The Solana network, renowned for its high throughput and low transaction costs, has found itself grappling with formidable challenges in recent times. A notable decline in on-chain activity has cast a shadow over its once vibrant ecosystem, leaving stakeholders and enthusiasts alike apprehensive about its future trajectory. This downturn can be traced back to the ripple effects of a significant price correction that rippled through the broader cryptocurrency market, causing SOL, the native token of the Solana network, to approach critical support levels.

The ramifications of this price correction have reverberated throughout the Solana ecosystem, triggering a cascade of events that have impacted various on-chain indicators. From transaction volumes to active addresses, numerous metrics have experienced pronounced declines, painting a grim picture for the network’s short-term prospects. The sudden drop in on-chain activity has left many questioning the resilience of Solana amidst turbulent market conditions.

Moreover, the dwindling trading interest in SOL has only served to exacerbate concerns surrounding its price stability. With fewer market participants actively engaging in trading activities, liquidity has become increasingly scarce, amplifying the potential impact of any adverse market movements. This has led to heightened fears among investors and traders of an impending sharp downturn in the SOL price, as the network struggles to regain its footing in the face of mounting challenges.

The situation has prompted a flurry of discussions within the Solana community, as stakeholders seek to identify potential solutions to reignite interest and activity on the network. From incentivizing liquidity provision to exploring new use cases and partnerships, there is a palpable sense of urgency to address the underlying issues and revitalize confidence in Solana’s long-term viability.

While the Solana network has undoubtedly faced its fair share of challenges in recent times, it is important to recognize that adversity often breeds innovation. As the community rallies together to confront these obstacles head-on, there remains hope that Solana will emerge stronger and more resilient, ready to navigate the complexities of the ever-evolving cryptocurrency landscape.

Solana’s Transaction Volume Declines 90%

Solana’s native cryptocurrency, SOL, has recently encountered a significant downturn, plunging to its lowest point in three weeks, settling at $162. This downward spiral was notably precipitated by the unveiling of the U.S. Consumer Price Index inflation rate for March, which slightly exceeded expectations, registering at 3.5% year-over-year.

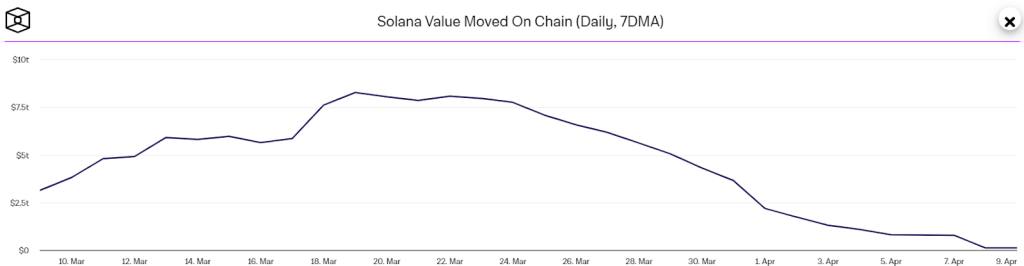

The tumultuous state of SOL’s market performance is attributed to a confluence of adverse on-chain metrics. The network grappled with managing an unprecedented surge in transaction requests, compounded by a discernible waning of interest in Solana SPL tokens. Particularly alarming is the staggering 90% reduction in transaction volume on the Solana network, indicative of a substantial loss of market activity.

Recent insights gleaned from on-chain analytics reveal an alarming plummet in Solana’s transaction volume. From a peak of $1.08 million merely a week ago, the figure has plummeted to a recent nadir of a mere $106 billion, marking an alarming decline of approximately 90%. This precipitous fall has undeniably contributed to a prevailing sense of pessimism regarding Solana’s price trajectory.

What exacerbates the situation is the growing consensus that the recent volatility in SOL’s price, characterized by rapid fluctuations, was primarily driven by ephemeral demand catalyzed by the memecoin frenzy and the recent airdrops of Solana SPL tokens. This viewpoint posits that the observed price adjustment on April 10 was not an isolated incident but rather part of a broader downward trend for SOL, further underscored by its inability to breach the $200 threshold on March 31.

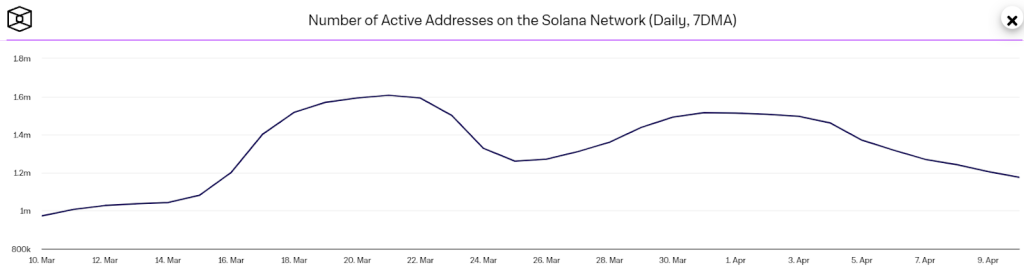

Delving deeper into on-chain trends, there is a discernible and troubling decline in active SOL addresses. The metric has plummeted from a zenith of 1.5 million to a meager 1.2 million, signaling a palpable diminution in investor and trader engagement. This precipitous decline in active addresses serves to reinforce the prevailing bearish sentiment, exacerbating the ongoing downward trajectory of SOL.

In sum, Solana’s native cryptocurrency, SOL, finds itself mired in a precarious situation characterized by a potent cocktail of adverse on-chain metrics, dwindling transaction volumes, and a discernible lack of investor interest. Unless significant remedial measures are undertaken to address these fundamental issues, the outlook for SOL remains decidedly bleak, with further downward price pressure likely to persist in the foreseeable future.

What’s Next For SOL Price?

Investors are currently grappling with a formidable challenge in their efforts to sustain Solana’s price above the crucial 20-day Exponential Moving Average (EMA) of $174. This struggle underscores the significant resistance posed by sellers at this level. In recent times, Solana’s valuation has witnessed a marked downturn, particularly within the last few hours, as endeavors to breach the $200 threshold have been met with staunch opposition.

As it stands, Solana is trading at $173.3, reflecting a decline of over 0.02% in the past 24 hours alone. This downward trajectory is causing concern among investors, raising questions about the underlying factors contributing to this decline and the potential implications for the cryptocurrency’s future trajectory.

Should the current trend persist, there exists a very real possibility that the SOL/USDT pair may plummet to the critical support level of $162. This price point assumes heightened significance as it represents a crucial juncture where investor sentiment and market dynamics could undergo a substantial shift. It is widely anticipated that investors will mount a vigorous defense at this level, as the failure to do so could precipitate further declines, potentially leading to a stark drop to $126.

Conversely, a scenario where Solana manages to stage a rebound from the $162 support level, coupled with a subsequent breakthrough above the 20-day EMA, holds significant implications for market sentiment and price action. Such a development could signal a period of consolidation within the $162 to $205 price range, as investors cautiously assess the cryptocurrency’s prospects and market conditions.

The importance of breaching the $205 barrier cannot be overstated, as it could serve as a catalyst for instigating a renewed phase of upward momentum. Breaking through this key resistance level would not only bolster investor confidence but also pave the way for Solana to reclaim lost ground and potentially embark on a sustained uptrend.

In summary, the current market dynamics surrounding Solana are characterized by heightened volatility and uncertainty, with investors closely monitoring price movements and key support/resistance levels. The ability to navigate these challenges effectively will be instrumental in determining Solana’s trajectory in the days and weeks ahead, shaping its position within the broader cryptocurrency landscape.