Story Highlights

Story Highlights

-

Worldcoin is selling WLD tokens to institutions, potentially increasing supply and impacting price.

-

Worldcoin aims to use the funds to support development and meet demand for verified IDs.

-

WLD price has fluctuated significantly after a billy early this year.

The volatile nature of Worldcoin’s digital asset, the WLD tokens, has set the cryptocurrency community ablaze with its recent tumultuous price swings, reaching a staggering 50% deviation. What’s triggering this frenzy, you ask? Well, it all boils down to the recent bombshell announcements surrounding the imminent sale of tokens from the Worldcoin treasury.

Picture this: a market already brimming with anticipation and speculation, now thrown into a whirlwind of uncertainty as whispers of token sales reverberate through the corridors of crypto enthusiasts’ minds. These revelations have acted as a catalyst, igniting a fiery storm of fervent trading activity and heated debates among investors, analysts, and industry pundits alike.

The implications are profound, sending shockwaves through the digital asset landscape. Every nuanced detail of this development is scrutinized under the magnifying glass of market sentiment, with each whisper and rumor amplifying the already heightened volatility of the WLD tokens. Investors nervously watch their screens, their pulses quickening with each tick of the price chart, as they grapple with the uncertainty of how these token sales will ultimately impact the market dynamics.

In this whirlwind of speculation and anticipation, the fate of Worldcoin’s digital asset hangs in the balance, its trajectory uncertain as it navigates the choppy waters of market sentiment and investor psychology. Will it weather the storm and emerge stronger, or will it succumb to the pressures of the market, leaving its investors in the lurch? Only time will tell as the saga of Worldcoin’s WLD tokens continues to unfold amidst the ever-changing landscape of the cryptocurrency market.

The volatile nature of Worldcoin’s digital asset, the WLD tokens, has set the cryptocurrency community ablaze with its recent tumultuous price swings, reaching a staggering 50% deviation. What’s triggering this frenzy, you ask? Well, it all boils down to the recent bombshell announcements surrounding the imminent sale of tokens from the Worldcoin treasury.

Picture this: a market already brimming with anticipation and speculation, now thrown into a whirlwind of uncertainty as whispers of token sales reverberate through the corridors of crypto enthusiasts’ minds. These revelations have acted as a catalyst, igniting a fiery storm of fervent trading activity and heated debates among investors, analysts, and industry pundits alike.

The implications are profound, sending shockwaves through the digital asset landscape. Every nuanced detail of this development is scrutinized under the magnifying glass of market sentiment, with each whisper and rumor amplifying the already heightened volatility of the WLD tokens. Investors nervously watch their screens, their pulses quickening with each tick of the price chart, as they grapple with the uncertainty of how these token sales will ultimately impact the market dynamics.

In this whirlwind of speculation and anticipation, the fate of Worldcoin’s digital asset hangs in the balance, its trajectory uncertain as it navigates the choppy waters of market sentiment and investor psychology. Will it weather the storm and emerge stronger, or will it succumb to the pressures of the market, leaving its investors in the lurch? Only time will tell as the saga of Worldcoin’s WLD tokens continues to unfold amidst the ever-changing landscape of the cryptocurrency market.

Token Sale Strategy

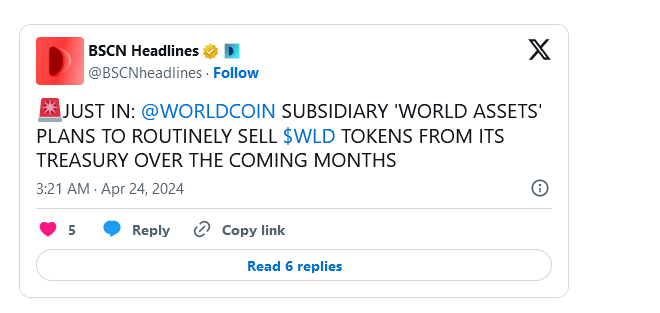

A recent blog post has set the cryptocurrency world abuzz with news of Worldcoin’s subsidiary, World Assets, unveiling ambitious plans to gradually sell WLD tokens over the course of six months. However, what’s truly capturing attention is the method: these tokens will be distributed through private placements with institutional trading companies outside the United States.

This strategic move isn’t just about selling tokens; it’s about meeting the surging global demand for World IDs verified by Orb and bolstering the development of the Worldcoin network. It’s a bold step toward expanding Worldcoin’s reach and solidifying its position in the ever-evolving cryptocurrency landscape.

But what does this mean for the market? With major token sales on the horizon, discussions are rife about the potential ramifications. One of the primary concerns is how this influx of WLD tokens will impact their availability and, subsequently, their value.

Consider this: Worldcoin currently holds a market value of $1 billion, but its total potential value is staggering—$54.5 billion. This impending shift in supply and demand dynamics has the potential to cause seismic changes in the cryptocurrency market.

The planned sale of WLD tokens represents a pivotal moment for Worldcoin and the broader crypto community. It’s not just about selling tokens; it’s about reshaping the market and redefining the rules of engagement.

Analysts and investors alike are on high alert, meticulously analyzing the potential outcomes of this token sale. Will it lead to a surge in token value, or will it trigger a market correction? The possibilities are vast, and the stakes are high.

In light of these developments, it’s crucial for investors to exercise caution and strategic foresight. Understanding the implications of this monumental token sale is paramount for navigating the volatile cryptocurrency market effectively.

As the countdown to the token sale begins, the cryptocurrency world holds its breath, anticipating the ripple effects that this move will inevitably unleash. It’s a watershed moment for Worldcoin, one that could shape the future of the cryptocurrency landscape for years to come.

Visionaries Behind Worldcoin

Introduced in July 2023, Worldcoin represents a pioneering venture in the realm of digital identity within the cryptocurrency sphere. Spearheaded by a trio comprising OpenAI CEO Sam Altman, CEO Alex Blania, and Max Novendstern, CEO of the biometrics research entity Mana, this project aims to redefine how individuals establish and manage their identities in the digital age.

At the heart of Worldcoin’s groundbreaking approach lies the “World App,” an innovative platform enabling users to authenticate their identity by utilizing retina scanning technology at specialized terminals known as “Orbs.” In exchange for this verification, users are rewarded with valuable Worldcoin tokens, thereby seamlessly intertwining identity verification with cryptocurrency incentives.

The trajectory of WLD token values mirrors the unpredictable twists and turns of a rollercoaster ride. Following an exhilarating surge in early March, during which prices skyrocketed by a staggering 435% to reach $11.74, the market experienced a subsequent downturn. Presently, WLD token prices have receded by more than 53%, stabilizing at $5.49.