In the tumultuous arena of cryptocurrency, the past 24 hours have witnessed a seismic shift, sending shockwaves rippling through the market landscape. A staggering decline of over 6 percent has struck the cryptocurrency market capitalization, slashing its valuation to a modest $2.7 trillion. At the epicenter of this cataclysmic event stands Bitcoin (BTC), the undisputed titan of the crypto realm, whose precipitous drop has triggered a domino effect, igniting a widespread sell-off frenzy across the altcoin market. The once-ebullient sentiments of bullish traders have been swiftly quelled by the unforgiving tide of this relentless downturn.

The repercussions of this crypto plunge have been nothing short of staggering, with a jaw-dropping sum of over $666 million vaporized from the market’s coffers in the blink of an eye. Long traders, who once harbored lofty ambitions of riding the crest of an ever-rising market wave, have found themselves engulfed by a sea of losses, accounting for an astonishing $531 million of the total liquidations.

In the face of this tumult, a palpable sense of urgency grips the trading community, prompting a mass exodus of short-term traders scrambling to seek solace and stability in the sanctuary of the stablecoin market. Herein lies the heart of the storm, where the sanctuary of stability beckons amidst the chaos. In a striking testament to this flight to safety, Tether’s USDT emerges as a towering colossus, boasting a 24-hour rolling trading volume that dwarfs even the combined volumes of Bitcoin and Ethereum. With a staggering $112.7 billion in trading volume, Tether’s USDT stands as a bastion of reliability amidst the tempestuous fluctuations of the cryptocurrency market, offering respite to weary traders battered by the unforgiving winds of uncertainty.

Top Reasons Crypto Market Slipped Today

Healthy Market Correction

In a landmark moment within the annals of cryptocurrency bull markets, the price of Bitcoin has breached its previous all-time high (ATH) for the first time preceding the halving event. This historic achievement is buoyed by heightened demand for Bitcoin, particularly fueled by the recent approval of spot Bitcoin exchange-traded funds (ETFs) in the United States. The ripple effects of this significant development have undeniably steered the market towards a bullish trajectory, marking a pivotal juncture in Bitcoin’s journey.

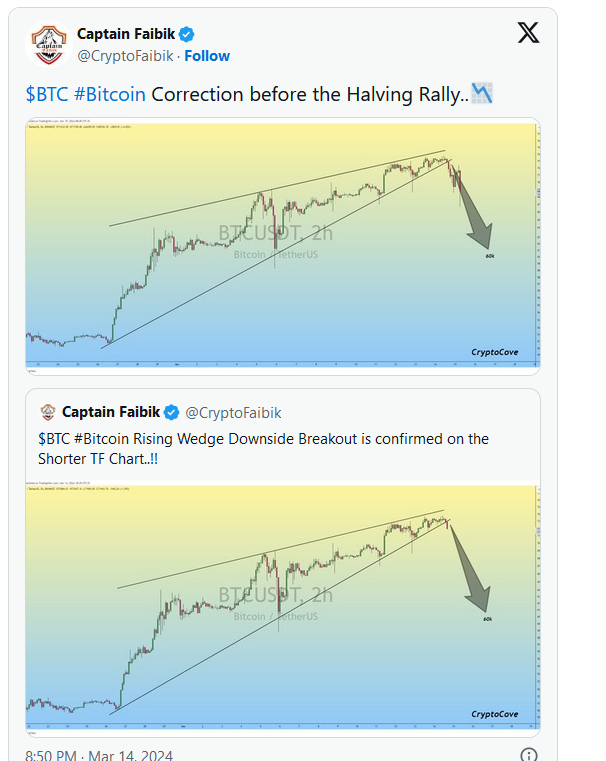

However, amidst the fervor surrounding this unprecedented surge, market observers had anticipated a necessary period of correction before the commencement of the halving rally. Notably, analysis conducted by renowned crypto analyst, Captain Faibik, sheds light on the potential trajectory of Bitcoin’s price movement. According to Captain Faibik’s analysis, Bitcoin’s price is poised to undergo a corrective phase in the upcoming days, with projections indicating a decline towards the $60,000 mark. This anticipated correction is viewed as a healthy recalibration of market dynamics, paving the way for a resurgence that could propel Bitcoin to scale new heights and achieve fresh ATHs in the foreseeable future.

Sell the News Event

In recent weeks, the altcoin market has been enveloped in a whirlwind of anticipation and speculation, propelled by the imminent arrival of Ethereum’s highly-anticipated London upgrade. As the upgrade finally made its debut on Ethereum’s mainnet this past Wednesday, the cryptocurrency community held its collective breath in eager anticipation, poised on the precipice of a potentially transformative moment.

However, the reality that unfolded proved to be markedly different from the lofty expectations that had been set. Rather than igniting a sustained rally in altcoin prices, Ethereum’s London upgrade swiftly transformed into what can only be described as a “sell-the-news” event. The initial excitement that had gripped the market quickly dissipated, replaced by a sobering realization that the anticipated surge in prices had failed to materialize.

Yet, amidst the disappointment and disillusionment, a silver lining emerges. The cryptocurrency market, in its characteristic ebb and flow, has undergone a correction—a natural and necessary recalibration of prices following the fervor surrounding the upgrade. However, far from signaling a harbinger of doom, this correction represents an invaluable opportunity for astute investors with a long-term perspective.

For these investors, the market correction is not a cause for alarm but rather a strategic opening—a chance to acquire digital assets at more attractive prices, thereby fortifying their portfolios and positioning themselves for future growth. In the midst of market volatility, it is the steadfast commitment to the long game that distinguishes seasoned investors from their more impulsive counterparts. It is in times like these that the true value of patience and foresight becomes abundantly clear.

As the dust settles and the market finds its equilibrium once more, the stage is set for a new chapter in the ongoing saga of cryptocurrency. The journey may be fraught with twists and turns, but for those who possess the wisdom to navigate its treacherous waters, the rewards are boundless. In the ever-evolving landscape of digital assets, one thing remains certain: opportunities abound for those who dare to seize them.

Bitcoin’s sudden 7% retreat sees $660M in liquidations over a day

A seismic shockwave reverberates through the cryptocurrency ecosystem as Bitcoin (BTC) undergoes a dramatic plunge, sending ripples of apprehension and volatility across the market. Within a mere 24-hour window, over $661 million worth of liquidations reverberated through the digital asset landscape, impacting a staggering 200,000 traders. This unprecedented turmoil unfolds against the backdrop of Ethereum’s highly anticipated London upgrade, marking a pivotal moment in the evolution of blockchain technology.

The tempestuous descent of Bitcoin’s price unfolded abruptly during early trading on March 15, witnessing a precipitous drop of 7.5% within a few fleeting hours—a precipitous decline from $72,000 to $66,500, leaving investors reeling in its wake. Despite fleeting attempts at recovery, Bitcoin grappled with staunch resistance, relinquishing its hard-fought gains and plummeting further to approximately $67,500 at the time of reporting—a stark 8.3% retreat from its dazzling all-time high of $73,737 just one day prior.

As the market grapples with this cataclysmic downturn, long-term investors brace themselves for the tumultuous ride ahead. Amidst the chaos, Pav Hundal, lead analyst at Australian crypto exchange Swyftx, sounds a cautionary note, warning of potential corrections to the low $60,000 or high $50,000 levels should ETF volumes continue to dwindle. Hundal’s apprehension is mirrored by data from Farside Investors, which reveals a staggering 48% decline in Bitcoin ETF inflow volumes on March 14—a portentous sign of waning investor confidence.

Echoes of apprehension permeate the market sentiment, with renowned cryptocurrency trader and analyst “CrediBULL Crypto” delivering a sobering prognosis to his legion of followers. He observes that the recent market upheaval has decimated much of the built-up open interest (OI) in derivatives markets, foreshadowing further downturns. In his grim forecast, “CrediBULL Crypto” envisions Bitcoin plummeting to the $63,000 to $64,000 range—a stark reminder of the volatile nature of digital assets.

Meanwhile, the release of economic data in the United States casts a shadow over market stability. Surpassing expectations, fresh PPI (Producer Price Index) data portends prolonged high rates from the Federal Reserve, while hotter-than-expected Consumer Price Index (CPI) data exacerbates concerns over America’s economic trajectory. These ominous signs, compounded by the retreat of Asian stock markets following dismal U.S. economic indicators, cast a pall of uncertainty over the global financial landscape.

In this maelstrom of market volatility, the cryptocurrency community braces itself for the tumultuous journey ahead, navigating the treacherous waters of uncertainty with steadfast resolve and unwavering determination.