As Mt. Gox traverses the closing stages of its protracted journey towards compensating creditors, anticipation and scrutiny intensify surrounding the latest developments in the compensation process. A report disseminated on Reddit on April 21st sheds light on the forthcoming disbursement plans, offering a glimpse into the scale and scope of the compensation efforts orchestrated by the defunct exchange.

The figures outlined in the report paint a vivid picture of the magnitude of assets earmarked for distribution among creditors. A staggering sum of 142,000 Bitcoin (BTC) and 143,000 Bitcoin Cash (BCH) is slated for allocation, underscoring the substantial reserves that Mt. Gox has earmarked for the restitution of creditors. Additionally, the inclusion of 69 billion Japanese yen, translating to approximately $510 million, further underscores the financial commitments underpinning the compensation process.

The projected timeline for the disbursement of these assets is equally noteworthy, with the report indicating that creditors can expect to receive their entitled funds by October 2024. This timeline, while providing a semblance of closure for creditors eagerly awaiting restitution, also serves as a stark reminder of the protracted nature of the compensation process and the myriad complexities involved in navigating the aftermath of the Mt. Gox debacle.

The looming disbursement of assets represents a pivotal juncture in the Mt. Gox saga, marking a crucial step towards closure for the legions of creditors who have patiently awaited restitution for their losses. Yet, it also prompts reflection on the broader implications of the Mt. Gox debacle, highlighting the need for robust regulatory frameworks and heightened vigilance within the cryptocurrency ecosystem to safeguard against future mishaps and protect the interests of stakeholders.

As creditors await the fruition of these disbursement plans, the specter of Mt. Gox continues to cast a long shadow over the cryptocurrency landscape, serving as a cautionary tale of the perils inherent in an industry characterized by rapid innovation and evolving regulatory landscapes. However, amidst the uncertainty and tribulations, the prospect of restitution offers a glimmer of hope, signifying a semblance of justice for those impacted by one of the most notorious episodes in the history of cryptocurrency exchanges.

A portion of Mt. Gox creditors have received repayment.

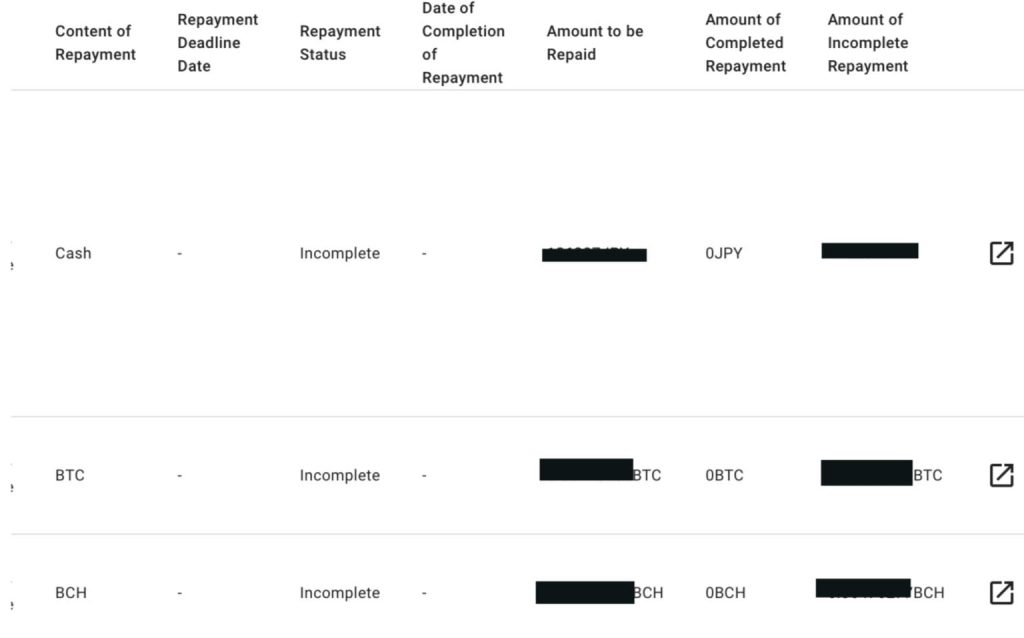

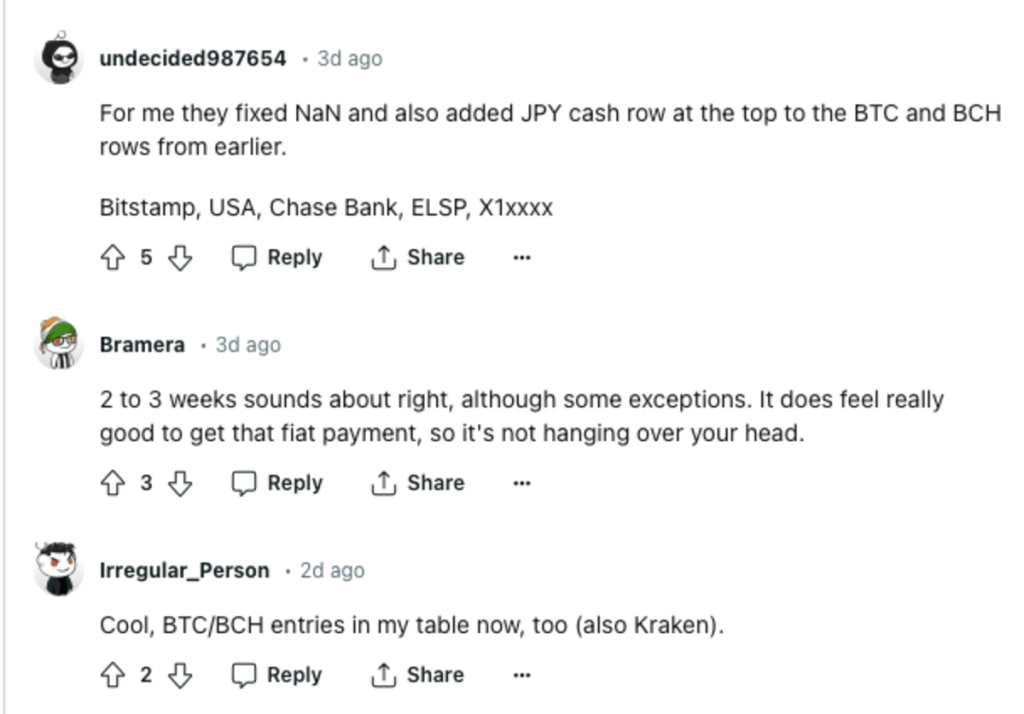

Updates to claims accounts of multiple Mt. Gox creditors signal advancements in the receipt of cryptocurrency and fiat repayments. Initial reports emerged on the Mt. Gox insolvency Subreddit in mid-April, where users observed the repayment data table reflecting the amounts slated for repayment on their accounts.

Among the creditors, one individual shared a recent screenshot showcasing a table within their Mt. Gox claims account. This table delineated the repayment status, completed repayment sums, and outstanding amounts, providing a comprehensive overview of the progress in the repayment process.

Additionally, certain creditors have reported the receipt of fiat currencies in their bank accounts.

One creditor shared their experience, stating, “Money received as USD into HSBC currency account and looks like zero fees.” They further noted the updating of the table, with changes on March 15th, April 8th, and subsequent updates when BTC lines were added. Encouraging fellow creditors, they concluded, “Hang in everyone, your time will come!”

In parallel, the latest update from MT.GOxBalanceBot reveals that the BTC wallet address of the defunct exchange currently holds 137.89K BTC. Notably, there have been no deposits or withdrawals recorded since May 10, 2018.

Total current balance on all known addresses* of the MtGox Trustee: 137890.98188037 BTC.

0 BTC have been moved away from these addresses since 2018/05/10. $BTC #bitcoin #mtgox mt.gox mt gox

2024-04-22T13:01:25.685Z

— MtGoxBalanceBot (@MtGoxBalanceBot) April 22, 2024

The recent developments have stirred varied responses within the community of Mt. Gox creditors. While certain individuals harbor doubts and remain cautious, others entertain the possibility of repayments from Mt. Gox commencing sooner than anticipated. There is speculation among some creditors that the repayment process might conclude before the scheduled date of October 31.

It’s worth remembering that the defunct exchange initiated its repayment to creditors back in December 2023.

Mt.Gox creditors will start receiving payments by the end of the year, according to emails received from the liquidator. pic.twitter.com/wICq9EnPJV

— Sjuul | AltCryptoGems (@AltCryptoGems) November 22, 2023

There were also reports indicating that certain Mt. Gox creditors received duplicate payments in their bank accounts.

Examining the oversight of the Mt. Gox crash and its potential repercussions on the price of BTC.

The tale of Mt. Gox stands as a stark reminder of the volatility and vulnerability inherent in the world of cryptocurrency. Once hailed as the pinnacle of Bitcoin exchanges, Mt. Gox’s meteoric rise was abruptly halted by a catastrophic hack in 2014, resulting in the unprecedented loss of 850,000 Bitcoin. To put this staggering figure into perspective, these stolen Bitcoins are now valued at over $57 billion, a sum that boggles the mind and underscores the magnitude of the incident.

In the aftermath of the hack, Mt. Gox was forced to file for bankruptcy protection, marking the ignominious downfall of what was once the world’s largest Bitcoin exchange. However, amidst the rubble of shattered dreams and broken promises, a glimmer of hope emerged in the form of “rehabilitation proceedings” initiated in 2018. These proceedings sought to address the grievances of affected creditors and pave the way for the eventual recovery of lost funds.

Yet, the road to redemption has been fraught with obstacles and setbacks, as delays and uncertainties have plagued the rehabilitation process. Legal disputes, bureaucratic hurdles, and logistical challenges have conspired to prolong the agony of creditors, leaving them in a state of limbo and uncertainty regarding the fate of their investments.

As the years have passed and the saga of Mt. Gox has unfolded, a sense of disillusionment and frustration has permeated the cryptocurrency community. Users who once entrusted their wealth to the exchange now find themselves grappling with the harsh reality of lost fortunes and dashed hopes. The prolonged wait for restitution has tested the patience and resilience of creditors, who have endured nearly a decade of uncertainty since the exchange’s demise.

Against this backdrop of prolonged suffering and unresolved grievances, experts have sounded the alarm regarding the potential impact on the price of BTC. With the progress of the repayment plan in 2024 looming on the horizon, fears of major selling pressure have begun to mount. Creditors, weary from years of waiting and uncertain about the future, may be compelled to liquidate their assets in a bid to recoup their losses. This influx of selling activity could exert downward pressure on the price of BTC, potentially triggering a cascade of market volatility and instability.

In essence, the oversight of the Mt. Gox crash and its ramifications for the price of BTC serve as a sobering reminder of the interconnectedness of the cryptocurrency ecosystem and the enduring legacy of past missteps. As the cryptocurrency community grapples with the fallout of one of its darkest chapters, the lessons learned from the Mt. Gox saga serve as a cautionary tale for investors and enthusiasts alike, highlighting the importance of vigilance, transparency, and accountability in safeguarding the integrity of the market.