Story Highlights

- An investor was tricked into sending $71 million worth of cryptocurrency to a scammer’s address by a fake address that looked like a legitimate one.

- The scammer stole the money by imitating the format of the investor’s earlier transfer and then quickly moved the money.

- This attack shows the importance of being careful when verifying addresses and using security measures.

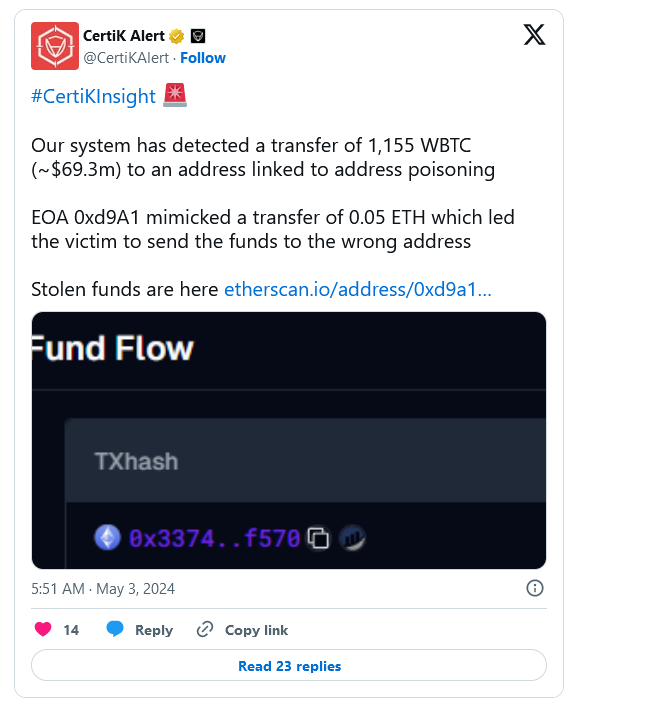

In a truly alarming and disheartening development within the cryptocurrency sphere, a WBTC (Wrapped Bitcoin) investor has fallen prey to an intricately engineered phishing scam, resulting in a devastating loss exceeding $71 million in WBTC value. This staggering sum, equivalent to a considerable fortune, has been reported as transferred – a whopping 1,155 WBTC – to an address under the control of the perpetrator.

The gravity of this incident cannot be overstated, as it underscores the persistent and evolving threat landscape facing digital asset investors. According to the authoritative insights provided by the blockchain security firm CertiK, the methodology employed in this fraudulent scheme demonstrates a level of sophistication that is deeply concerning for the entire crypto community.

Central to this nefarious tactic is the concept of “address poisoning,” a term that has now become synonymous with the malicious exploitation of unsuspecting investors. In essence, scammers craft counterfeit addresses, meticulously designed to bear a striking resemblance to those associated with high net worth wallets. This cunning ruse aims to lure victims into a false sense of security, deceiving them into believing that the destination address for their transactions is legitimate and trustworthy.

What sets this particular incident apart is the calculated exploitation of vulnerabilities inherent in the victim’s transaction history. Through astute manipulation and analysis of past transactions, the attacker was able to meticulously orchestrate a scenario wherein the investor was persuaded to transfer funds to what appeared to be a bona fide address. Tragically, this address was under the complete control of the exploiter, resulting in irretrievable losses of immense proportions.

The repercussions of this heinous act reverberate far beyond the immediate financial impact endured by the victim. Such incidents erode trust and confidence in the burgeoning cryptocurrency ecosystem, casting a shadow of doubt over its integrity and security protocols. Moreover, they serve as a stark reminder of the ever-present threats posed by malicious actors, necessitating a constant and unwavering commitment to vigilance and robust security measures.

In light of this harrowing episode, the need for heightened awareness and proactive risk mitigation strategies within the cryptocurrency community cannot be overstated. It is imperative that investors remain diligent in scrutinizing transaction details, verifying the authenticity of recipient addresses, and leveraging reputable security solutions to safeguard their digital assets against exploitation.

As industry stakeholders collectively reflect on the ramifications of this unfortunate event, it is incumbent upon us to redouble our efforts in fortifying the resilience of the cryptocurrency ecosystem. By fostering a culture of accountability, transparency, and collaboration, we can strive towards a future where such egregious breaches of trust are mitigated, if not entirely eradicated, ensuring the longevity and prosperity of the digital asset landscape.

Tactics & Strategies Revealed

The deceptive scheme commenced with subtle subtlety, as the unsuspecting victim initiated a seemingly innocuous transfer of 0.05 ETH, unwittingly signaling activity within their wallet to the nefarious scammers. Seizing upon this initial interaction, the perpetrators swiftly set their scheme into motion by fabricating a vanity wallet address meticulously designed to mimic the format of the preceding transfer.

In a tragic turn of events, the investor, ensnared in the illusion of authenticity, fell victim to the ploy and proceeded to transfer a substantial quantity of WBTC into the clutches of the scammer’s address.

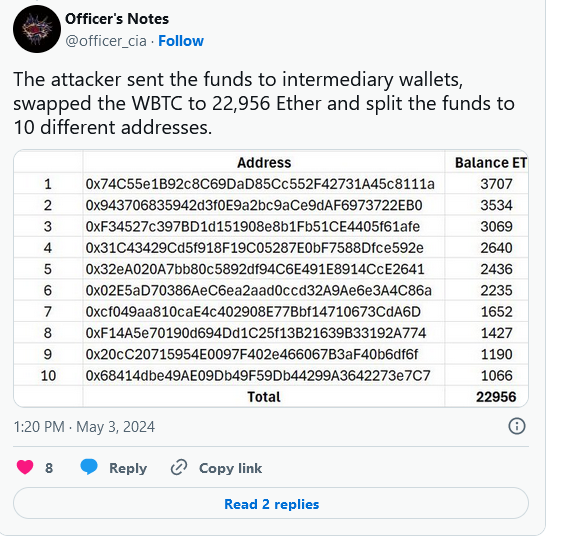

Upon receipt of the ill-gotten gains, the exploiter wasted no time in executing a series of maneuvers aimed at laundering the 1,155 WBTC through a labyrinth of intermediary wallets. Employing a sophisticated strategy, the attacker orchestrated the conversion of WBTC into Wrapped Ether (WETH) before further exchanging it for a staggering sum of 22,956 Ether.

With meticulous precision, the perpetrator then dispersed the laundered funds across a network of ten disparate addresses, effectively obscuring their digital trail and erecting formidable barriers to any potential recovery efforts. This convoluted process not only served to obfuscate the origins of the illicitly obtained funds but also posed significant challenges for investigators seeking to trace and reclaim the stolen assets.

The brazen audacity and meticulous execution demonstrated by the exploiters underscore the evolving sophistication of cybercriminal tactics within the cryptocurrency landscape. As the dust settles on this distressing episode, it serves as a sobering reminder of the critical importance of robust security measures and unwavering vigilance in safeguarding digital assets against the relentless onslaught of malicious actors.

Users, It’s Time to Be Cautious!

As instances of phishing attacks and various other fraudulent schemes continue to proliferate, it is paramount for users to exercise heightened caution and unwavering vigilance when verifying recipient addresses and engaging in transactions. Experts emphasize the critical necessity of implementing comprehensive security protocols to effectively safeguard digital assets from malicious exploitation.

As law enforcement authorities diligently labor to trace and potentially recover the ill-gotten gains, this distressing incident serves as a poignant reminder of the inherent vulnerabilities inherent in cryptocurrency transactions. It underscores the pressing imperative for the adoption of enhanced security measures to mitigate the ever-present threats posed by cybercriminals in the digital realm.

Also Read Crypto Hack Weekly Report: DeFi Double Trouble & A $70M Phishing Attack