The Securities and Futures Commission of Hong Kong (SFC) has issued a cautionary advisory concerning HKCEXP, a crypto trading platform that purportedly presents suspicions. HKCEXP is alleged to have enticed investors by falsely asserting registration with the regulatory authority as an “SFC-registered business.”

Investors are cautioned by the SFC regarding HKCEXP.

In June 2023, Hong Kong officially initiated its crypto licensing system for virtual asset trading platforms, enabling licensed exchanges to provide retail trading services.

The SFC emphasized in February that investors should exclusively engage in trading activities on licensed trading platforms. The regulatory body had set a deadline of February 29 for crypto exchanges to apply for operational licenses. Those exchanges failing to submit their applications were mandated to cease operations in Hong Kong by May 31.

Advising investors to take prompt action, the SFC recommended that they refrain from trading on platforms not listed on either the “list of licensed virtual asset trading platforms” or the “list of virtual asset trading platform applicants.” The regulator urged these investors to “take early precautions,” such as closing their accounts.

Out of the 22 crypto trading platforms that sought licenses, four had previously opted into the SFC’s regulatory framework for crypto trading platforms.

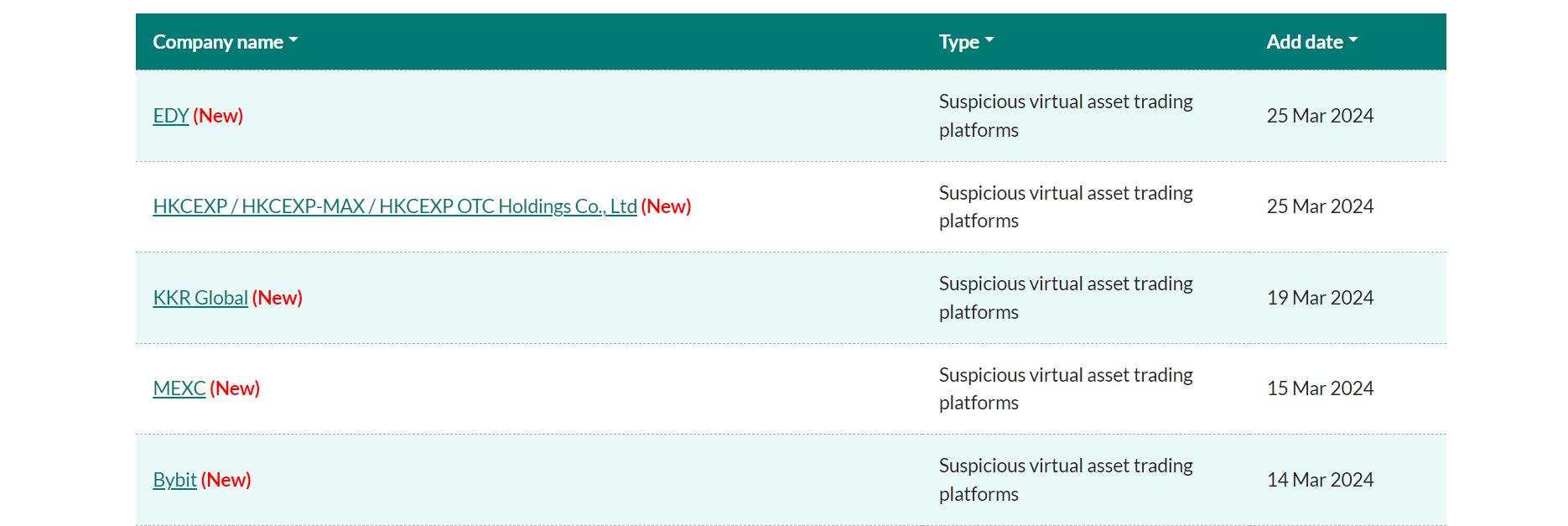

Despite the SFC’s diligent efforts in spreading awareness, Hong Kong remains confronted with counterfeit entities masquerading as bona fide crypto exchanges. The regulatory body cautions against HKCEXP, the newest addition to the list of crypto exchanges falsely purporting to be registered with the regulator.

The SFC alleged that HKCEXP supplied a deceitful Hong Kong address for its registration. Furthermore, a Hong Kong resident who utilized the platform notified the SFC of excessive fees levied for fund withdrawals.

To bolster secure crypto trading practices, the SFC will uphold a public registry of licensed crypto platforms. Emphasizing regulatory compliance, the SFC declared that exchanges failing to pursue licensing would encounter limitations on their operations and promotional endeavors within Hong Kong.

As regulatory scrutiny intensifies, leading cryptocurrency exchanges seek licensing in Hong Kong.

As per the SFC, 22 exchanges have filed applications ahead of the February 29 deadline. Among these applicants are well-known names in the crypto sector, such as OKX, Bybit, Bullish, Crypto.com, Huobi HK, Matrixport HK, and Gate.HK.

Reportedly linked with Binance, the HKVAEX crypto platform has also submitted its application for evaluation. The Hong Kong SFC has already granted licenses to two platforms — HashKey Exchange in November 2022 and OSL Digital Securities in December 2022.

Once sanctioned by the Hong Kong SFC, crypto exchanges can onboard retail investors for trading Bitcoin and Ether. Currently, the SFC is assessing various altcoins and stablecoins for trading approval.

On February 23, BitForex, an exchange, went offline following the withdrawal of $57 million from its hot wallets. Last year, Japanese regulators raised concerns about BitForex operating without proper registration.

Despite being reportedly headquartered in the region, the SFC also flagged BitForex for lacking a license to operate a Virtual Asset Trading Platform (VATP) in Hong Kong.

Users of the exchange’s official Telegram channel reported several account issues, including login difficulties and missing asset information on the dashboard. Some users also encountered pop-up screens indicating they were blocked from accessing the company’s website.

The SFC advises investors to authenticate trading platforms using its public register of licensed persons and institutions, as well as the list of licensed virtual asset trading platforms, to access pertinent information about licensed entities, including their official websites.