Story Highlights

- Goldman Sachs warns against simplistic interpretations of past Bitcoin halving events.

- Despite macroeconomic shifts, Bitcoin’s price has surged impressively ahead of the halving.

- Analysts remain divided on post-halving outlook, emphasizing medium-term dependency on BTC ETF adoption.

As we countdown the ticking clock, the world of cryptocurrency braces itself for a monumental event: the Bitcoin halving. In just a mere couple of days, something extraordinary is set to occur, sending ripples through the digital currency landscape. This eagerly awaited event is poised to chop the reward for mining Bitcoin right in half, reducing it from 6.25 BTC to 3.125 BTC per block. It’s not just a simple adjustment; it marks a significant milestone in the evolution of Bitcoin, a moment that could potentially shape its future trajectory.

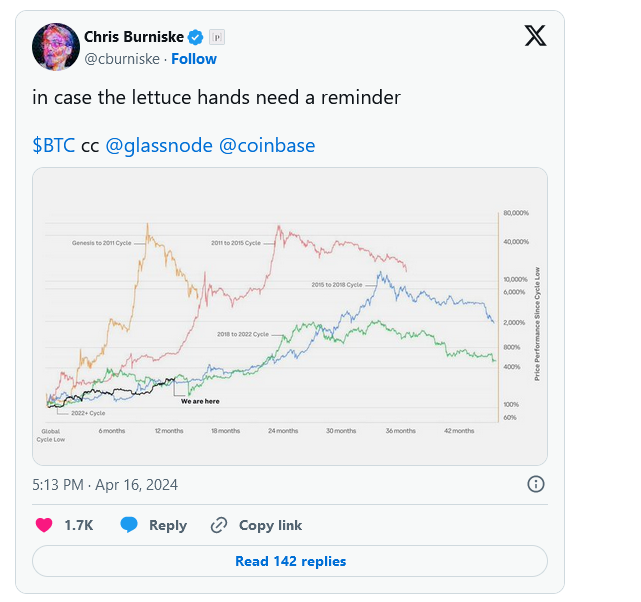

Now, history tells us something intriguing about these halving events. They tend to trigger prolonged periods of excitement and fervor in the market. Like fireworks lighting up the night sky, Bitcoin’s price often shoots up, dazzling investors and enthusiasts alike. But here’s where things get interesting: Goldman Sachs, a heavyweight in the world of finance, offers a word of caution. They’re urging us not to jump to conclusions too hastily.

Picture this: Goldman Sachs’ team of experts in Fixed Income, Currencies, and Commodities (FICC) and Equities are poring over the data. They’ve noticed a consistent trend – every time Bitcoin has halved in the past, its value has skyrocketed. It’s like clockwork. But here’s the catch: they’re telling us to look beyond the surface. Don’t just focus on Bitcoin’s internal mechanics; consider the bigger picture.

Let’s zoom out for a moment. Think about the broader economic landscape. What’s happening in the world of traditional finance? Well, for starters, central banks are on a money-printing spree, pumping trillions of dollars into the economy. Interest rates? They’re scraping the bottom of the barrel, almost hitting rock bottom. In simpler terms, it’s a climate where people are willing to take risks – big risks.

And guess what? Cryptocurrencies like Bitcoin thrive in such an environment. When traditional investments seem lackluster, people turn to alternative assets like Bitcoin in search of higher returns. It’s like a domino effect – one thing leads to another, and before you know it, Bitcoin’s price is soaring to new heights.

But here’s where Goldman Sachs throws in a curveball. Yes, Bitcoin has a history of surging after halving events. But this time, things might be different. Why? Because the world is a different place now. Economic conditions have shifted. The playbook has changed.

So, what’s the bottom line? Well, it’s a bit like walking a tightrope. On one hand, you’ve got the excitement and anticipation surrounding the Bitcoin halving. On the other hand, you’ve got Goldman Sachs waving a caution flag, reminding us to tread carefully.

In the end, only time will tell how this story unfolds. But one thing’s for sure: as we inch closer to the Bitcoin halving, the world is watching with bated breath, waiting to see what happens next.

Macroeconomic Shift: Then vs. Now

In the annals of cryptocurrency lore, previous Bitcoin halvings unfolded amidst a backdrop of financial fervor, where the M2 money supply of major central banks surged, and interest rates dipped precariously close to zero. This scenario set the stage for a daring dance across financial markets, with cryptocurrencies like Bitcoin emerging as the belle of the ball, captivating investors with promises of lucrative returns.

But oh, how the tides have turned in the realm of macroeconomics! Today, the landscape looks vastly different, painted with strokes of high inflation and interest rates that loom ominously overhead. Behold, the likes of the U.S. Federal Reserve, the European Central Bank, the Bank of Japan, and the People’s Bank of China, witnessing unprecedented expansions in their M2 money supplies. It’s a stark contrast to the tranquil waters of yesteryears, leaving us to ponder the potential impact of this seismic shift on Bitcoin’s impending halving and its ensuing price odyssey.

Yet, amidst this tempest of economic upheaval, Bitcoin has emerged as a phoenix rising from the ashes of uncertainty. Its price has soared to dizzying heights this year, defying all expectations and smashing through records with a fervor unmatched. And what lies at the heart of this meteoric ascent? Look no further than the influx of capital into U.S.-based spot exchange-traded funds (ETFs), a phenomenon of epic proportions. These ETFs have become the beacon guiding the way, drawing in vast sums of investment within a mere blink of an eye, propelling Bitcoin ever skyward in its journey to new heights of financial glory.

As we stand on the precipice of yet another halving event, the stage is set for a spectacle unlike any other. The echoes of past halvings reverberate through time, mingling with the whispers of uncertainty that linger in the air. But one thing remains certain amidst the swirling currents of change: Bitcoin, with its unwavering resilience and unyielding spirit, stands poised to carve its path through the tumultuous seas of finance, leaving an indelible mark on history’s ledger for generations to come.

Post-Halving Outlook

As the countdown to the highly anticipated halving event ticks away, analysts find themselves entrenched in a spirited debate, each voicing their own perspective on what lies ahead for Bitcoin. Some argue vehemently that the market has already priced in a substantial portion of the anticipated surge in Bitcoin’s value. They warn that the post-halving landscape might not be as euphoric as some hope, cautioning against the possibility of a “sell-the-fact” scenario where prices could retreat following the event. On the other side of the spectrum, there are those who remain cautiously optimistic, seeing the halving as a pivotal moment that could catalyze further upward momentum.

In the midst of this discourse, Goldman Sachs steps into the fray with their unique insight. They view the halving not only as a symbolic reminder of Bitcoin’s scarcity, but also as a catalyst for potential growth in the medium-term. However, they emphasize a crucial caveat: the extent of Bitcoin’s trajectory in the coming months hinges heavily on the widespread adoption of Bitcoin exchange-traded funds (ETFs), marking a significant shift in the landscape of cryptocurrency investment.

As the days dwindle down to the fateful event, the convergence of market dynamics and macroeconomic conditions casts a shadow of uncertainty over Bitcoin’s future. Yet, amidst the ambiguity, there is an underlying sense of anticipation, a palpable excitement for what this moment could mean for Bitcoin’s journey. It’s not just a halving event; it’s a crossroads, a juncture where the past meets the future, and the decisions made today could reverberate for years to come. In this crucible of speculation and analysis, Bitcoin stands as a beacon of innovation, poised to weather the storm and emerge stronger on the other side.