Despite ongoing on-chain accumulation, recent data suggests a concerning trend regarding the demand for Bitcoin exchange-traded funds (ETFs) in the United States. Ki Young Ju, the founder of CryptoQuant, a leading on-chain analytics platform, has pointed out that this stagnation in demand has persisted for the past four weeks. What’s particularly noteworthy is that this assessment holds true even when transactions related to ETF settlements are excluded from the analysis. This indicates a broader trend of tepid interest in Bitcoin ETFs among investors, despite continued activity in the on-chain space. Such stagnation raises questions about the sentiment and outlook of market participants towards Bitcoin ETFs, potentially signaling challenges ahead for Bitcoin holders who may have anticipated greater uptake and demand for these investment vehicles.

Demand for spot Bitcoin ETFs in the United States experiences a significant downturn.

Spot Bitcoin ETFs serve as derivative products within the crypto market, offering investors, particularly regulated institutions and large-scale investors (often referred to as “whales”), a convenient means to gain exposure to the world’s most valuable cryptocurrency without the complexities associated with custody. Established spot ETF issuers such as Bitwise and Proshares employ regulated custodians to safeguard the entirety of the Bitcoin assets underpinning all issued shares in circulation. This custodial arrangement provides a layer of security and assurance for investors seeking to participate in the Bitcoin market through ETFs.

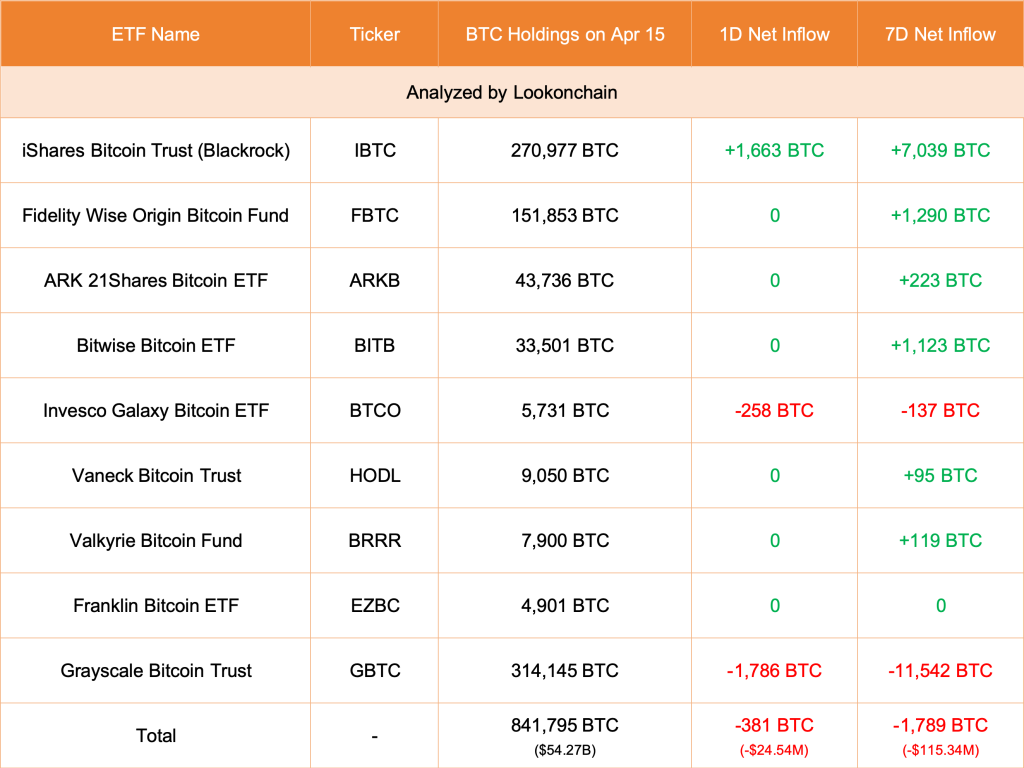

However, recent data indicates a notable slowdown in demand for spot Bitcoin ETFs over the past trading month. Despite the prominence of leading ETF providers and their robust custodial arrangements, the level of investor interest appears to be waning. Particularly striking is the observation that, with the exception of the iShares Bitcoin Trust (IBIT) by BlackRock, virtually all other spot Bitcoin funds based in the United States have experienced zero inflows over the past two days.

This trend underscores a broader sentiment shift within the market, suggesting a potential loss of enthusiasm among investors for spot Bitcoin ETFs. While the reasons behind this slowdown are multifaceted and may vary, ranging from regulatory uncertainties to shifting investor preferences, the data nevertheless signals a notable shift in demand dynamics within the Bitcoin ETF space. This slowdown may prompt further examination and analysis within the industry, as market participants seek to discern the underlying factors driving this trend and its potential implications for the broader cryptocurrency market.

Selling pressure continues to weigh heavily on BTC.

The reduction in inflows into spot Bitcoin ETFs can be ascribed to the uncertain and volatile market environment prevailing at present. Sellers are exerting significant downward pressure on BTC, as evidenced by recent market activity. As of the current moment, sellers are dominating the market sentiment, resulting in a persistent downward trajectory for Bitcoin prices. According to observations gleaned from the BTCUSDT daily chart, the cryptocurrency has experienced a notable decline of 14% from its all-time highs.

Despite Bitcoin’s prices fluctuating within a broad range, with support levels around $61,000 and resistance levels near $73,800, it’s apparent that sellers hold the upper hand in the short term. This is underscored by the prevailing market dynamics, which continue to favor selling pressure. It’s worth noting that Bitcoin’s prices remain confined within the bearish trend initiated on April 13th, as indicated by the ongoing downward movement. This reinforces the notion that sellers are currently exerting greater influence within the market, tipping the balance in their favor from an effort-versus-result perspective.

The looming possibility of spot Bitcoin ETFs experiencing outflows looms large if Bitcoin prices continue their downward trajectory and breach the crucial support level of $60,000, extending the trend observed at the end of last week’s trading session. This scenario presents a critical inflection point for the cryptocurrency market, with significant implications for investor sentiment and market dynamics.

Should Bitcoin prices falter and dip below the $60,000 threshold, it is foreseeable that investor confidence in spot Bitcoin ETFs could wane, leading to a potential exodus of funds from these investment vehicles. This outflow of capital from spot Bitcoin ETFs would further exacerbate selling pressure on Bitcoin, potentially triggering a cascade of selling activity as investors seek to mitigate their losses or capitalize on downside opportunities.

In such a scenario, the likelihood of Bitcoin prices plummeting to levels as low as $53,000 or even $50,000 cannot be discounted. These price targets represent critical support levels where buyers may step in to defend against further downside, but the prevailing market sentiment suggests that downward momentum could persist, potentially pushing Bitcoin prices to new lows.

The prospect of Bitcoin prices declining to $53,000 or $50,000 underscores the prevailing bearish sentiment within the market and highlights the heightened volatility and uncertainty facing cryptocurrency investors. As market participants brace for further price fluctuations, the importance of monitoring key support and resistance levels, as well as broader market trends, cannot be overstated. Investors should remain vigilant and prepared to adapt their strategies in response to evolving market conditions to navigate the challenging landscape effectively.

Currently, it is uncertain whether sentiment will undergo a shift. Despite the approval of several spot Bitcoin and Ethereum ETFs by Hong Kong regulators on April 15, the market is yet to witness their impact. Ethereum, much like Bitcoin, is experiencing downward pressure and steadily approaching critical support levels.