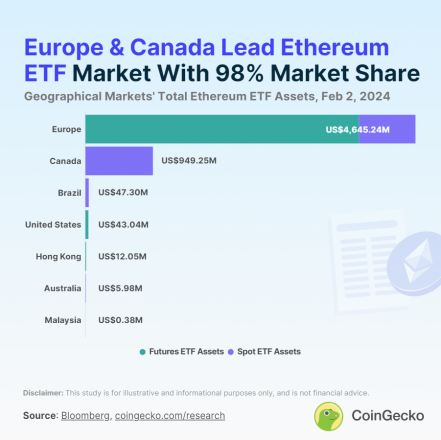

Ethereum futures ETFs lead the market, with Canada and Europe taking the lead, trailed by Brazil and the US.

According to a report by CoinGecko on Feb. 2, the total assets of Ethereum (ETH) exchange-traded funds (ETFs) amount to $5.7 billion, with Europe holding an 81% majority share. The largest Ethereum ETF globally is XBT Ethereum Tracker One (COINETH), with nearly $3.5 billion in assets. Its counterpart, XBT Ethereum Tracker Euro (COINETHE), follows as the second largest, with $511 million in assets. Both ETFs, which are based on ETH futures, have been traded in Europe since October 2017, marking the world’s first introduction to ETH ETFs. In Canada, CI Galaxy Ethereum ETF (ETHX) leads with over $478 million in assets, while Europe’s 21Shares Ethereum Staking ETP (AETH) is the second largest ETH ETF, with $329 million in assets. Launched in 2019, AETH was the world’s first of its kind.

Hence, the predominant presence of ETH ETFs is observed primarily in Canada and Europe, where the top 10 ETFs are exclusively traded. The United States lags behind, with its highest-ranked ETH ETFs positioned 14th or lower.

This disparity is linked to the hesitancy of the US Securities and Exchange Commission in approving spot ETH ETF applications, prompting speculation about the potential for the US to address this gap.

As a result, ETH ETFs are predominantly concentrated in Canada and Europe, where the top 10 ETFs are exclusively traded. In contrast, the United States trails behind, with its highest-ranked ETH ETFs positioned 14th or lower.

This discrepancy stems from the US Securities and Exchange Commission’s reluctance to approve spot ETH ETF applications, leading to speculation about whether the US can close this gap.