Over the past 24 hours, Bitcoin (BTC) has experienced a notable rebound of 2.5%, propelling its price to $70,561. This surge occurred amidst a broader uptrend in the cryptocurrency market, which witnessed a collective gain of 1.5%.

In the span of a week, Bitcoin has demonstrated a 6.5% increase, although it has experienced a slight decline of 2% over the course of a month. However, when considering the broader timeframe, Bitcoin has exhibited remarkable growth, boasting a staggering 134% surge over the past year.

Looking ahead, there is optimism surrounding Bitcoin’s prospects for the coming year, with expectations running high that it may outperform its previous performance. The recent surge in Bitcoin’s price is partly attributed to the anticipation that escalating inflationary pressures may compel the Federal Reserve to implement rate cuts, thereby bolstering the appeal of alternative assets like Bitcoin.

Moreover, the imminent occurrence of Bitcoin’s next halving, scheduled to take place in just over a week, adds further anticipation to the market. Historically, Bitcoin halving events have been associated with periods of heightened price appreciation, as the reduction in the rate of new Bitcoin issuance often leads to increased scarcity and upward price pressure.

Given these factors, there is growing anticipation within the cryptocurrency community that Bitcoin may witness further price increases in the near future.

Bitcoin’s price rises above $70,000 – Is now the time to buy?

The ongoing trend in BTC’s chart remains positive, indicating the potential for further rallies in the near future.

The 30-day average (depicted in orange) started ascending again yesterday and still has ample room to increase before BTC reaches overbought levels. A similar situation applies to BTC’s relative strength index (illustrated in purple), which has climbed from nearly 20 a few days ago to approximately 60 today.

This indicates an uptick in momentum for Bitcoin. However, as the RSI has yet to surpass the 70 threshold, we might anticipate another influx of buyers in the near future.

Another noteworthy observation from the aforementioned chart is the convergence of Bitcoin’s resistance (marked in red) and support (indicated in green) levels. This convergence typically signals the potential for a significant price movement.

Given the imminent halving event, such a movement appears plausible. Moreover, with BTC’s trading volume remaining robust at $38 billion, there’s a temptation to posit that this movement will likely be positive.

In fact, recent remarks by Grayscale CEO Michael Sonnenshein hinted at a potential cessation of selling pressure, as he suggested that outflows from the firm’s Grayscale Bitcoin Trust may have reached a state of equilibrium.

#Bitcoin has a history of choppy price action during ATH breaks.

It has a history of choppy price action around the halving event.

All of these cases have one common denominator: price rallied hard after.

Be patient. The best is yet to come.

— Jelle (@CryptoJelleNL) April 11, 2024

Investors should exercise caution regarding the potential for selling pressure in the near term due to the halving event, as traders may engage in the common practice of “selling the news.”

Nonetheless, the prevailing sentiment among most analysts is that the reduction in BTC’s supply resulting from the halving will likely drive its price higher over the long term.

Currently, the coin is just 4% shy of its all-time high of $73,737. With significant inflows of funds into BTC persisting, it appears inevitable that a new record will be established sooner rather than later.

Forecasts suggest that BTC could reach $75,000 by May, with further potential to climb to $80,000 or even $90,000 by the end of Q3 2024.

Exploring Small-Cap Options for Significant Returns

While Bitcoin retains its strength, it’s prudent for astute traders to contemplate diversifying their investment portfolios in anticipation of the next significant bull market.

A well-curated portfolio can optimize a trader’s exposure to potential gains, particularly if they have the foresight to identify promising assets.

One approach to identifying such assets is to seek out presale coins that have achieved successful fundraising efforts and possess robust fundamentals.

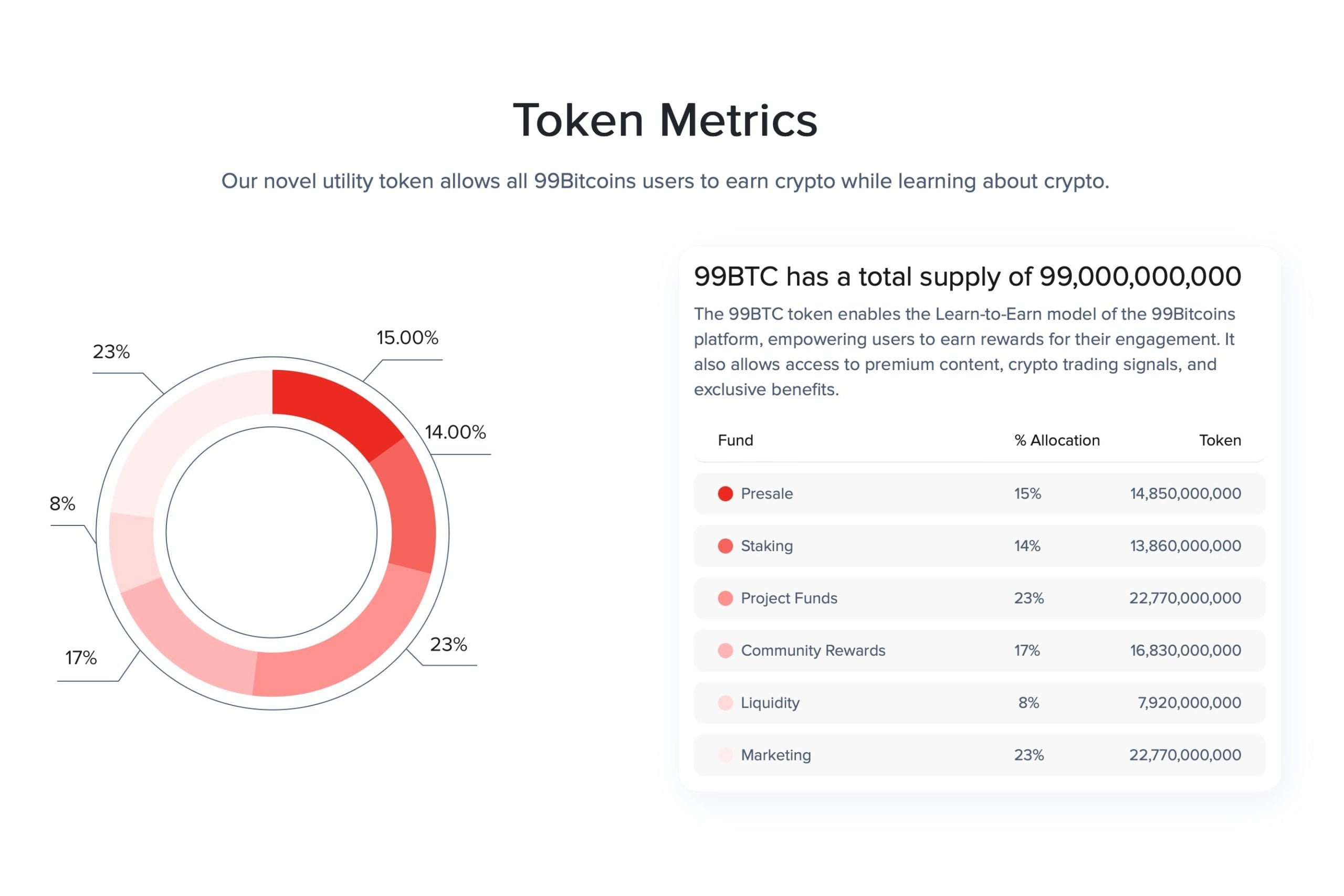

A prime illustration of this strategy is exemplified by 99Bitcoins (99BTC), an emerging Ethereum-based coin designated to function as the native token for the 99Bitcoins website and ecosystem.

For over a decade, 99Bitcoins has been a go-to destination for both novice and intermediate traders seeking educational resources, solidifying its reputation as a trusted authority in the cryptocurrency market.

Now, the platform is venturing into the realm of tokenization with the launch of its own token, having recently commenced its presale.

Remarkably, despite its presale only commencing this week, the token has already garnered an impressive $125,000 in funding. This rapid achievement underscores the confidence investors have in the well-established 99Bitcoins brand.

Given that the utility of 99BTC will be integrated within the platform’s ecosystem, it is poised to attract substantial demand throughout its lifecycle.

Following its launch, the upcoming months will witness its integration with the Bitcoin blockchain, allowing holders to convert it into a BRC-20 version.

With its robust reputation and established brand, these attributes are poised to contribute to its success upon its launch and listing.

Investors have the opportunity to participate in the sale through the 99Bitcoins website, where one unit of 99BTC is priced at $0.001.

READ MORE ABOUT: Bitcoin Price Prediction: Here’s Why BTC Price Could Hit $140,000 by July