Criticism persists due to Solana’s heavy reliance on intensive transaction validation, yet the ecosystem presents distinctive opportunities for bandwidth-intensive DApps like token launches, NFT collections, games, and social networks. Let’s explore how these ecosystem activities impact the price of Solana.

The Performance of SOL in the Solana Ecosystem

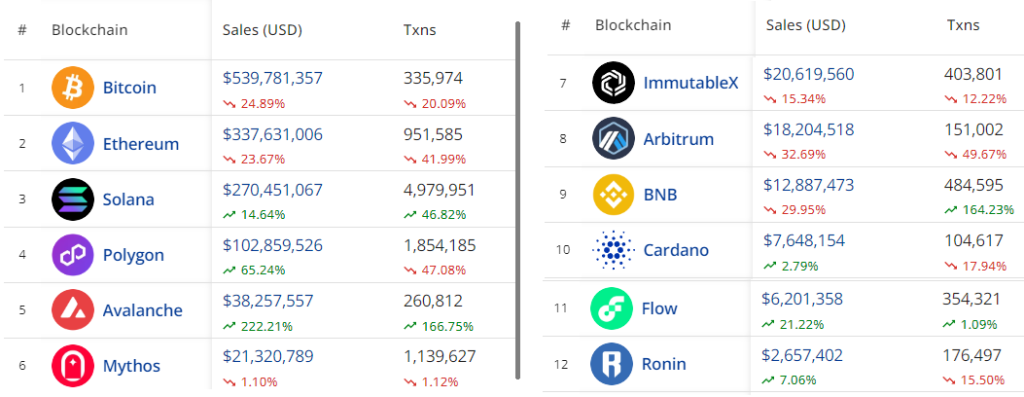

According to CryptoSlam, Solana has become the third-largest NFT market by volume, reaching $270.5 million—trailing Ethereum by just 20%. Despite Ethereum leading in the most valuable collections, Solana’s ecosystem boasts notable NFTs like Saga Monkes, Froganas, Mad Lads, and Tensorians. With strong DApp volumes and TVL resilience, a significant price correction for Solana isn’t imminent. Yet, high expectations from airdrops and SPL token performances are exerting downward pressure on Solana’s price.

Solana’s market value is currently $40.6 billion, reflecting a price of $94—50% lower than its peak in November 2021. Despite this dip, if projects emphasizing network stability amid high transaction demand continue to express interest, there is potential for upward movement. This becomes crucial given the common challenges faced by many blockchain networks, such as rising transaction fees and prolonged instability.

What’s Unfolding within the Solana Ecosystem?

Recent interest has brought attention to rug-pull scams in the Solana ecosystem, eroding user confidence and adversely affecting Solana’s price. Memecoin projects are yielding less-than-expected profits for users, leading them to explore alternatives in different blockchain ecosystems.

Additionally, fraudulent airdrop events and extended token launch processes associated with airdrop events are instigating fear and concern among Solana users.