Approximately $100 billion exited the cryptocurrency market within the last 24 hours due to Bitcoin’s late trading crash on January 3.

BTC experienced an 8% decline, reaching a low of around $42,000 before recovering to reclaim $43,000 on January 4.

Amid speculation about the awaited pack of spot Bitcoin ETFs, possibly facing scrutiny from the US Securities and Exchange Commission, industry experts and analysts maintain confidence in their approval expected next week.

Approval for Bitcoin ETFs is Still Under Consideration

On January 4, cryptocurrency YouTuber Lark Davis mentioned, “Bitcoin experienced a decline triggered by a rumor initiated by Matrixport,” and went on to say: “Gives you a taste of what would happen if the SEC actually did deny the ETF. BUT, chances are still overwhelmingly in favor of an approval.”

The Ark 21Shares spot BTC ETF application faces its final deadline on January 10. Expectations are high that the SEC may batch approve up to 12 in the queue to avoid a first-mover advantage.

“We are in a phase where market reactions hinge on baseless Bitcoin ETF predictions from unreliable sources. This is counterproductive, as many have failed to learn from past experiences,” remarked an observer.

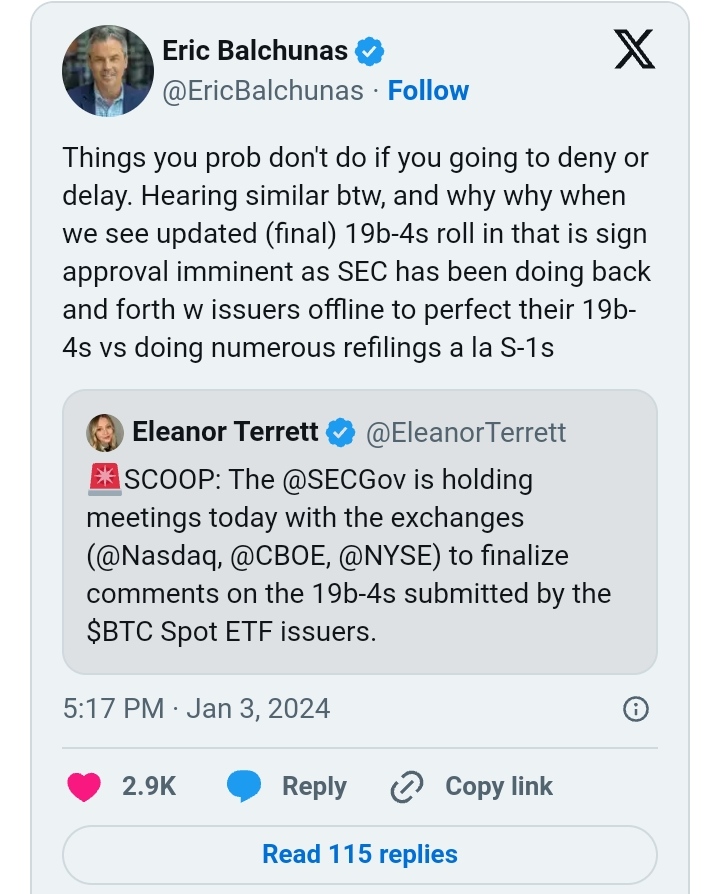

Bloomberg’s senior ETF analyst, Eric Balchunas, noted that indications such as ongoing meetings and filed amendments strongly suggest forthcoming SEC approvals.

He mentioned that many inquiries about the “rejection” report have come his way. Despite hearing only positive signals, he’s seeking clarification, questioning whether the person has credible sources or is merely speculating.

The SEC could reportedly start notifying issuers of approval on Friday, potentially leading to trading next week, as per Fox Business.

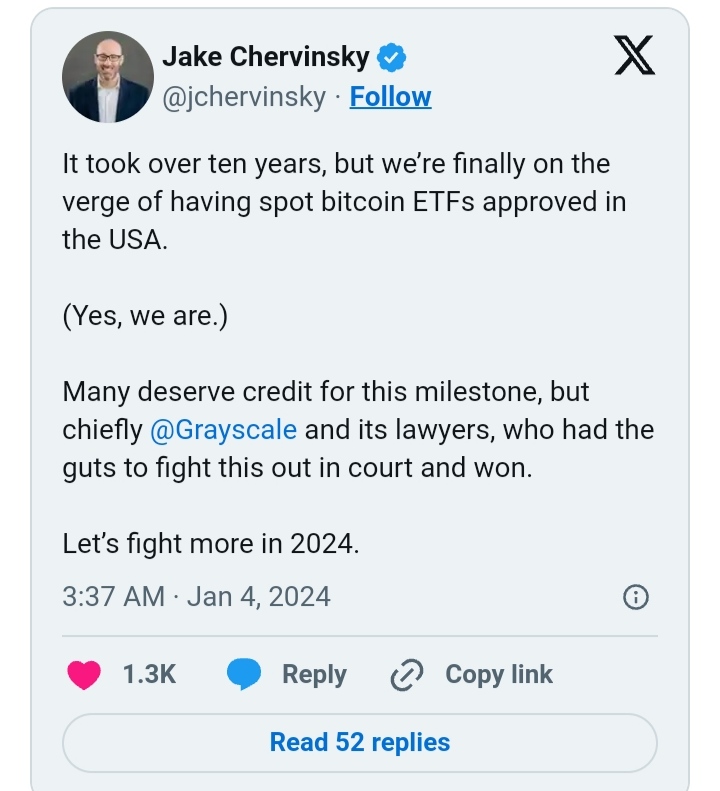

Jake Chervinsky, a crypto lawyer, expressed confidence that spot Bitcoin ETFs might finally get approval in the USA after a decade.

Grayscale is Engaging in Discussions with Major Banks Regarding ETF

In a related development, Grayscale, the crypto asset manager, is said to be in discussions with major banks such as JPMorgan and Goldman Sachs.

These talks involve the potential involvement of these banks as “authorized participants,” entities with the authority to create and redeem shares of the proposed Bitcoin ETF, as per sources cited by Bloomberg.