IN BRIEF

- DTCC announces that it will not allocate any collateral to exchange-traded funds (ETFs) linked to Bitcoin or cryptocurrencies, nor will it provide loans for this purpose.

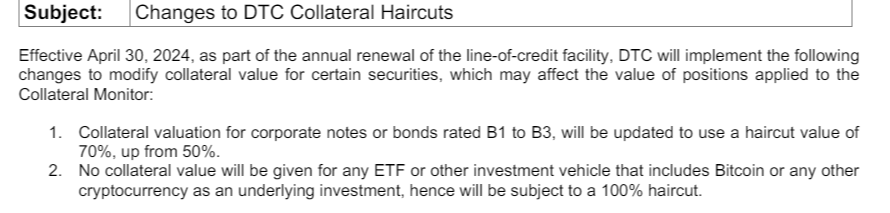

- Effective April 30, 2024, DTCC will implement changes to collateral values for certain securities as part of its annual renewal of the line-of-credit facility.

- Crypto analysts and investors are left to contemplate the implications of this decision on the burgeoning Bitcoin ETF industry.

The Depository Trust & Clearing Corporation (DTCC), a pivotal entity responsible for the settlement of the majority of securities transactions within the United States, has unveiled significant alterations to its collateral valuation procedures, slated to come into effect as of April 30, 2024. In a noteworthy move, DTCC has unequivocally stated its decision to abstain from offering collateral or extending loans in support of exchange-traded funds (ETFs) associated with Bitcoin or any other cryptocurrencies.

This announcement marks a pivotal juncture for the cryptocurrency industry, as DTCC’s stance carries significant weight within the financial sector due to its central role in facilitating securities transactions. By disavowing involvement in Bitcoin and cryptocurrency-related ETFs, DTCC has signaled a cautious approach to the burgeoning digital asset space, citing potential risks and uncertainties inherent in these assets.

The decision by DTCC to eschew collateral support for Bitcoin and cryptocurrency ETFs underscores the perceived volatility and regulatory ambiguity surrounding these digital assets. While Bitcoin and cryptocurrencies have garnered considerable attention and investment interest in recent years, they remain subject to heightened scrutiny and regulatory oversight, with concerns ranging from market manipulation to investor protection.

In the wake of DTCC’s announcement, crypto analysts, investors, and industry stakeholders are left to ponder the ramifications of this decision on the nascent Bitcoin ETF industry. With ETFs serving as a popular investment vehicle for mainstream investors seeking exposure to Bitcoin and cryptocurrencies, DTCC’s reluctance to provide collateral support could pose challenges for ETF issuers and investors alike, potentially impeding the growth and development of this sector.

Furthermore, DTCC’s move raises broader questions about the evolving regulatory landscape surrounding cryptocurrencies and their integration into traditional financial markets. As regulators grapple with the complexities of overseeing digital assets, the decision by DTCC to distance itself from cryptocurrency-related ETFs underscores the need for clarity and regulatory certainty to foster investor confidence and market stability.

Ultimately, DTCC’s decision represents a significant development in the ongoing intersection between traditional finance and the cryptocurrency ecosystem, highlighting the challenges and opportunities inherent in navigating this rapidly evolving landscape. As the digital asset space continues to evolve, market participants must remain vigilant and adaptable, responding to regulatory developments and market dynamics to ensure the long-term sustainability and viability of cryptocurrency investments.

DTCC has decided against providing any collateral for Bitcoin ETFs.

The advent of spot Bitcoin ETFs has garnered heightened interest from institutional investors in this investment vehicle. Within a mere three-month period following their launch, U.S. Bitcoin ETFs have amassed an impressive $12.5 billion in assets under management (AUM).

However, notwithstanding this surge in popularity, DTCC has recently announced forthcoming changes to collateral values for select securities during the annual line-of-credit facility renewal, commencing April 30, 2024. These adjustments may potentially impact position valuations within the Collateral Monitor.

This notification, issued on April 26, suggests that exchange-traded funds and analogous investment instruments linked to Bitcoin or other cryptocurrencies as underlying assets will no longer be allocated any collateral value. Consequently, their collateral value is set to undergo a complete reduction of 100%.

Source: DTCC official announcement

As part of the adjustments, bonds rated B1 to B3 will undergo a 70% decrease in their evaluated market price when utilized as loan collateral, marking an increase from the previous 50%. This alteration poses hurdles for businesses, as it necessitates the provision of extra collateral to maintain existing loan amounts.

However, as clarified in a post by crypto market analyst K.O. Kryptowaluty, this adjustment will solely apply to inter-entity settlements within the Line of Credit (LOC) system.

A Line of Credit (LOC) serves as a vital borrowing mechanism between a financial institution and an individual or entity, facilitating access to funds up to a pre-established credit threshold. This arrangement grants borrowers the flexibility to utilize these funds as needed, with interest typically levied solely on the amount borrowed.

According to insights provided by Kryptowaluty, the utilization of crypto ETFs for lending purposes and as collateral in brokerage activities will remain unaltered, contingent upon the risk tolerance levels of individual brokers. The analysts advocate for crypto investors to adopt a pragmatic approach, summarizing the situation as follows: “tl;dr: Ignore the unfounded panic; no significant developments are underway.”

The impact of the ruling on the cryptocurrency market.

The recent announcement has cast a somewhat negative shadow over the cryptocurrency market, particularly impacting Bitcoin. Despite fluctuations in sentiment throughout the weekend, Bitcoin is presently valued at $62,978.86, reflecting a 2.2% decline over the past 24 hours.

Furthermore, the global cryptocurrency market cap has experienced a 1.9% decrease over the past 24 hours, currently standing at $2.44 trillion. As of the latest data, Bitcoin’s market capitalization sits at $1.24 trillion, translating to a Bitcoin dominance of 50.8%. Notably, Stablecoins maintain a market cap of $161 billion, constituting a 6.6% share of the total cryptocurrency market capitalization.

DTCC’s position on cryptocurrency ETFs diverges from the stance adopted by other traditional financial entities. Notably, clients of Goldman Sachs have displayed a revived interest in the cryptocurrency market following the approval of spot Bitcoin ETFs. Similarly, BNY Mellon, a venerable institution with a storied history, has expressed intentions to explore exposure to Bitcoin ETFs. The recent filing of BNY Mellon’s Form 13F with the SEC has garnered significant attention across the global cryptocurrency community.

BNY Mellon’s investments in BlackRock and Grayscale Bitcoin ETFs underscore the growing significance of cryptocurrencies within the traditional financial sector, both domestically and internationally.

Following the successful launch of Bitcoin ETFs, there has been a recent downturn in overall inflows. Over the past three days, numerous ETF issuers have witnessed substantial outflows from their spot Bitcoin ETFs. According to James Sayffart, a dedicated ETF analyst at Bloomberg, the ETF market experienced a challenging week, marked by a net outflow of $218 million from spot Bitcoin ETFs in the U.S. on April 25, following the previous day’s outflow of $120 million.

Rough day across the board for the Cointucky derby and the #Bitcoin ETFs yesterday. 5 ETFs saw outflows for a total of -$217 million. Franklin was only ETF with an inflow at $1.9 million. pic.twitter.com/9NF9iXi2GN

— James Seyffart (@JSeyff) April 26, 2024

In just one day, Grayscale’s GBTC ETF witnessed a substantial outflow of $82.4197 million. According to data sourced from Farside investors, the cumulative historical net outflow for GBTC stands at a notable $17.185 billion.

READ MORE ABOUT: When to Expect Bitcoin’s Bull Market Highs: A Post-Halving Analysis