On April 30, PeckShieldAlert, a well-known blockchain investigator, made a significant discovery. An address linked to the infamous Poloniex hacker executed a transfer of 501 BTC, equivalent to approximately $32 million, to three distinct wallet addresses. This transaction is raising eyebrows in the cryptocurrency community, as it suggests a concerted effort to obfuscate the origins of the pilfered funds.

The Poloniex hack remains one of the most notorious incidents in the crypto sphere, and any movement of the stolen assets garners immediate attention. The sheer magnitude of the transfer underscores the ongoing challenges faced by authorities and blockchain investigators in tracking and recovering illicitly acquired cryptocurrencies.

As the investigation unfolds, stakeholders are closely monitoring any developments surrounding the movement of the stolen funds. The sophistication of these maneuvers highlights the need for robust security measures and increased vigilance within the cryptocurrency ecosystem to mitigate the risks associated with such illicit activities.

The Poloniex hacker persists in endeavors to hide the funds.

PeckShieldAlert disclosed a significant development concerning the activities of the Poloniex hacker. The largest Bitcoin transaction attributed to the hacker amounted to 486.62 BTC, which translates to approximately $30.8 million, and was directed to a single address. Alongside this substantial transfer, two additional transactions involving smaller amounts were also detected. Specifically, 10 BTC, valued at around $623,000, and 5 BTC, valued at approximately $316,000, were transferred to new wallet addresses.

These transactions signify ongoing efforts by the Poloniex hacker to manage and obscure the movement of the stolen funds. The magnitude of the largest transfer underscores the substantial financial impact of the hacker’s actions, while the division of funds into smaller amounts suggests a strategy aimed at complicating tracking efforts by authorities and blockchain investigators.

As these developments unfold, it becomes increasingly evident that the hacker is employing sophisticated tactics to evade detection and preserve anonymity. Such activities highlight the ongoing challenges faced by cybersecurity experts and law enforcement agencies in combating cryptocurrency-related crimes and ensuring the security of digital assets within the blockchain ecosystem.

#PeckShieldAlert #Poloniex Hacker-labeled address has transferred ~501 $BTC (worth ~$32M) to 3 new addresses:

-bc1qvdfydd…kune2uut (486.62 $BTC, worth ~$30.8M)

-bc1qewwzl…qr5vff5p3 (10 $BTC, worth ~$623K)

-bc1qzr60y3…mcdsscvr (5 $BTC, worth ~$316K) pic.twitter.com/0htvMNhYCY— PeckShieldAlert (@PeckShieldAlert) April 30, 2024

The origins of the incident can be traced back to a breach of the hot wallet on the Poloniex exchange on November 10, leading to a staggering loss exceeding $33 million.

Initially, PeckShieldAlert flagged the hack and promptly alerted the exchange. Subsequently, other on-chain analysts, notably Tom Wan, provided further insights. Wan disclosed that the perpetrator had absconded with various assets, among them ETH and LINK coins valued at $10 million and $2.4 million, respectively.

A @DuneAnalytics query ready for you to track how much the Potential hacker got from Poloniex

Currently estimated loss at ~$34M, including:

– $10M ETH

– $2.56M GLM

– $2.4M LINKand more https://t.co/judOiLzv4q pic.twitter.com/gcB4eofdwB

— Tom Wan (@tomwanhh) November 10, 2023

Following the initial revelation, Lookonchain analysts delved deeper into the matter, uncovering the Poloniex hacker’s attempts to launder the ill-gotten funds. Specifically, the hacker sought to obfuscate the origins of the stolen assets by exchanging them for ETH and TRX, thereby complicating tracking efforts and distancing themselves from the illicit activity.

Further developments emerged on November 18, 2023, when PeckShieldAlert provided additional information. It was disclosed that Poloniex had obtained knowledge of the hacker’s identity and had initiated communication with law enforcement agencies in China, Russia, and the United States. In a bid to facilitate the recovery of the stolen funds and bring the perpetrator to justice, Poloniex also announced a white hat bounty of $10 million, enticing anyone with relevant information to come forward and aid in the investigation.

These revelations shed light on the multifaceted nature of the response to the Poloniex hack, highlighting the collaborative efforts between industry experts, law enforcement authorities, and affected parties in pursuit of justice and the restoration of trust within the cryptocurrency community.

👀👀👀It seems promising progress in tracking @poloniex stolen funds. @justinsuntron The whitehat reward of $10m is being offered. https://t.co/vWYgyYbEYs pic.twitter.com/6hZx72Buu2

— PeckShield Inc. (@peckshield) November 18, 2023

To date, Poloniex’s endeavors to retrieve the pilfered funds have yielded no success. The recent transfer of BTC by the hacker has raised apprehensions regarding their efforts to obscure their transaction history, potentially signaling intentions to liquidate the funds at a later juncture.

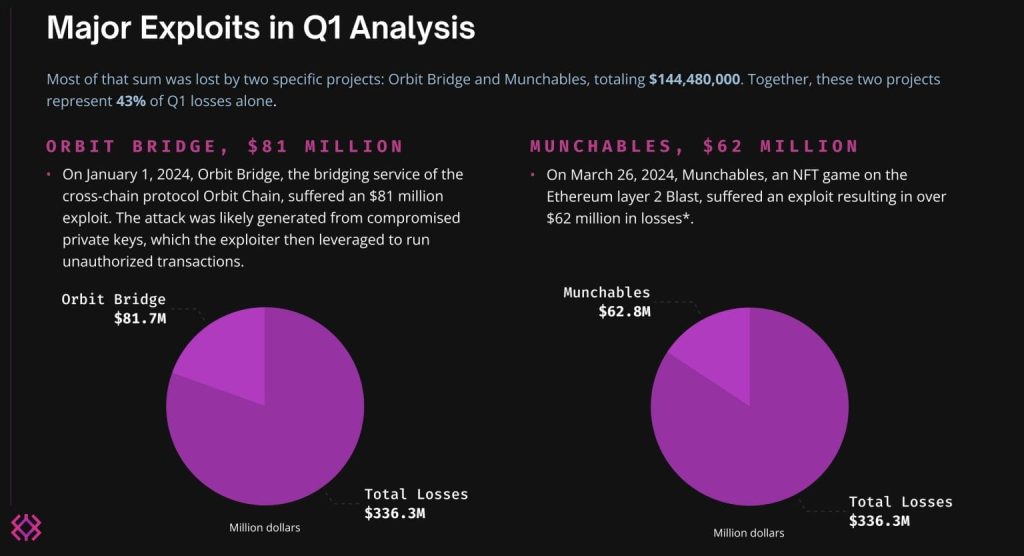

Crypto hacks and fraudulent activities resulted in a loss of $336.3 million during the first quarter of 2024.

In a recent report released by blockchain security firm Immunefi, it was revealed that the cryptocurrency sector incurred losses exceeding $200 million due to 32 incidents of hacks and rug pulls occurring between January and February 2024. This marks a 15.4% surge compared to the corresponding period in the previous year, during which $173 million was unlawfully obtained.

January to February 2024 recorded $200.4M in total losses

January to February 2024 recorded $200.4M in total losses

Despite the concerning rise in cryptocurrency-related hacking and fraudulent activities, the first quarter (Q1) of 2024 saw a notable improvement, with losses experiencing a 23% decline compared to the same period in 2023. During Q1 2024, the cumulative losses attributed to hacking and fraud amounted to approximately $336.3 million, marking a significant decrease from the $437.5 million recorded in the corresponding quarter of the previous year.

The report from blockchain security firm Immunefi shed light on the prevalence of cyberattacks and fraudulent schemes within the cryptocurrency landscape. Throughout Q1 2024, a total of 46 hacking incidents and 15 cases of fraudulent activities were identified. Among these incidents, two prominent projects, Orbit Bridge and Munchables, bore the brunt of the losses, collectively amounting to $144,480,000. Notably, this accounted for a staggering 43% of the total losses incurred in Q1, underscoring the severity of the impact on these particular projects.

These findings underscore the persistent challenges faced by the cryptocurrency industry in safeguarding digital assets and protecting investors from malicious actors. Despite the decline in losses compared to the previous year, the prevalence of cyber threats highlights the urgent need for enhanced security measures and proactive risk mitigation strategies within the crypto ecosystem. As the industry continues to evolve, stakeholders must remain vigilant and collaborate to address vulnerabilities and uphold the integrity of the digital asset market.

Orbit Bridge and Munchables losses totaled $144.48M

Orbit Bridge and Munchables losses totaled $144.48M

Immunefi emphasized that decentralized finance (DeFi) platforms were exclusively responsible for all the exploits identified in Q1. This is attributed to their substantial total value locked in Web3 protocols, nearing $100 billion, rendering them an attractive target for malicious actors.

READ MORE ABOUT: Funds are siphoned from the inactive DeFi lending platform Yield Protocol by hackers.