Story Highlights

- Bill Morgan comments on Ripple’s legal battle with the SEC, particularly regarding the SEC’s claims about discounted institutional XRP sales.

- The SEC is seeking $7 billion from Ripple in damages and fines, and Morgan suggests this could lead to class-action lawsuits.

- Morgan emphasizes the importance of transparency in crypto transactions due to the SEC’s classification.

In the realm of cryptocurrency, few voices carry as much weight as that of Bill Morgan, a stalwart figure renowned for his insights and acumen. Recently, Morgan has sounded a clarion call, ringing alarm bells within the crypto sphere regarding the legal quagmire facing Ripple, a prominent player in the digital currency landscape. Ripple presently finds itself embroiled in a heated legal battle with the formidable U.S. Securities and Exchange Commission (SEC), a confrontation fraught with potential peril and uncertainty.

At the heart of this legal maelstrom lies the pivotal question of whether XRP, Ripple’s native digital asset, should be classified as a security under U.S. securities laws. The outcome of this deliberation holds immense ramifications not only for Ripple but for the broader cryptocurrency market. Should the SEC prevail in its assertion that XRP constitutes a security, Ripple could face stringent regulatory scrutiny, potential fines, and significant operational disruptions. Moreover, such a determination would likely trigger a cascade of legal challenges from investors and stakeholders, further complicating Ripple’s already precarious position.

The specter of investor lawsuits looms large over Ripple, casting a shadow of uncertainty over its future prospects. Should disgruntled investors seek redress through legal channels, Ripple could find itself mired in protracted litigation battles, draining its financial resources and eroding investor confidence. The prospect of protracted legal wrangling could exacerbate volatility in the XRP market, causing tumultuous fluctuations in its price trajectory.

Indeed, the fate of XRP hangs precariously in the balance, its valuation subject to the vagaries of legal interpretation and regulatory enforcement. Investors and market observers keenly await the outcome of Ripple’s legal skirmish with the SEC, acutely aware of the far-reaching implications it holds for the broader cryptocurrency ecosystem. As this high-stakes legal drama unfolds, the cryptocurrency community remains gripped by a sense of anticipation and trepidation, cognizant of the seismic impact it could have on the future trajectory of Ripple and the digital asset landscape as a whole.

SEC’s Move: A $7 Billion Demand?

Just two days ago, the Securities and Exchange Commission (SEC) brought the spotlight onto Ripple Labs Inc. by unveiling a meticulously crafted chart delineating potential remedies, an act that not only underscored the complexity but also hinted at the gravity of the situation. This move was akin to the opening act of a high-stakes drama, setting the stage for what is expected to be a seismic shift in the cryptocurrency landscape. The cryptic nature of the chart left industry analysts and enthusiasts alike speculating about the potential ramifications, with whispers circulating throughout the financial corridors about the impending fallout.

Fast forward to today, and the anticipation has reached fever pitch as the SEC is slated to formally unveil their demands, with murmurs suggesting that the penalties and damages could potentially reach a jaw-dropping $7 billion. This figure, if realized, would not only reverberate through the corridors of Ripple but could also send shockwaves across the entire cryptocurrency ecosystem, serving as a stark reminder of the regulatory hurdles that continue to loom large over this burgeoning industry.

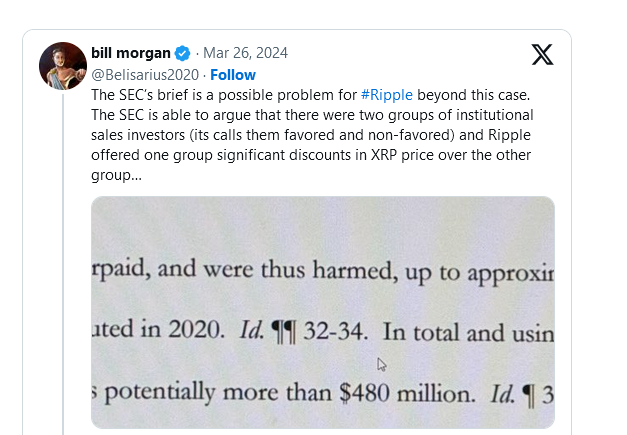

Amidst this backdrop of uncertainty and speculation, Bill Morgan, a prominent figure in the cryptocurrency community, took to social media platform Twitter to air his concerns regarding the SEC’s allegations against Ripple. At the heart of the matter lies the accusation that Ripple’s purported favoritism towards select institutional investors resulted in staggering losses amounting to a staggering $480 million. Morgan’s tweet served as a clarion call to investors, warning them of the potential repercussions of these allegations and urging them to remain vigilant amidst the unfolding legal saga.

Indeed, the implications of the SEC’s probe into Ripple’s sales practices extend far beyond the confines of the courtroom. They strike at the very core of investor confidence in the cryptocurrency market, raising questions about transparency, fairness, and accountability. The specter of litigation looms large, casting a shadow of uncertainty over Ripple and its stakeholders. Should investors who were excluded from these transactions choose to band together in pursuit of justice, the road ahead promises to be fraught with legal complexities and challenges.

In the court of public opinion, Ripple finds itself at a critical juncture, tasked with not only defending its actions but also restoring faith in its business practices and governance structures. The outcome of this legal battle could potentially reshape the landscape of the cryptocurrency market, influencing regulatory frameworks and investor sentiment for years to come.

As the saga unfolds, one thing remains abundantly clear: the ripple effects of the SEC’s probe into Ripple’s sales practices are far-reaching and profound, underscoring the need for greater regulatory clarity and transparency within the cryptocurrency ecosystem. Only time will tell how this high-stakes drama plays out, but one thing is for certain: the eyes of the world are firmly fixed on Ripple as it navigates the treacherous waters of regulatory scrutiny and legal challenges.

Understanding the SEC’s Strategy

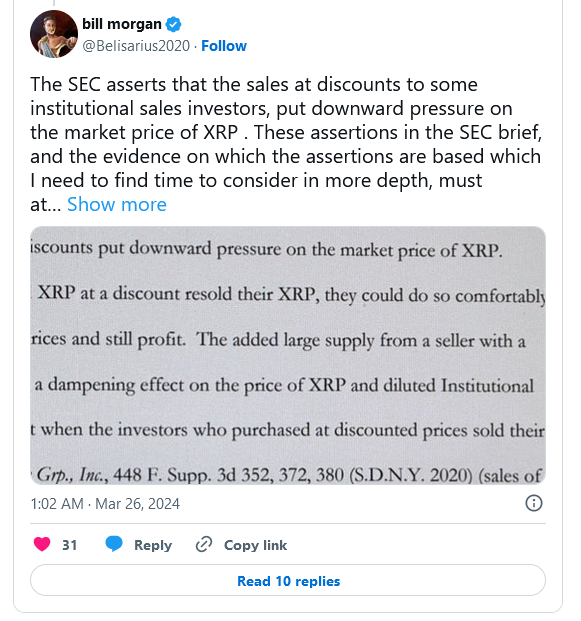

Morgan underscores the profound significance inherent in the SEC’s characterization of Ripple’s sales as investment contracts, a determination laden with weighty implications. This designation suggests that Ripple ought to have disclosed pertinent information under the assumption that these sales were registered, thereby injecting a layer of complexity into the ongoing legal skirmish and accentuating the imperative of transparency within the realm of cryptocurrency transactions.

Indeed, as Ripple confronts these formidable legal challenges head-on, the global cryptocurrency community remains on tenterhooks, keenly observant of every legal maneuver and courtroom development. The outcome of this legal saga stands poised to exert profound and far-reaching effects not only on Ripple’s immediate fate but also on the broader contours of the cryptocurrency market as a whole.

The stakes could hardly be higher; the resolution of this high-profile legal showdown holds the potential to reshape prevailing regulatory paradigms, redefine market dynamics, and recalibrate investor sentiment towards cryptocurrencies. Consequently, stakeholders across the spectrum, from cryptocurrency enthusiasts to institutional investors, are scrutinizing every twist and turn in this legal saga with bated breath.

In this crucible of legal scrutiny, Ripple finds itself not merely defending its own practices but also serving as a bellwether for the entire cryptocurrency industry, a test case that could set precedent and establish new norms for regulatory compliance and transparency. The outcome of this legal battle will undoubtedly reverberate across the cryptocurrency landscape, leaving an indelible mark on the industry’s trajectory for years to come.