On Tuesday, the price of Bitcoin (BTC) experienced a significant decline of over 5%, dropping below the crucial $60,000 threshold. This downturn came on the heels of a disappointing debut for the first day of spot Bitcoin ETF trading in Hong Kong. Additionally, fresh economic data from the United States painted a picture of persistent inflation, bolstering arguments for the Federal Reserve to delay any interest rate cuts.

After initially reaching heights close to $65,000 during early trading hours in Asia, Bitcoin saw its value dwindle, eventually settling in the range of the high $59,000s.

Amidst mounting macroeconomic and fundamental challenges, technical analysis suggests that BTC may be on the verge of a near-term correction, potentially dipping into the $50,000 range. Notably, Bitcoin has been facing consistent resistance levels since mid-April, particularly at its 21-day and 50-day moving averages (DMAs), indicating a prevailing bearish sentiment in the market.

Adding to the bearish sentiment is the formation of a descending triangle pattern in Bitcoin’s price chart over the past few weeks. Descending triangles are typically regarded as bearish indicators, often preceding downward breakouts in price.

These technical and fundamental factors are contributing to a growing sense of uncertainty surrounding Bitcoin’s near-term price trajectory. Investors and analysts alike are closely monitoring market developments and economic indicators for further clues on the direction of the cryptocurrency’s movement.

Should the Bitcoin price break to the south of its recent range lows at $60,000, a quick retest of $53,000 is possible. Source: TradingView

Should the Bitcoin price break to the south of its recent range lows at $60,000, a quick retest of $53,000 is possible. Source: TradingView

If Bitcoin were to breach below its recent range lows of $60,000, there’s a possibility of a swift retest of the $53,000 level. This potential scenario could entail a near-term decline of around 12% from its current valuation. Such a move would result in Bitcoin’s pullback from its March all-time highs, which were close to $74,000, to nearly 30%.

The launch of the spot Bitcoin/Ether ETF in Hong Kong fails to generate significant interest.

The debut of spot Bitcoin and Ether ETFs in Hong Kong on Tuesday disappointed expectations.

Despite the anticipation built by Hong Kong ETF providers ahead of the launch, suggesting it could outperform the US launch, the reality fell short. According to Bloomberg data shared on X, the total trading volumes amounted to just under $12.5 million. The newly introduced Bitcoin ETFs in Hong Kong witnessed trade volumes of less than $10 million.

Hong Kong Crypto ETFs were predicted to have $300 million inflows on the first day.

Instead they had a total of $12.4m in total trading volume. pic.twitter.com/YUGgD6ugjh

— wallstreetbets (@wallstreetbets) April 30, 2024

The market was greatly disappointed by this outcome. It’s hardly surprising that the Bitcoin price experienced a significant decline following the release of these figures.

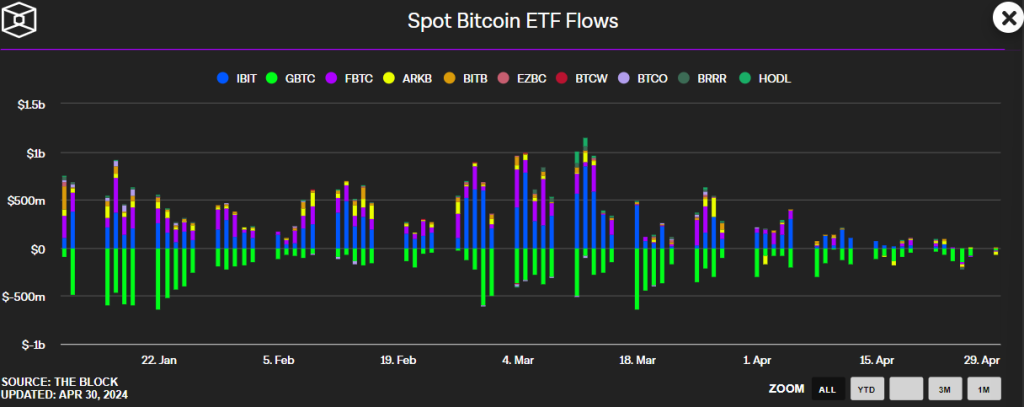

The lackluster debut of the Hong Kong ETF occurred at a time when inflows into spot Bitcoin ETFs in the US were also showing signs of slowing down. According to data from The Block, flows have been consistently negative since last Wednesday.

Flows have been net negative since last Wednesday, The Block data shows.

Flows have been net negative since last Wednesday, The Block data shows.

Nevertheless, the presence of these ETFs in one of the world’s leading financial hubs marks a significant milestone for the cryptocurrency industry.

The accumulation of macroeconomic challenges continues to grow.

The lackluster debut of the Hong Kong ETF has contributed to selling pressure, compounded by the ongoing accumulation of macroeconomic challenges.

Additionally, data concerning inflation and employment costs in the US for Q1 surpassed expectations.

Sticky core inflation…

The US Employment Cost Index rose by 1.2% in the first quarter of 2024, accelerating from a 0.9% increase in the previous three-month period and beating the market consensus of a 1% growth.

Employment costs rose the most in one year, as wages and… pic.twitter.com/SId678qKuT

— Ayesha Tariq, CFA (@AyeshaTariq) April 30, 2024

This has raised concerns that inflation in the US will persist above the Federal Reserve’s target of 2.0%.

It’s understandable, then, that Federal Reserve policymakers appear to be accepting of the recent market adjustments to expectations of rate cuts.

According to data from CME, the likelihood implied by the market of no rate cuts by September now stands at 50%. Just one month ago, this probability was only 6.5%. Furthermore, the probability of no rate cuts occurring this year has climbed to 25%, up from 1% a month ago.

According to Bank of America (BoA), the Federal Reserve is adopting a “wait-and-see” approach until there is greater clarity on inflation.

❖ Powell Seen as 'Comfortable' With Repricing of Fed Expectations: Bank of America

The Fed's main message after tomorrow's rate decision is likely to be that "policy needs more time, the next move is most likely a rate cut, and the committee is in a wait-and-see mode until the…

— *Walter Bloomberg (@DeItaone) April 30, 2024

“We suspect Powell is comfortable with the substantial pricing out of cuts this year,” Walter Bloomberg cited Bank of America as saying.

In a recent article in The Wall Street Journal, highly regarded Fed analyst Nick Timiraos argued that the Fed will indicate “it has the tolerance to maintain high rates for an extended period.”

As a result, it comes as no surprise that the US Dollar Index and US government bond yields are trading near recent highs.

On Tuesday, the DXY rebounded above 106 and is now targeting yearly highs at 106.50. Meanwhile, the US 10-year bond yield was last seen at 4.68%, with a potential retest of last week’s yearly highs at 4.74% on the horizon.

In an environment characterized by tightening financial conditions—when the market anticipates higher interest rates and both the dollar and yields increase—Bitcoin typically performs poorly.

Has the bull market for Bitcoin come to an end?

The convergence of weak ETF inflows, tightening financial conditions, and bearish technical indicators suggests that Bitcoin could soon experience a downturn, potentially leading it to the $50,000 range in the near future.

But would this signify the end of the Bitcoin bull market that commenced in late 2022?

Despite the inevitable spread of fear, uncertainty, and doubt (FUD) across social media platforms like X, such an outcome is highly unlikely.

For one, if we consider Bitcoin’s typical four-year cycle, there’s still approximately 1.5 years remaining in the current bull market phase.

This assertion gains further credence from the recent occurrence of the Bitcoin halving, a significant catalyst in previous four-year cycles.

Historically, each of the first three Bitcoin halvings has been followed by substantial price surges to new all-time highs, albeit not immediately, typically taking around 4-6 months to materialize.

Don't let this retrace distract you from where we are in the Bitcoin cycle$BTC #BitcoinHalving #Bitcoin pic.twitter.com/LniRS6xu8u

— Rekt Capital (@rektcapital) April 30, 2024

The real question at hand is whether the price action following this halving will deviate from historical patterns.

Notably, the lead-up to the latest halving exhibited distinct characteristics. Bitcoin managed to reach a new all-time high prior to the halving, a first in its history. This arguably heightened the risk of a post-halving correction, which appears to be unfolding at present.

However, this doesn’t necessarily preclude the possibility of witnessing new all-time highs after the halving, potentially in late 2024 or 2025.

In the meantime, while bets on rate cuts are being deferred, it’s likely that interest rates in the US have peaked. Essentially, the question shifts from “if” to “when” the US begins to cut rates.

As financial conditions ease in the future, they should eventually provide a supportive backdrop for the market.

Arguably, the risks are skewed more towards economic weakness in the US and lower inflation rather than strength. This is underscored by the fact that interest rates remain at multi-decade highs and the yield curve has been inverted for well over a year.

If the US economy were to weaken, leading to a faster decline in inflation, this would hasten the implementation of rate cuts.

Could ETF and safe-haven demand provide a boost to BTC?

Additional factors are poised to contribute to the upward trajectory of BTC. A significant portion of potential buyers for the US ETFs has yet to enter the market.

Many individuals are in the process of conducting thorough due diligence on these new products before committing to investment. Furthermore, a considerable number of investors still lack access to these ETFs as they have not yet been offered by their respective banks or wirehouses.

The risks are heavily skewed towards a continuation of inflows over the coming years. It is highly improbable that the current assets under management (AUM) in spot Bitcoin ETFs will not continue to rise.

Moreover, the broader narrative of Bitcoin as “digital gold” is expected to gather momentum in the foreseeable future.

BlackRock CEO, Larry Fink, is literally on Fox Business arguing with the host about why #Bitcoin is the modern day digital gold, how it protects you from inflation and removes counter party risk associated with governments.

The narrative is changing! 🤯pic.twitter.com/OOSAs4eHjt

— The ₿itcoin Therapist (@TheBTCTherapist) March 9, 2024

It’s probable that an increasing number of companies and nations will incorporate it as a reserve asset, particularly as Wall Street amplifies its allocation.

Bitcoin could also sustain its appeal as a safe haven if worries about geopolitical or financial stability resurface.

The Federal Reserve’s rate hikes have placed significant pressure on numerous regional banks in the US, and issues in this sector could resurface unexpectedly.

Traders may recall the Bitcoin price surge in March 2023, coinciding with the collapse of several banks.

READ MORE ABOUT: Runes constitute 68% of the total Bitcoin transactions following the halving.