Cardano (ADA) finds itself navigating through a multifaceted market landscape characterized by varying investor sentiments and divergent market indicators. As highlighted by Dan Gambardello on X, ADA has encountered a recent decline in its price; however, amidst this downturn, it exhibits glimpses of inherent resilience and prospects for future expansion. This optimism stems primarily from ADA’s strong technological underpinnings and the escalating activity within its network. Despite short-term market fluctuations, the fundamentals of Cardano’s ecosystem hint at a promising trajectory for growth and development.

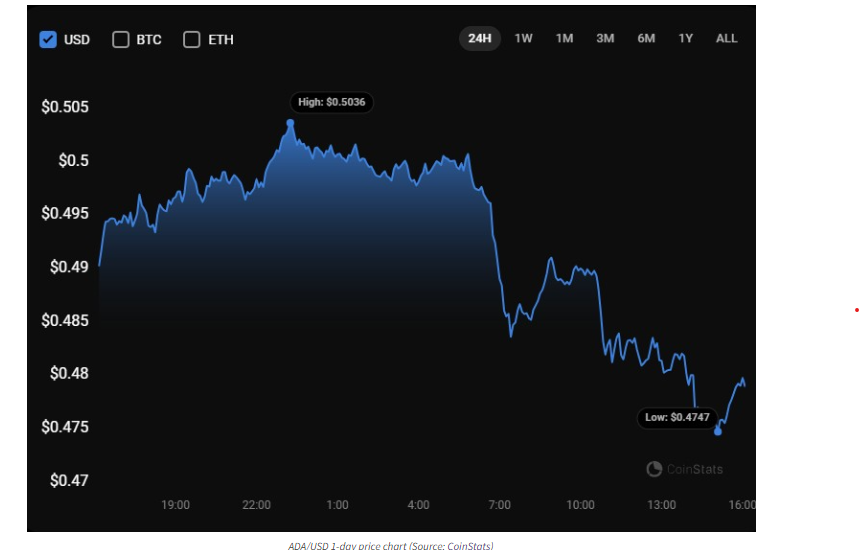

Despite these notable strengths, ADA has experienced a decline in value, witnessing a decrease of 2.51% over the last 24 hours, with additional decreases observed over the past week and month. As of the latest update, ADA is trading at $0.4789, according to data from CoinStats.

In contrast to the downtrend in price, Cardano’s network is witnessing a remarkable surge in user interaction and transaction volume. Recent reports indicate that the platform is handling approximately 255,000 payments daily, marking a significant increase compared to previous figures. Moreover, there has been an average daily rise of 5,500 new wallet creations, highlighting growing interest and adoption within the Cardano ecosystem.

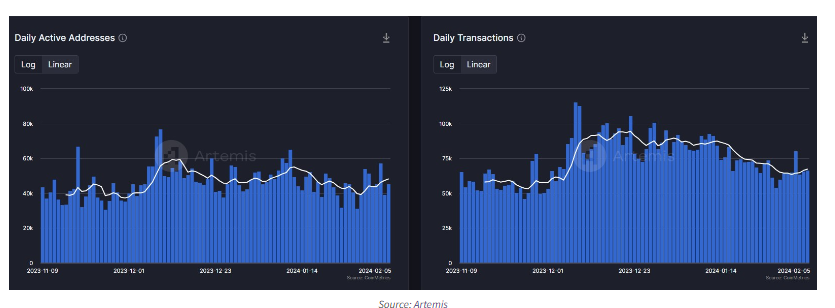

This surge in adoption is further underscored by the uptick in daily active addresses, which have increased from 31,000 to 45,000. Additionally, daily transactions have risen from 54,000 to 80,000, indicating a robust level of activity within the network. These metrics collectively signify a growing enthusiasm for Cardano’s ecosystem, suggesting a promising outlook for its future growth trajectory.

However, despite the positive indicators from network activity, Cardano is confronted with immediate market challenges, particularly in overcoming key resistance levels hindering its price recovery. The ADA token currently grapples with a challenging market environment, facing critical resistance zones situated between $0.54 and $0.56. These resistance levels pose significant obstacles to any potential upward momentum in ADA’s price, requiring strategic navigation and market resilience to overcome.