.

Solana Beats Ethereum

In a comprehensive analysis delivered with astute insight and foresight, Joe McCann, the multifaceted CEO and CIO of Asymmetric, a distinguished crypto hedge fund, has embarked on a meticulous critique of Ethereum’s suitability for the retail market while heralding Solana’s meteoric ascent as “The Chain for Retail.” McCann’s critique, unveiled on the digital stage of social media (formerly known as Twitter), reverberated through the crypto sphere, punctuating a narrative that transcends mere speculation, delving deep into the intricate nuances of blockchain technology and market dynamics.

With surgical precision, McCann dissects Ethereum’s architectural shortcomings, contending that its foundational layer, referred to as Layer 1 (L1), is plagued by sluggish transaction speeds and exorbitant costs—a veritable quagmire for retail users seeking efficiency and affordability. Furthermore, he scrutinizes Ethereum’s Layer 2 (L2) solutions, highlighting the fragmented landscape comprising over “40 L2s,” which, he argues, compounds the user experience (UX) into a labyrinthine nightmare, further alienating retail participants.

The labyrinthine maze of Ethereum’s ecosystem, compounded by the fragmentation of liquidity across myriad L2 solutions, serves as a formidable barrier to adoption by a broader retail audience, McCann posits. Moreover, he elucidates the complexities inherent in bridging disparate components of Ethereum’s infrastructure, adding yet another layer of friction for new users navigating the labyrinth of decentralized finance (DeFi).

In a discerning pivot, McCann turns his gaze toward corporate-backed open-source initiatives such as Base, Coinbase’s L2 solution. While acknowledging their potential to alleviate some UX issues, he cautions against the inherent prioritization of corporate interests, often at the expense of the broader community. This duality underscores the intricate interplay between corporate involvement and the decentralized ethos underpinning blockchain development, a delicate balance that demands nuanced navigation.

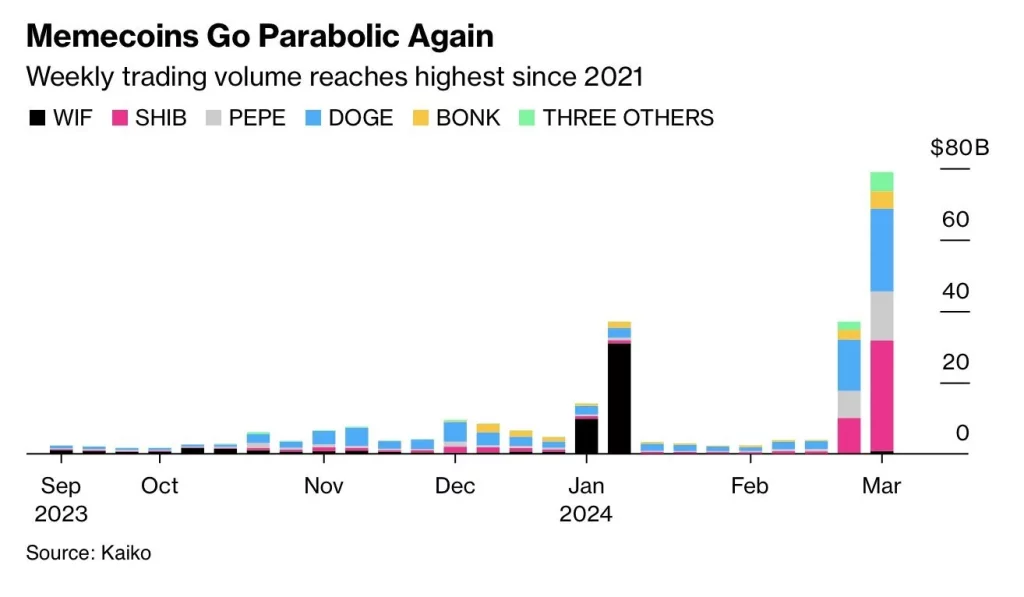

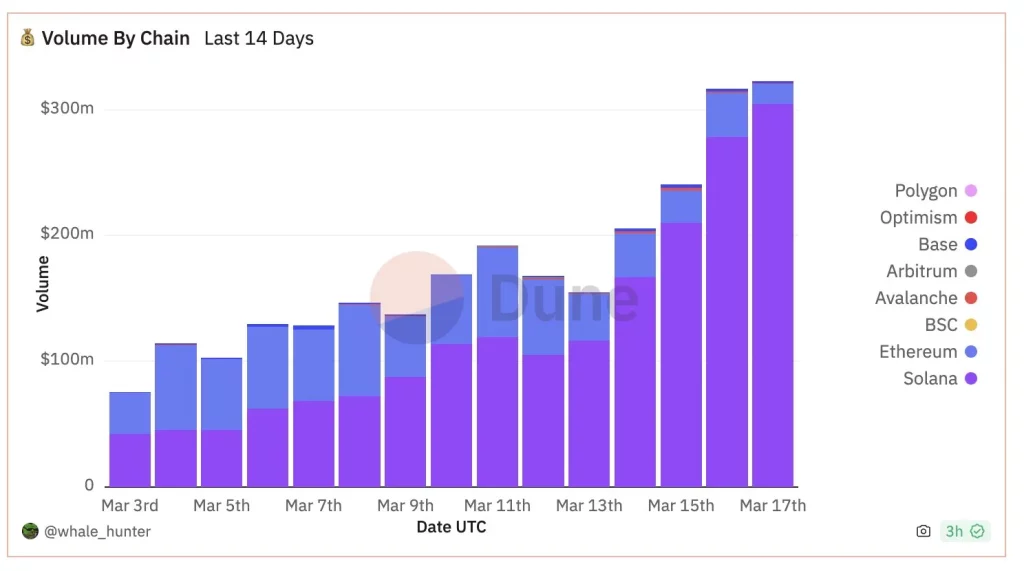

Solana emerges as a beacon of innovation amidst this landscape of critique and contemplation. McCann attributes Solana’s meteoric rise to its adeptness in serving the retail segment, facilitated by its association with memecoins and speculative trading. Originally hailed as “Blockchain at Nasdaq speed” for its unparalleled throughput and low latency, Solana has undergone a transformative narrative shift, propelled by its embrace by the memecoin community—an endorsement that underscores its resonance with retail users.

The explosion of memecoin speculation on Solana, particularly following the conclusion of the NFL season, serves as a testament to its appeal and utility for retail speculators. McCann highlights the pivotal role played by trading bots, colloquially termed the ‘Robinhood-ification of crypto,’ in driving trading activity, leveraging Solana’s superior UX to facilitate seamless transactions. Notably, the majority of these bots are engaged in trading memecoins on Solana, a testament to its growing dominance in the decentralized exchange (DEX) landscape.

Drawing a sharp contrast between Solana’s market cap and that of Ethereum, McCann employs their relative valuations to underscore Solana’s growth potential. With Ethereum hovering just under the $500 billion mark and Solana trailing at approximately $115 billion, McCann contends that Solana’s trajectory toward a $1 trillion market cap presents a nearly 10x growth opportunity, far outstripping the potential for Ethereum—a compelling narrative that positions Solana as the proverbial frontrunner in the race for retail dominance.

In a resounding crescendo, McCann encapsulates his bullish outlook for Solana, emphasizing its retail-friendly ecosystem and the vibrant activity surrounding memecoins—a sentiment echoed by the pulsating rhythm of the market. As the digital ticker tape unfurls, Solana trades at $201.27, a testament to its burgeoning significance in the ever-evolving landscape of decentralized finance.